I was having a chat about Artificial Intelligence (AI) in banking the other day. It was an interesting conversation, although most of the examples were for customer service via Chatbots, which doesn’t impress me much. I know that systems like Erica, short for Bank of AmErica, are up and running to make life easier, but hey google, pay my mate $50. Sorry, I meant Alexa, Siri, Cortana, whoever.

I’m much more intrigued by heavy-duty AI. The sort that gets us towards Ex Machina or HAL. It’s coming. I already cite examples like JPMorgan’s AI system that wiped out 360,000 hours of legal work overnight, and UBS’s high net worth system that does in a second what took humans 45 minutes to administer.

For me, this is the power of AI in banking, as it is tackling the low-hanging fruit of manual administration within the bank. Banks have always sought cost savings with technology and this sort of technology offers a lot. It is why the Deutsche Bank CEO John Cryan says that half of the bank’s employees will be wiped out by machines in the not too distant future, as the humans’ jobs are just to be abacuses.

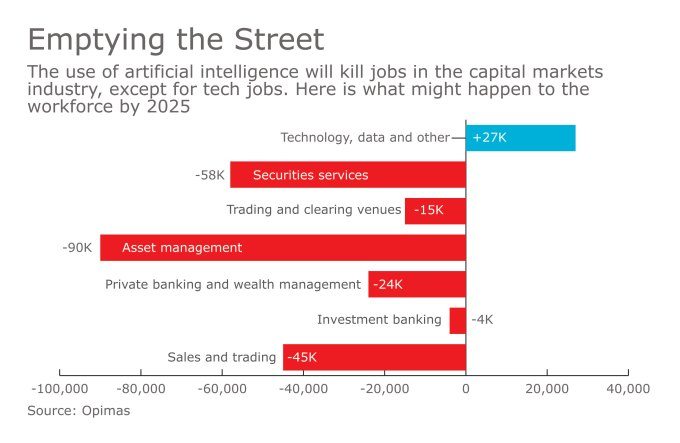

In fact, a recent American Banker article cites research by Optimas that shows 230,000 jobs disappearing in capital markets over the next seven years.

This gets everyone worried and up-in-arms. Oh, machines are going to wipe out our jobs? What will we do?

My response is that most of the jobs of the next century haven’t been invented yet, and old jobs will be replaced by new ones. If we’d told our grandfathers that only 1 in 100 of them would be working on a farm, but we’d have 100 times as much food, they’d have thought you crazy and sent out the lynch mob. But that’s where we are today. 100 years from now, who knows?

I mean there are already many new jobs replacing old ones in finance, just look at FinTech. Work is blossoming across the tech world, in AI and Blockchain specifically, and generally across the Internet of Things. This is why the jobs of the future are ones that require coders. Coders are the 21st century’s rock stars, and being able to code today is as important as being able to speak English.

This is demonstrated well in banking by a fascinating analysis of the US banks job advertising performed by Jeremy Bloom and shared with me recently. It’s a fascinating article that is showing the efforts of JPMorgan and Goldman Sachs, in particular, trying to turn their banks around from being financial institutions that deploy technology to being technology firms that distribute finance.

The article cites Goldman Sachs CEO Lloyd Blankfein’s recent presentation at the Credit Suisse Financial Services Conference, where the running theme is that Goldman Sachs is doing technology stuff to win business:

"Engineering underpins our growth initiatives," says a summary page, and it doesn't mean financial engineering. In fixed income, currencies and commodities, engineers are 25 percent of headcount, and the presentation touts growth in Marquee (its client-facing software platform) and "systematic market making." In equities, Goldman touts its quant relationships. In consumer banking (now a thing!), the centerpiece is Marcus, Goldman's online savings and lending platform. And in investment banking, "Engineering enhances client engagement through apps, machine learning and big data analytics."

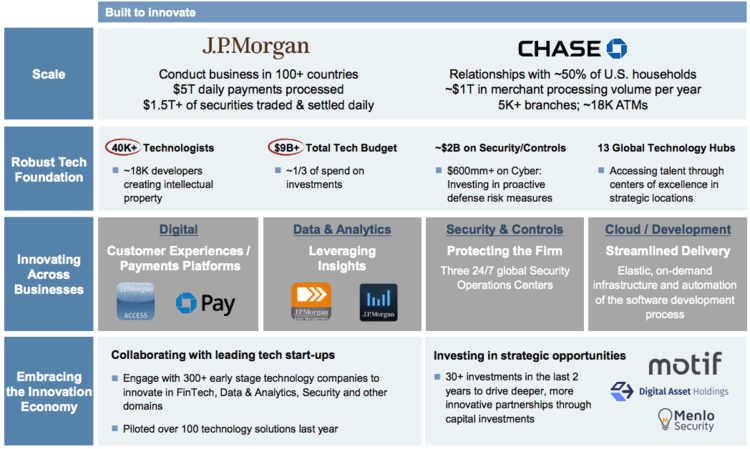

Mind you, investment banking firms have always been good with technology which is why Goldman Sachs and JPMorgan are leading the charge of digital transformation in the USA. For example, JPMorgan describe themselves as a technology company …

… which some find laughable …

#Tech firm with a #banking licence? Crap, according to @nekliolios during #Faceoff #WFTR18 round 7. pic.twitter.com/p1lT6RwSuZ

— HenkJan van der Klis (@hjvanderklis) February 27, 2018

… but I’m going to endorse that JPM and Goldman are technology firms distributing finance.

Why?

Because actions speak louder than words, and these charts from Jeremy’s article speak volumes. For example, when comparing all of the big US banks job listings and looking at the proportion that are for engineers, the stats are pretty interesting:

If you prefer a table to visualize this, it's pretty apparant that both Goldman and JP Morgan are making the most serious effort here:

| Company | Jobs listed | Engineer jobs | Percentage: |

| BofA | 19488 | 120 | 0.62% |

| Citigroup | 11149 | 97 | 0.87% |

| Credit Suisse | 1999 | 23 | 1.15% |

| Goldman Sachs | 4579 | 1121 | 24.48% |

| JP Morgan | 14272 | 1166 | 8.17% |

| Morgan Stanley | 3744 | 39 | 1.04% |

| UBS | 2691 | 242 | 8.99% |

I recommend you read the rest of Jeremy's article to get the full low-down. It is thanks to this analysis that I can confidently say that JPM and GS get digital.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...