I usually start the new year by making some predictions, but so many others have been writing about 2018 trends that I’m not going to. There are four big things for 2018 from a FinTech viewpoint that are obvious to me however, which are:

- Getting down to business with Artificial Intelligence (AI): several of the large banks like JPMorgan and UBS were doing interesting things with AI in 2017, but I think this will be a lot more pervasive and recognised across all banks in 2018. This is primarily for compliance and risk, as AI can develop and apply complex rules across all business processes in real-time, and when most banks have 1 in 3 staff checking compliance, it makes absolute sense to replace them with learning software.

- Rationalising and cleansing core data structures: many banks have built their core operations on fragmented systems aligned to products. This has distributed customer data across multiple platforms, and banks recognise that they cannot use AI effectively on data spread across the business. As a result, many will develop strategies for building an Enterprise Data Architecture in 2018 which rationalises and cleanses their fragmented data stores.

- Continuing the digital drive: many banks are waking up to more and more challenges in digitalising their operations, and this will be even more pressured in 2018 thanks to the arrival of Open APIs under the Payment Services Directive 2 (PSD2) and Open Banking in the UK in January. The open sourcing of financial services has been bubbling for a decade, and now that regulations are forcing this onto the large institutions, 2018 will be a big year for doing digital properly and becoming an Open Bank.

- Distributed Ledger Technology (DLT) continues to rise: during the last couple of years, we have seen many proof of concept and trials of DLT, but 2018 sees it become mainstream as various institutions go live with real-world applications. The Australian Stock Exchange (ASX) is one of the first, but there are others. Watch this space carefully in 2018 as things are changing fast.

These four big things are trends rather than predictions, and I’ve decided that predictions are no longer relevant. After all, who wants to predict the price of a bitcoin? Who had any idea it would rise from under $1,000 to $20,000 a coin last year? Can we predict which FinTech firms will breakout this year? Who had any idea that Coinbase would become one of the biggest FinTech unicorns last year?

Therefore, rather than me making predictions, I thought it interesting to review the views of other commentators.

My partner firm 11FS wrote a blog just before Christmas with their predictions. I particularly liked Sam Maule's regarding 2018 for the USA. Well worth a read.

Jim Marous of The Financial Brand crowdsourced a whole range of expert opinions for 2018, which are summarised as the 10 priorities for this year as being:

- Removing Friction from the Customer Journey

- Expanding Use of Data and Advanced Analytics

- Improving Multichannel Delivery (note: I never use the word channel)

- Embracing PSD2 and Open API Banking

- Building Fintech Partnerships

- Expansion of Digital Payments

- Navigating Compliance and Regulatory Changes

- Exploring Advanced Technologies

- Competing with New Challengers

- Testing Blockchain Technologies (that was last year imho)

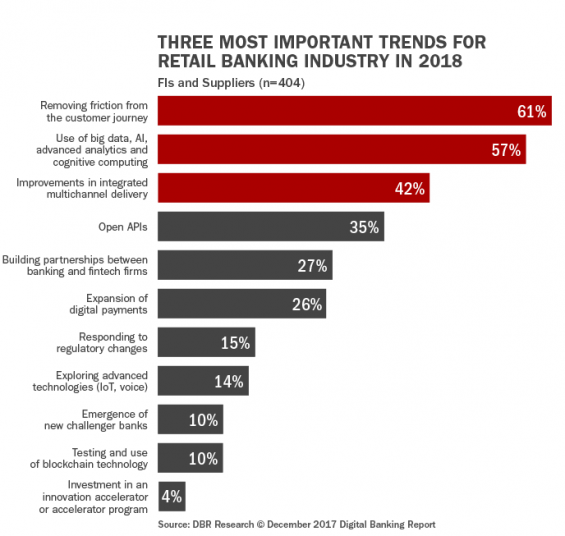

The top trends for retail banking are:

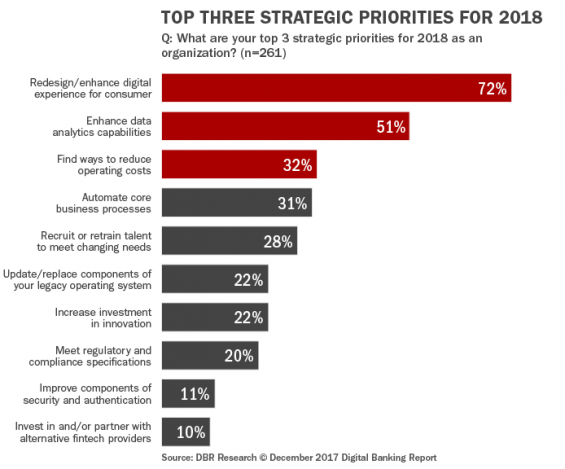

And the top strategic priorities for 2018 include:

Jim also wrote another piece that nicely summarises Forrester’s predictions for 2018 which include:

- Banks not embracing Open Banking, but increasing partnerships with start-ups;

- Faster moves to embrace Digital Banking whilst losing focus on face-to-face communications; and

- Focus on back office transformation.

Similar to my own views therefore.

Saxo Bank's Banking Circle sent me a press release with their top three predictions, which are:

The demise of traditional, slow, expensive cross border payments

The correspondent banking network has for some time been under pressure, and 2018 will see that trend continue. Financial utilities will step in to pick up the slack. Allowing a third party to handle non-core activities enables financial institutions to innovate and expand their core domestic offering, whilst focusing its own energies on improving and maintaining the all-important customer relationship.

Payment Service Providers (PSPs) will help merchants to expand internationally

Many barriers to cross border trade are coming down, and payments must follow suit by removing cost and time barriers sooner rather than later. PSPs must work harder to provide new global payment methods, which meet the merchant’s needs – fast payments, low fees, good FX rates, transparency, compliance, security. Otherwise, merchants will be forced to seek alternatives and PSPs will be left behind.

Tech giants move into banking

The current vertical separation of the value chain in the financial industry has created an opportunity for large tech businesses to monetise their user base by delivering financial services. This is why 2018 is being tipped as the year of the Bank of Amazon or Google Bank. These trusted household brand names are perfectly placed to provide banking services. Not only do they have the funding and ambition to rapidly increase scale and reach international markets, but they have enormous customer bases who already trust them with huge amounts of their personal data, so using them for banking is not such a big step.

I actually disagree with the last one here, as I don't think the big Tech giants want to be banks. They want to steal bank business, particularly margin on payments and credit, but I really do not see them wanting to be full-service deposit account holding banks. Too much overhead of compliance.

Another interesting forecast came from a firm called Romexsoft, who think that 2018 will see:

- Blockchain Technology Will Enter the Mainstream (last year)

- Asia is Becoming the Place for Fintech Investment (last year)

- Expect More ICO’s (sure)

- Legacy Financial Institutions are Getting on Board (for a while)

- Mobile Technology Continues to Innovate (more IoT than mobile)

- Security, Privacy, and Trust Will Continue to Be Challenges (never goes away)

- Fintech Will Continue to Disrupt (or legacy firms partner with them)

Henri Arslanian also posted his top 10 2018 predictions on Let’s Talk Payments as follows:

- Bitcoin and cryptocurrencies – here come the institutional investors?

- Crypto regulations and tax – are the regulators and tax authorities set to join the party as well?

- ICOs – is the child becoming a teenager?

- RegTech – a wave of consolidation ahead?

- Banks embracing FinTech – the end of innovation teams?

- SupTech – say hello to your new tech-driven regulator?

- Open Banking – aggregating your banking data with your favourite tech firm?

- Voice as a user interface – is Alexa your new banker?

- FinTech arbitrage – build in the West and sell in the East?

- Fraud and cybersecurity – avoiding bad apples and Black Swans?

Certainly, I agree that 2018 will be the year that the regulators crack down on ICOs and cryptocurrencies … or try to, at least.

Pascal Bouvier, Venture Partner with Santander InnoVentures, has a slightly more negative view of 2018, doubling down on his macro risks optics first discussed in 2017. Pascal believes that there is a strong possibility of trade wars between nations and regions, regulatory divergence, cryptocurrency risks, cyber attacks and such like. Not so cheerful, but useful to bear in mind.

Meanwhile, I will say that one thing is certain in 2018, which is that cryptocurrencies valuations continue to rise (some say bitcoin will exceed $100,000 soon), and regulators will focus upon these markets to try and lock them down.

Happy New Year!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...