I just had a nice holiday in Dubai. The hotel had a huge mixture of Asians, Russians, Indians, Europeans and even a few Americans. It was lovely. Geared up for families, there were rug rats and strollers everywhere. This got me thinking. Yet again, I was thinking how different these children’s lives will be to my own.

My first trip abroad was when I was eight years old and my father drove us to France and Spain. It was a long four-week sojourn, and I loved it. Before that, we had always had holidays in Devon, so the sunshine of San Sebastian really made a difference.

My first flight was when I was thirteen years old, and we all trolled off to Majorca. I fell in love with a Spanish girl and sneaked my first proper kiss late on the Friday night. My parents were not so impressed with that, as they thought I had disappeared and was lost. Just as we got to first base, shouts of “Chris, Chris, Christopher” rang out in the dark cricket-chirping night.

My first long-haul flight was when I was twenty-seven years old. I was lucky enough to convince my manager that I was the right guy to launch our products in Australia, and there I was on my way to Sydney via Singapore and Doha, as airplanes back then could only fly for around eight hours before needing to refuel. Landing in Singapore, I could remember my distinct disappointment at walking into the bright lights of Changi airport and a massive McDonalds. Hmmm, Singapore is America.

Singapore was different back then. It was a smaller city, with Raffles having quite a bit of space around it – not anymore – and the Merlion proudly sitting at the mouth of the Singapore River, and the tip of The Fullerton Hotel’s Waterboat House Garden with Anderson Bridge as its background. Prime Minister Lee Kuan Yew had just shut down Bugis Street – the sin city of old Singapore – and introduced lots of rules about no littering or spitting in the street. My friend from my long-haul flight showed me around the hawker’s markets, where delicious food was served in street markets at low cost, and I ate drunken prawns at the table where they were boiled alive in front of me.

I am telling this story as there was one particular shock back then. My stay was at the Sheraton Hotel where each floor had dedicated butlers and maids. My butler would clean my shoes through the night and was always there at the touch of a button. I was blown away by this level of service and, when I checked out, saw that it had cost $230 a night for my stay. Pretty good value I thought, as the US dollar converted this to around £165 a night. Very reasonable I thought.

I got back home and, when my credit card statement arrived, realised that I had misinterpreted my hotel statement badly, as it was not USD but SGD. 1 SGD converted to around 30 pence, and so my bill was more like £80 a night, rather than £165. Amazing service and amazing value. At today’s exchange rates, the bill would be £125 a night for a hotel at $230 a night, except that today’s Sheraton Hotel in Singapore charges SGD$320 these days, so the price is more like £175.

OK, OK. It shows I’m an old git, but hey, travelling down memory lane is interesting in that 2.5 million people lived in Singapore back then, compared to 5.5 million people today. The city has exploded as a major financial centre, and the skyline is now full of tall buildings. Singapore is the hub for South East Asia and it is a very different place today to what it was thirty years ago. I probably could have guessed that, but instead stayed firmly put in London, where I love our history, culture, diversity and access.

Nevertheless, my global travels began and, since then, there are very few places that I have not visited. I’m naturally curious and travel non-stop. It’s both a living and work, and it’s a great combination.

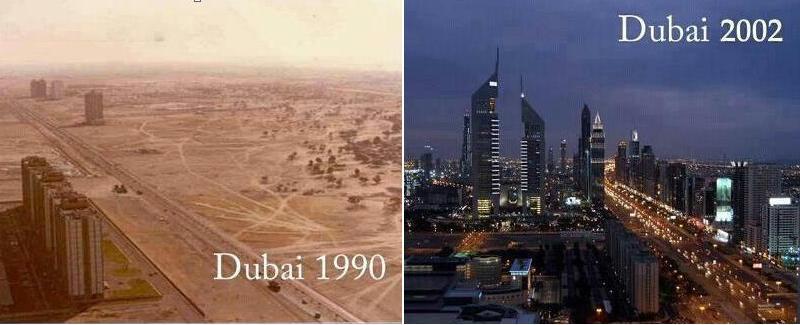

I was lucky enough to be invited to keynote at a conference in Dubai in 2002. Upon landing, there were a few tall buildings around, but less than 100. The Burj Al Arab Hotel – a seven star hotel, as they kept impressing upon me – was fairly newly finished (1999) and was the standout at the time.

I remember having a tour of the hotel with it’s gold-covered pillars and crystals. Half way through the tour I asked how much the hotel cost to build. The answer was that they ran out of money half way through and so they appealed to the then emir Sheikh Maktoum who said: “just finish it”. As a result, no one knows the total cost. The Palm was just being built and I remember news that David Beckham and other footballers were investing there. But I had no idea that Dubai would turn into what it is today.

Back then, the population of Dubai was a million people. Today, it is three million people. In my many visits to Dubai between 2002 and today, I just remember thinking that I could not believe they were building so much. Every visit there were more tall buildings, more cranes, more construction, more vision and ideas about the future and more dynamics at work than I’ve seen in any other city in such a short time.

Today, you cannot buy property in the Palm unless you’re a multi-millionaire (although prices are declining right now). Same with Singapore.

Why am I writing all this?

I guess as it’s really hit me when thinking about Dubai and Singapore that these highly controlled states, with government structured funding, investment and management, have both turned themselves from sleepy backwaters to integral global hubs in a short space of thirty years. They have both seen an explosion of construction and vision, controlled by the government, with unlimited investment and funding if they believe it is important. Both cities have seen the importance of financial services early in their reinvention, and created themselves as the core hubs of their regions. Singapore is definitely the major financial artery for South-East Asia as is Dubai for the Gulf Region.

In both cases, I have been incredulous of the innovation and impetus in these cities, and believed that such vision would fail, particularly in the case of Dubai. I was wrong. Dubai stumbled in 2008-9, but it has bounced back faster and harder than ever before. It is like one massively moving train that you either jump on and enjoy the ride, or ignore and get run over.

In both cases, I have seen what looked like cities that were cheap turn into the most expensive places to live anywhere in the world. How fast life changes. In thirty years, Singapore has gained a stranglehold over South East Asia, whilst Dubai has achieved the same in the Gulf in just fifteen years.

Now, I sit here today and look at China, India, Nigeria, Kenya, Brazil, Argentina and Mexico, and feel the same buzz as I had back in Singapore and Dubai. In other words, why is it important to be a FinTech Hub? Because you are building the financial hubs of the next world. Invest in property where there is a buzz; divest in cities clinging to the past. Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...