I see a strong need for global regulatory co-ordination. In particular, in a globalised world with a global network where everyone can connect and transact in real-time, anytime, anywhere, the idea of national regulators regulating a system that does not recognise national borders seems counter-intuitive.

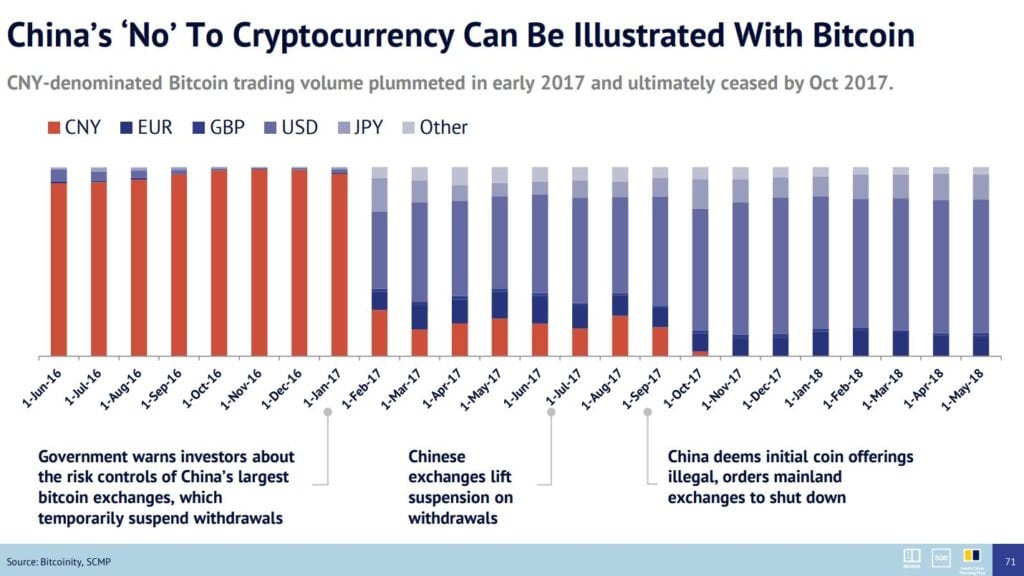

This was illustrated well by bitcoin which has evaded most national regulations. But what happens is that when something circumvents national borders, the national regulators find alternative ways to crackdown. For example, it does interest me the libertarians believe they’ve invented money without government with bitcoin, when China has proven them wrong. China banned all bitcoin trading on domestic and foreign exchanges last year and lo and behold, bitcoin disappears.

Source: South China Morning Post

Well, it kind of disappears. It’s just going underground.

The point is that regulators can regulate ... but it’s harder to regulate networks that don’t recognise borders.

I can illustrate this personally as I like to watch UK TV when travelling. Now, such activity has been more and more focused upon by the UK TV broadcasters (BBC, ITV, etc), as you need a television license in the UK to watch UK TV. I do have a license, but am just never at home in the UK. If you don’t buy the license, then you can be fined and potentially jailed. As a result, foreign viewers of UK TV are banned … unless you use a Virtual Private Network (VPN). VPN software can change your computer’s address (IP address) from I’m here in Poland to look like you’re instead in England. That means you can then watch UK TV … unless the broadcaster cares.

I recently found my VPN software allowed me to watch ITV abroad but not the BBC, because the BBC care more about that license fee so they blocked me. Of course, they care more about the license fee because it pays for their content, so they have successfully blocked most overseas access to their channels …

… but not all. You can still watch the BBC from overseas if you know how.

This is the same with bitcoin trading, using the Darknet and more. Regulators will crackdown on these activities until it is only the most dedicated, needy people who engage in them. And if those activities are truly illegal, then the regulators will find a way to track down those dedicated, needy people, as illustrated by the Europol story I posted recently.

The reason I bring all of this up is that two headlines caught my attention over the weekend:

Federal Reserve defends collaboration with foreign regulators from The Financial Times; and

Trump poised to take control of the Federal Reserve from CNBC

The first article is all about the Republicans saying how Trump has failed to make America First in financial interests, because the Federal Reserve works with people like the Financial Stability Board, co-ordinating global regulatory activities. To illustrate the thinking, Patrick McHenry, a senior Republican in the House of Representatives, sent a letter in 2017 to the then Fed Chair Janet Yellen, saying:

“Despite the clear message delivered by President Donald Trump in prioritising America’s interest in international negotiations, it appears that the Federal Reserve continues negotiating international regulatory standards for financial institutions among global bureaucrats in foreign lands.” He said the Fed was engaging in international talks “without transparency, accountability, or the authority to do so”. Mr McHenry added: “This is unacceptable.”

So, it intrigued me that the follow-on article talks about Donald Trump over-loading the Board of the Fed with his people.

The Board of Governors of the Federal Reserve is required to have seven members. It has three. Two of the current governors were put into their position by President Trump. Two more have been nominated by the president and are awaiting confirmation by the Senate. After these two are put on the Fed’s board, the president will then nominate two more to follow them. In essence, it is possible that six of the seven Board members will be put in place by Trump.

Does this mean we can expect more national economic programs to be focused upon by the Fed than international co-operation with the G20 and FSB? Is the Pope Catholic?

What does this mean for the global regulatory drive? Well, the whole point of regulating is stop undesirable activity but the undesirables job is always to find ways to avoid the regulatory oversight through regulatory arbitrage. Find a place where the regulations are different, so that your activity in one country which is illegal is legal in another.

That’s the whole way in which the crypto community is moving, and why they are basing themselves in Puerto Rico; and it’s the whole way the financial community has moved, which is why they are all based in the Caymans and Virgin Islands.

Ah well, as I said the other day, it’s only illegal if we say it is.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...