I was intrigued to see the latest account switching numbers for the UK.

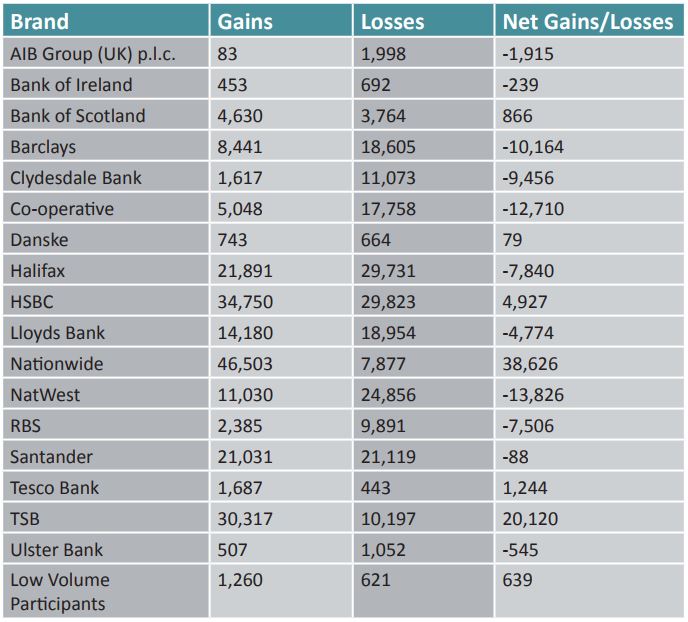

Switching has been a focus of the Competition & Markets Authority, regulators, government and more, and yet promoting people to switch is not working. According to the latest stats, there are around 70 million deposit accounts across the UK, with the average citizen having 2.4 accounts, and yet we’re only seeing a million account switches a year. That’s about 1.4% who switch, whilst 98.6% of customers can’t be bothered.

This is lower than before the account switching regulation came into force in 2013. Leading up to that regulatory change, a parliamentary review brought the CEOs of the mainstream banks and asked them how many customers switch. Paragraph 103 of the hearing:

We tried to establish how many people were switching personal current accounts. Eric Daniels told us that at Lloyds Banking Group it was "somewhere between 7% to 11% of the customer base every year". He described this figure as both "very high" and "about the international norm." Brian Hartzer gave the comparable figures at RBS as "about 9% of accounts" which he described as 50% higher than in Australia. Benny Higgins (Tesco Bank) was dismissive of these figures, claiming that if you take out secondary accounts, the real underlying switching rate was "probably more like 3%. It's very, very low." Jayne-Anne Gadhia (Virgin Money) was similarly dismissive of the 7% to 11% figure, telling us "that the underlying rate of switching is probably less than 5%." She believed that the level of switching had fallen since the financial crisis began because "people have been less ready to take the risk of switching accounts", describing this as "unfortunate." Of the five largest current account providers only Ana Botin of Santander acknowledged that "the level of switching is low."

You would think that switching would have increased when regulation was introduced to make it easier, guaranteeing everything transferred smoothly across within seven days. You would think that switching would have increased when regular TV adverts highlight you can do it:

And money saving experts regularly appear on TV talking about how you can get £200 off the bank as a bribe if you switch. For example, the UK’s leading expert appears every January encouraging people to switch. Here he is in 2016 on Good Morning Britain:

And here he is again in January 2018 on This Morning:

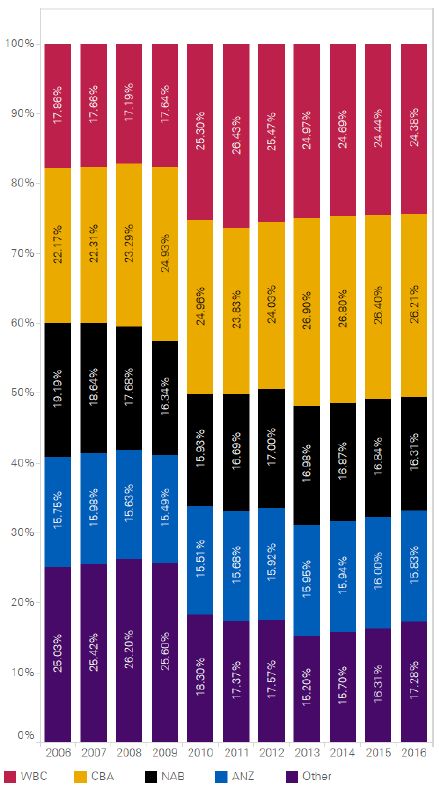

Same messages but it falls on deaf ears. Even though it is easy, simple, guaranteed, regulated and encouraged through bribery, the great British public stubbornly refuse to change their bank account provider. It is notable for example that the big banks market domination of current account banking has increased over the last two decades. Maybe, must maybe, competition in banking isn’t what is needed. After all, I was involved in a discussion back in 1997 about increasing competition in banking in Australia through the Wallis Reforms. This dramatic change to bank regulation was meant to address key issues such as: “concerns over the anti-competitive effects of market concentration and collusion between financial market participants”; and “competition in retail transaction accounts and small business finance, currently at relatively low levels, is likely to be crucial in future”.

Even with all that, KPMG’s 2017 analysis of the major Australian banks found that the combined market share for the Big Four (National Australia Bank, Commonwealth Bank, ANZ Banking Group and Westpac) stood at over 82%, up from 75% a decade before.

The same is true in most economies: the big banks just get bigger, and then cross-sell loans, cards, savings, investments and mortgages like crazy through those accounts.

Why is banking so lethargic and lacking competition? In part it is regulation that wants to enforce financial stability, and demands strong levels of capital and oversight for that reason. More importantly however is the customer. From The Guardian in 2010, and I think it still holds true today:

Three-quarters of banking customers do not even consider changing accounts, according to research by consumer body Consumer Focus.

Despite record levels of complaints about banks and their services, only 7% of customers in the past two years expressed their displeasure by moving from one bank to another. A further 17% thought about switching, but decided against it, citing fear of costs when things go wrong, the hassle involved and fear of a negative effect on credit rating. In contrast, 31% switched energy suppliers, 26% changed telecoms providers and 22% home insurance.

While the majority of consumers are satisfied with their bank, one-third of those dissatisfied with the service were deterred from changing accounts by the switching process. Many consumers also felt there was little difference between banks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...