I regularly come back to the topic of bank branches, which are topical. A recent UK headline said that a town is now branchless ...

Closure of Lloyds leaves this Warwickshire town with no banks

… whilst another says that the closing of branches is all about increasing profits for the banks ...

The cashless society is a con – and big finance is behind it

... Brett King, who has long campaigned to say that banks don’t need branches, just posted ...

Bank Products Are Dead. “Long Live Experiences!”

… and on my own blog, I’ve posted many times about branches becoming redundant:

- This bank branch is dead … no it’s not! It’s, uh, resting …

- Do banks need branches?

- When an app replaces 1200 bank branches …

- 90 minutes a year in a branch versus 45 hours on an app

- British bank branch network decimated with move to mobile

- As branches close, what do we do with the people?

- Why would a digital bank have branches?

- The role of the bank branch in the digital age

- Digital is not a channel (nor is the branch)

But, for all this, I don’t believe that bank branches are dead. I disagree with Brett and others who believe they will disappear. I believe the branch has a strong role for customer engagement, and will last well into the future, but not as a service centre of place for advice. I believe the branch is a marketing investment to secure the bank brand. This is because money is emotional. It is not a rational thing, but to have their most valued items in a third party that has zero physical representation is difficult for many.

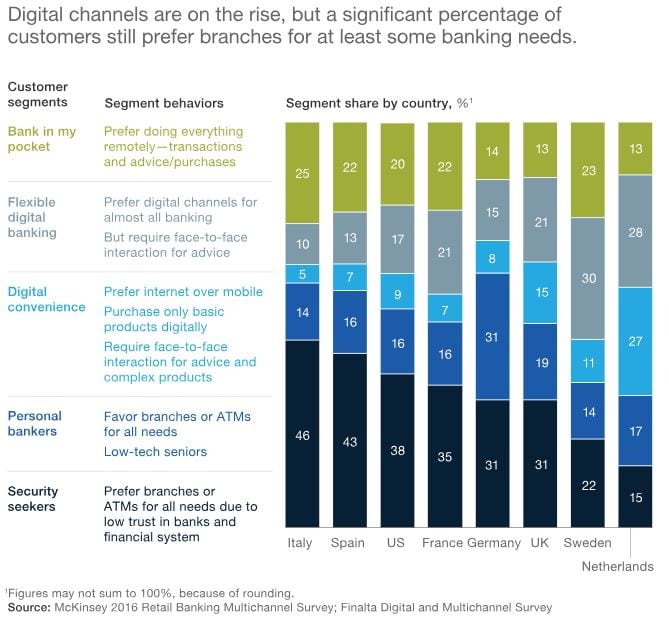

This was reinforced for me this week by a new study from McKinsey, whose research proposes that branches need to turn smart and that most customers still prefer an in-branch experience.

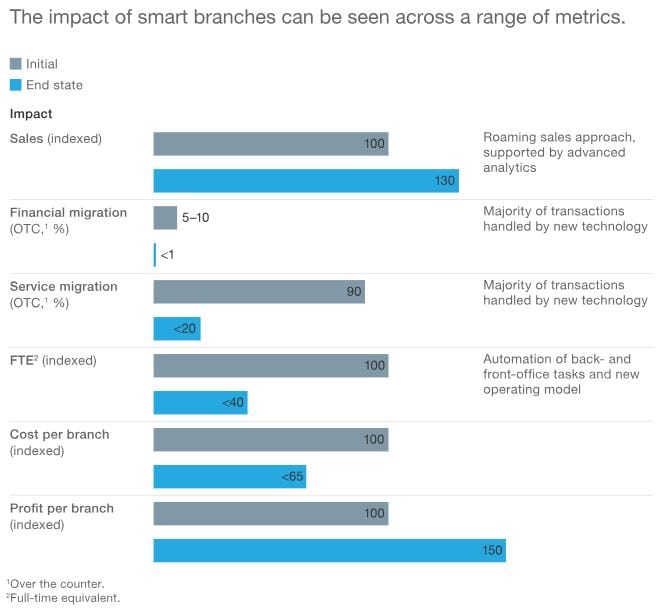

I found their research a little bit bland to be honest, as it droans on about how branches need to turn smart with tablets and robots. However, there is a key chart towards the end which shows that the smarter the branch becomes with technology, the lower the cost and the more the revenue.

This is the key thing for me, and it reinforces so many other discussions about technology. As we automate everything, and software eats the world, the more that human activities are augmented with intelligence and service improves. Robots and algorithms don’t get rid of all physical assets and human beings; instead, they make the physical engagement more compelling and intelligent.

Ten years ago, I remember seeing a prototype of the branch of the future where, as I walk in, my face is recognised, a robot greets me Hello Chris, I believe you’re here to talk about a mortgage today. Please go to Room #3, and the mortgage advisor has no questions about me, my financial history or requires any form filling. It’s already done.

And I think this is the real issue here. Banks are updating branches for the digital age without thinking about what the digital age branch should look like. Branches are getting facelifts and staff are given iPads, but what is it that the customer is coming to the branch for?

It’s not for advice or services, which is what we think it’s for. It’s for understanding, empathy and a feeling of worth. Yes, they may want a mortgage – most bankers claim it’s the big-ticket items that branches exist for in the future, because they require advice – but the customer can just as easily find a mortgage online.

If I come into the branch for a mortgage, it’s not for advice but for understanding. How long does this mortgage last? What happens if I want to break out of this mortgage early on? Can I move this mortgage on to the next house and is that free?

In fact, I want you to advise me on all the things you currently do not. For example, I always remember my first mortgage from a bank. The branch manager invited me in and we had a great dialogue. I felt reassured this was the right thing to do, and signed the forms. What I didn’t realise was that the branch manager had sold me a mortgage protection insurance I didn’t need, and that if I repaid the mortgage within the first five years, there would be significant early redemption charges amounting to thousands of pounds.

It is this culture of hiding the things that make the bank’s profit but punishes the customer that has to change. If banks can transform into trusted advisors in branches and break out of their mentality of making profits from hidden fees, then there’s every chance that the future branch as a marketing investment will work.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...