I just presented at a conference focused upon smaller banks. How can they respond to the digital change? Many of them came up with a whole load of barriers to change. Here are the things that cropped up:

We have too much to do

Yep, small financial firms are busy bees, with lots on their plate. Products are changing, customer needs are moving, regulations are updating and finding enough resource and bandwidth to keep up is nigh impossible. Tough. Make it so.

But it’s going to cost too much

No, it isn’t. Where are you from? The 1980s? It doesn’t cost a lot now to adapt and change at all. That’s why FinTech firms are bootstrapping on a few 1000 dollars and getting momentum. Just look at Stripe. A $9.2 billion company based upon 7 lines of code. It doesn’t cost anything to get change these days so just do it. Make it so.

But we have to build it

No, you don’t. You only think that way ‘cos you’ve always done it that way, and if you always do what you’ve always done, you’re always going to get what you always got … less some. These days, anyone building everything is an idiot. Build what you’re good at, buy what you can’t do and partner with anyone doing it better than everyone else. Make it so.

But the regulator won’t allow it

Really? Have you asked them? Do you know this for a fact or are you just making it up? I know plenty of regulators who are happy for credit unions, community banks, thrifts and small financial firms to innovate the hell out of the big banks using tech, so start trying harder. Believe. Make it so.

But the big banks have the advantage ‘cos they’re big

No, they don’t. In fact, the big banks have the disadvantage because they’re big. The bigger the bank, the harder it is to change. The smaller the bank, the more nimble you should be. And if you’re not, why not? Work out what’s stopping you and change. Make it so.

But it’s hard to change

Sure, it is. It’s hard to run a marathon, but people do it. If you don’t think you can change a teeny-weeny bank, then what the hell are you doing there? After all, there’s massive banks that are changing and they’ve got 1000x the challenges you have. Just get on with it. Make it so.

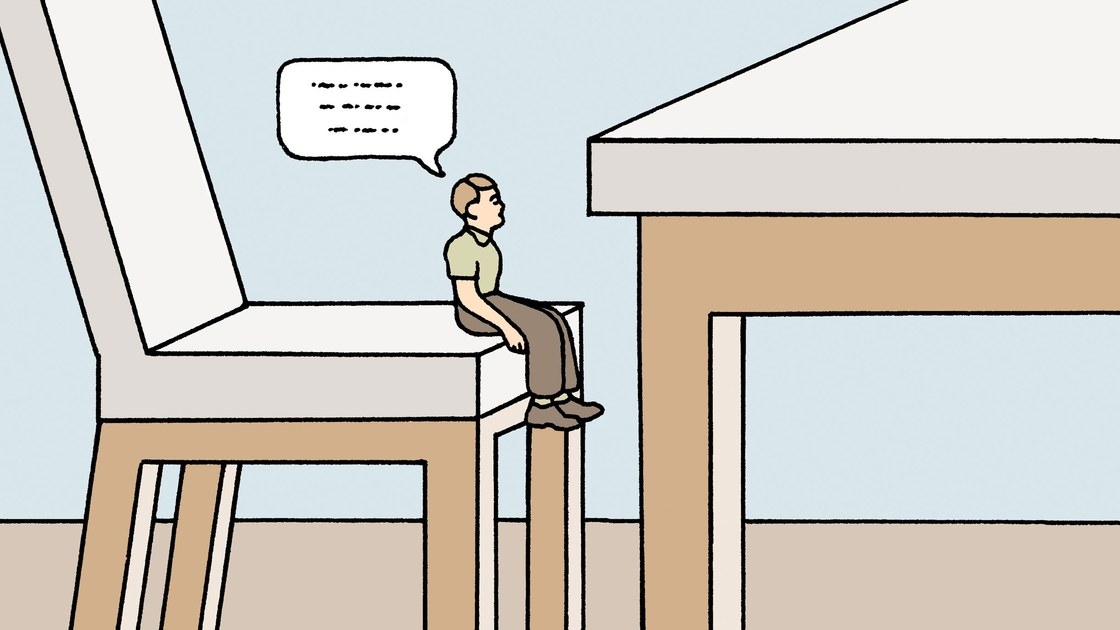

This list could go on and on, but you get where I’m coming from. Most of the barriers to small financial firms seizing the digital opportunities are created by negative thinking. But then I have to say that most small financial firms I’ve met are ultimately constrained by the negative thinking of their CEO. This is because many small financial firms are led by a CEO who was anointed ages ago. They got the job, and they’ve been there for years. They’re not really a CEO to be honest, but just a caretaker for the next guy.

The number of times I meet a small financial firm’s leadership team and find the CEO is the head of the table surrounded by yes people is a long list. They’ve been the CEO for years, no one challenges them, and they don’t want to be challenged. They see all this stuff going on around them, and bring people like me in to show that they care. Then they don’t do anything about it because they’re proud of their heritage and want to keep their customers on-side and believe their differentiation is their history.

Well, forgive me, but that is absolutely abysmal in the digital age. Yes, I sure believe there is a place and role for small banks in the digital age, but you have to work out what is that place and what is that role? If you are not 1000% clear on that strategic focus and if you have not defined 1000% who your customers are and why, then I doubt you’ll be around in a decade as there are 100s of bigger tech and financial giants who are absolutely clear about their strategy and customer focus. So, for all those raising false barriers with a lackadaisical CEO who is just paying lip service to change … change the CEO. Make it so.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...