I was super impressed by an article written by FinTech friend Bradley Leimer for International Banker the other day, and asked if I could share on the blog. Bradley kindly said yes, so here you are. Enjoy the read!

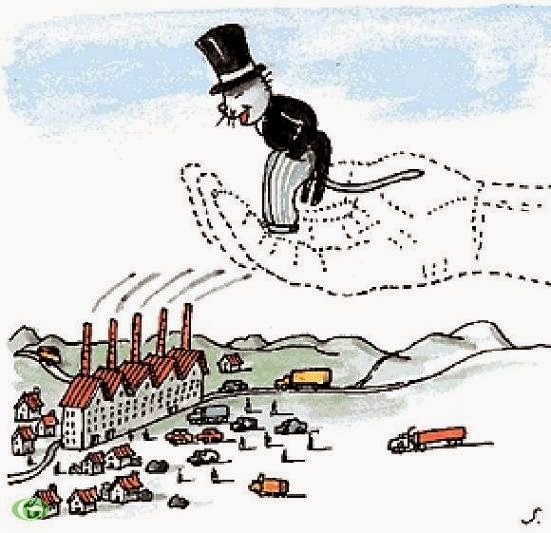

The Invisible Hand of Financial Services by Bradley Leimer, Managing Director and Head of Fintech Strategy, Explorer Advisory & Capital

When Scottish economist Adam Smith published the Nature and Causes of the Wealth of Nations in 1776, he introduced the idea of the invisible hand. The basis of his belief was that “free individuals operating in a free economy, making decisions, primarily focused on their own self-interest, logically take actions that result in benefiting society as a whole—even though such beneficial results were not the specific focus or intent of those actions” (source: Investopedia). Smith, the founder of modern economics, propagated the idea that government intervention and regulation of the economy was neither necessary nor beneficial. The actions of individuals (and businesses) would eventually benefit society, and therefore, the common good. But that’s rarely how individuals, corporations or our global economy really seem to work.

While the decade-long recovery of the equity and housing markets was seen by many as a harbinger of a strong global economy, something was very much amiss. Not everyone benefited from the invisible hand during the recovery. Financial service as an industry continues to feel uneven. Too few have access to bank accounts—the ability to save, invest or access credit at critical junctures. As the financial-services business model moves toward more open banking—and hopefully creates new forms of customer value—industry innovations must migrate banking toward service of the common good. Can the industry act as a true global fiduciary, or must there always be a conflict of interest in their obligations to improve the financial conditions of the individuals, businesses and communities that they serve? I would argue that banking must find ways to become more utilitarian—and more fully inclusive—in order to truly thrive.

Banking’s past is its future at scale

To understand banking’s future, it is important to think about its past. While the function of banking certainly progressed beyond exchanging money at tables in temples, its business model remained fairly simple and relatively static up until the 20th century. Banks took money in; they loaned it out; they invested in individuals, families, businesses and eventually broader markets. For retail and commercial clients, banks had a symbiotic relationship with their customers, and capital remained relatively transparent. Banking remained localized, personalized and tied to physical customer engagement.

Like most industries, banking changed dramatically due to rapid globalization and digitalization. The scale of banks grew and matured into what we see now: the modern global financial-services industry—a dynamic, interwoven system of global capital movement and interdependent technologies. With increased regulatory pressure and capital requirements, the number of global financial institutions has fallen dramatically. For example, the number of banks in the United States went from 14,400 in first-quarter 1984 to 4,938 in third-quarter 2017 (source: St. Louis Fed). This increased industry consolidation coupled with enterprise expansion has resulted in more efficient institutions, but only a handful of banks (typically less than six) dominate nearly every geographic market. This is not necessarily good for financial customers.

Large publicly traded financial-services firms have suffered from short-term thinking and strategies driven by fiscal quarters and financial results. Collective industry decisions around banking solutions dominated purely by a profit motive are rarely in the public interest. Banking products and services, once relatively easy for consumers to digest, evolved into a tangled nest of fees and complicated disclosures controlled by layers of siloed management. Somewhere in the transition of the last 25 years, customer value seemed to be wandering in the wilderness at many of the largest global financial institutions. Customers were now exotic segments, not centralized assets. With the advent of online and mobile technology further distancing the customer (generally under the guise of creating efficiencies), banking’s business model continued to stack up increased profits created with increasingly complex financial services that had little to do with building customer value. Some of these, such as collateralized debt obligations (CDOs), enabled systematic risk that resulted in the Great Recession and permanently eroded trust in the industry.

The past decade’s recovery and low interest-rate environment served as the perfect incubator for the rise of external fintech investment and disruption. Banking’s once formidable relationship with its customers is beginning to shift as the industry experiences the first waves of external innovation. Thousands of startups, focused on areas from payments to credit to wealth creation and advice, have created a new dynamic. Both large technology platforms and small nimble startups deliver better value—or at least, more differentiated value—than what most financial brands can deliver. Banks seem to lack a true north in regard to acting as fiduciary for every customer at scale, and startups are quickly acting to exploit this. Customers with lingering distrust around traditional banking are more likely to abandon them for fintech solutions. This has started to change the way banks invest, partner and build both customer-facing and back-office technologies. Banks need to embrace changes beyond those that drive efficiencies and short-term profitability. To truly become agents of a more progressive model, banking itself needs a reset.

What if banking doesn’t change? The likely answer is disruption, in the form of external technology providers that better serve customers at scale. During the past decade, Amazon has grown from selling books online to disrupting everything from cloud computing to grocery. Facebook grew to connect a third of the global population while becoming one of the largest ad platforms ever created. Google and Apple have redefined categories and impacted customer relationships in every vertical. Increasingly, Asian commerce platforms such as Ant Financial have demonstrated innovation within massive open frameworks. As these digital platforms have arisen, the initial moves by these tech giants into banking services—most notably payments and credit—may soon alter the perception of what a successful financial enterprise looks like. The way financial brands embrace (or counter) the rise in the scale and pace of their challengers is critical. How creative banks are in building new forms of customer value—and increasingly more inclusive means of serving their communities—may determine their very survival.

In his annual investor letter, BlackRock CEO Larry Fink stated that “society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate”. Fink went on to say, “Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we working to create a diverse workforce? Are we adapting to technological change? Are we providing the retraining and opportunities that our employees and our business will need to adjust to an increasingly automated world? Are we using behavioral finance and other tools to prepare workers for retirement, so that they invest in a way that will help them achieve their goals?” (source: BlackRock). While some in the industry have dismissed Fink’s comments as his annual pre-Davos PR-fueled masquerade (lacking in action by even BlackRock itself), his words still offer up some inspiration for those calling for change. In order to have broader impact, the industry must now move aspiration to action.

Achieving total global financial inclusion

American economist Milton Friedman argued in his 1970 op-ed that fulfilling the social responsibility of business is to increase its profits (source: New York Times Magazine). To this end, the banking model has been very successful. Post Great Recession, global banks are well capitalized and many are posting record profits. Why, then, should banking look for ways to change its model? The simple answer is that the industry is not fully inclusive. More than two billion people lack access to basic financial services. Over 200 million micro, small and medium-sized enterprises lack adequate financing, which starves them of their full potential (source: World Bank). In the US, there were 15.6 million completely unbanked consumers as of 2017 (source: Forbes). There are tens of millions more still impacted by the housing-market crash, and most Americans have underfunded savings and retirement accounts. In many other markets, the situation is even worse. Banks must become more socially responsible and inclusive.

How will the underbanked and financially underserved prepare for an extended lifetime without access to financial services? Though the numbers are daunting, there are some positive developments to report. Between 2011 and 2014, the number of globally unbanked shrunk by 700 million people, much of this stemming from Africa (source: World Bank). Extreme poverty is also on the decline (defined as living on less than $1.90 a day). In 1970, 60 percent of the world’s 3.7 billion people lived in extreme poverty—today, that number is 0.7 billion of the world’s 7.5 billion people, about 10 percent (source: Future Crunch). While encouraging, this has a lot to do with the rapid economic growth in countries such as China, India and Indonesia and the globalization of trade. Poverty and inequality remain. There is more work to be done.

While the financial-services industry should certainly not be held accountable for every aspect of global inequality, it is still a moment for introspection. Financial inclusion is now becoming a priority for policymakers, regulators and development agencies globally. A recent study on the subject by the World Bank details the path toward global financial inclusion with the broader goal to further reduce extreme poverty and balance economic prosperity. The paper first acknowledges recent improvements due to digital technology and the digitization of cash and credit. It adds focus to the importance of fintech solutions that reach further into populations that often rely solely on mobile phones for access. It points out the importance of digitizing identity to make it easier to open accounts, and allow for easier transfers of customer data, financial accounts and credit histories between geographies. This is critical to meet the needs of the unbanked or permanently displaced populations.

The World Bank study states that “since 2010, more than 55 countries have made commitments to financial inclusion, and more than 30 have either launched or are developing a national strategy”. As these countries accelerate their efforts, governments need additional public/private coordination of their efforts to ensure financial access for the rural poor and women (the gender gap is present in poverty as well, as women are more impacted than men by more than 9 percent)—both groups that make up large portions of those impacted by global extreme poverty. These efforts must also include a focus on increasing financial literacy and the creation of robust “financial consumer-protection frameworks, and adapt relevant regulatory and supervisory authorities, including by utilizing technology to improve supervision”.

Financial institutions must be active partners in these efforts, working with the entities across the financial spectrum, regulators and NGOs (nongovernmental organizations) that are focused on expanding financial inclusion in the markets they serve. Banks can focus on further modernizing retail payments, credit platforms, remittances and fraud platforms. This helps further shift cash and paper-based financial instruments to digital, aiding in the creation of financial histories that expands the use of financial accounts and access to credit. Banks must also “support legal, regulatory and policy reforms, the design of government programs to open up access to a range of financial services, including savings, insurance and credit, so that transaction accounts provide a pathway to full financial inclusion”. The study also concludes that banks must continue their efforts to leverage new technologies found through collaboration with fintech firms, work to strengthen competition (both internal to the industry and external) and ensure a “level playing field for banks and non-bank (or non-traditional service providers), such as telecoms companies, ‘fintech’ firms, post offices, cooperatives and agent networks”.

What is the reward for achieving global financial inclusion? Accenture estimates that banks could generate up to $380 billion in annual revenues by closing the small-business credit gap and bringing the unbanked and underbanked adults into the formal financial system. It’s more than doing well by doing good. Systemic financial exclusion results in expanded poverty, shorter lifespans and an erosion of societal equality. Banks should embrace this challenge. Closing the gap and moving toward full global financial inclusion will, quite frankly, elevate the human experience for our global population.

The poetry of banking

There’s a certain poetry within financial services, and if you listen carefully, you can hear its melody weave throughout the lives of every human being on the planet. Whether it is payments, credit, the creation and protection of wealth and distribution to future generations— financial services are elemental. Access to the banking system is a basic tenet of our modern, functioning society, and yet fair and open entrance to these benefits is unevenly distributed. This needs to change.

Whether or not you view financial enterprises as active participants, banks play a key role in the dual mechanisms of capitalism and social welfare felt throughout our global society. We must move beyond the notion that a rising gross domestic product (GDP) is the best way to measure the wealth of nations, especially when much of this growing wealth continues its concentration in single digits of society. A broader measure of economic performance, the Inclusive Development Index (IDI), bases wealth on the broader society and “their household’s standard of living—a multidimensional phenomenon that encompasses income, employment opportunity, economic security and quality of life” (source: World Economic Forum).

As the financial-services business model changes, what could banking look like in a hundred years? Banking will be around in some form in a hundred years, but banks may not be. To survive, the banking industry must become an integral part of the creation of economic equality by working toward total global financial inclusion. It’s not just common sense; it is for the common good.

The legacy of this era is up to all of us.

We are all part of the invisible hand.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...