Someone asked me about getting return on investment in fintech. The discussion is about how many firms are actually delivering on their promise. So many unicorns are loss-making firms, and billion-dollar valuations on million-dollar revenues seems like a lot of hype. One article typified this feeling: High-society fintech under pressure to perform for billionaire backers in The Sydney Morning Herald yesterday.

The article talks about the impact, or rather lack of impact, of peer-to-peer (P2P) lenders in the Australian markets. The article focuses on the largest Australian P2P lender, SocietyOne, who gained significant investments from three of Australia’s billionaires: Rupert Murdoch, James Packer and Kerry Stokes. This was back in 2014 when the American P2P lender Lending Club had floated with a valuation of some $US5.4 billion (it’s now down to a third of that value).

At the time, Morgan Stanley estimated that P2P lending would leap from almost nothing to AUS$22 billion (USD$15.5 billion) by 2020. That figure does not look likely today. SocietyOne has just passed the AUD$500 million mark and the next largest P2P lender, RateSetter, has reached AUD$380 million. Add in the other firms in this space, MoneyPlace and Wisr, and you get a total of around AUD$1 billion, which is around one percent of the total market for personal finance.

Now, I’m not saying that the Aussie market is the same as the UK – it is not – but it would be interesting to compare the Australian experience with P2P in Britain. The main differences are that the credit risk metrics in Australia are not as rich as the UK’s data set, and the lenders are more I2I – Institutional to Individual – rather than P2P which “perverts” the market, according to Greg Symons, a co-founder of SocietyOne.

Regardless, if the Australian market could correct its inefficiencies then it could reflect the UK market history, which is an interesting story in itself. I’ve often said that the first FinTech I ever met was Zopa, back in March 2005 when it launched. It’s been joined by RateSetter and more, and has government backing and financial markets regulations. The latter didn’t just appear, but was an active campaign amongst the P2P lenders to get such recognition and trust.

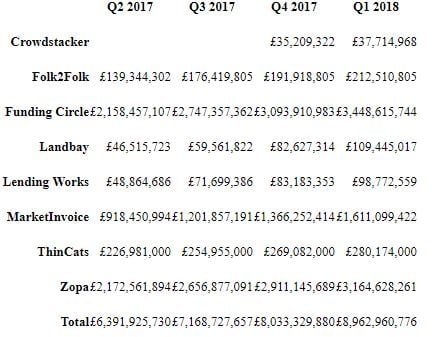

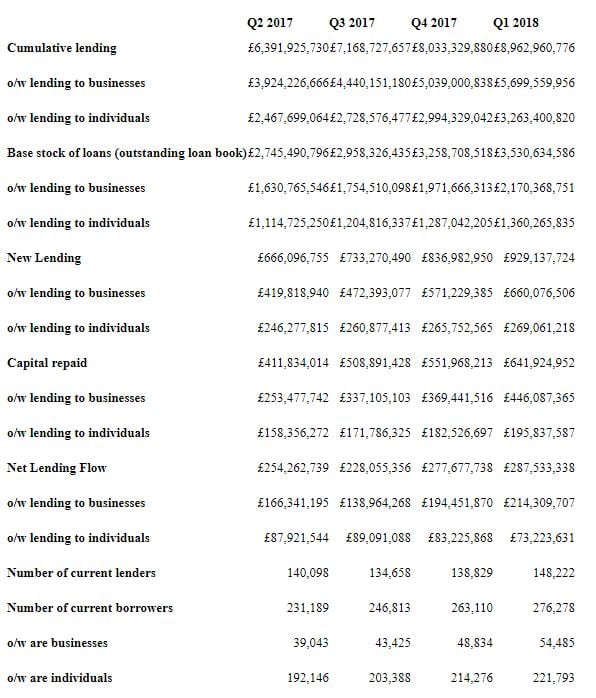

It even has its own self-regulatory body, the UK Peer to Peer Finance Association (P2PFA), which aims to set good practice standards in the UK’s peer-to-peer lending sector. P2PFA recently released Q1 2018 data for its member platforms which shows P2P lending is nearing £9 billion in loan originations, having provided finance for approximately 50,000 business and 221,000 individuals. Total investors stand at around 150,000. And that is just the numbers for their members, and doesn’t include RateSetter, which has originated almost £3 billion in loans, or Funding Circle which has originated over £5 billion.

Therefore, my estimate if you add those numbers to the books is that UK P2P lending has cumulatively originated over £17 billion in loans. Growth rates are around 50% per annum or higher for the largest providers like Zopa, which is now originating around £1.5 billion of new lending per year for 2018 which, based on current forecasts, would be over £2 billion in 2019.

Based on those statistics, we have a 13-year old company growing rapidly in a crowded market space. If we add the net new lending of Zopa, RateSetter and the other platforms together, then we’re looking at around £2 billion per annum of new loans.

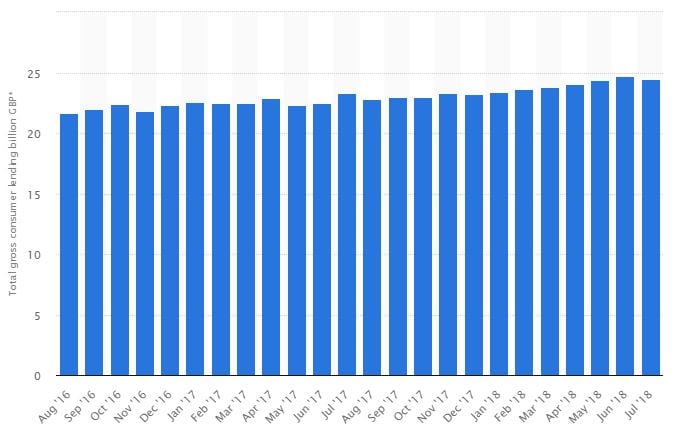

In a market that, according to Statista, has a total value of £25 billion in gross lending, excluding student loans …

… then P2P lending is definitely mainstream in the UK.

From personal experience, I know that it has not been that way in many other markets, due to nuances of regulation, data access and funding sources, but it does go to show that P2P lending if handled correctly can have a serious impact. If handled correctly means getting the right regulatory structure, government involvement and industry structure. Therefore, for those wanting to create these markets in other countries where it’s struggling, like the Australian example, there could be a few lessons learned in our marketplace that could give them insight.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...