In a final write-up on leadership, there was a fantastic presentation about the lessons DNB had learned in trying to make digital change happen. Solveig Hellebust, Group Executive Vice President for People & Operations at DNB or, as she called it, POP, talked about the five things that make the difference.

These are the lessons the bank has learnt after years of developing their culture and operations to be digital.

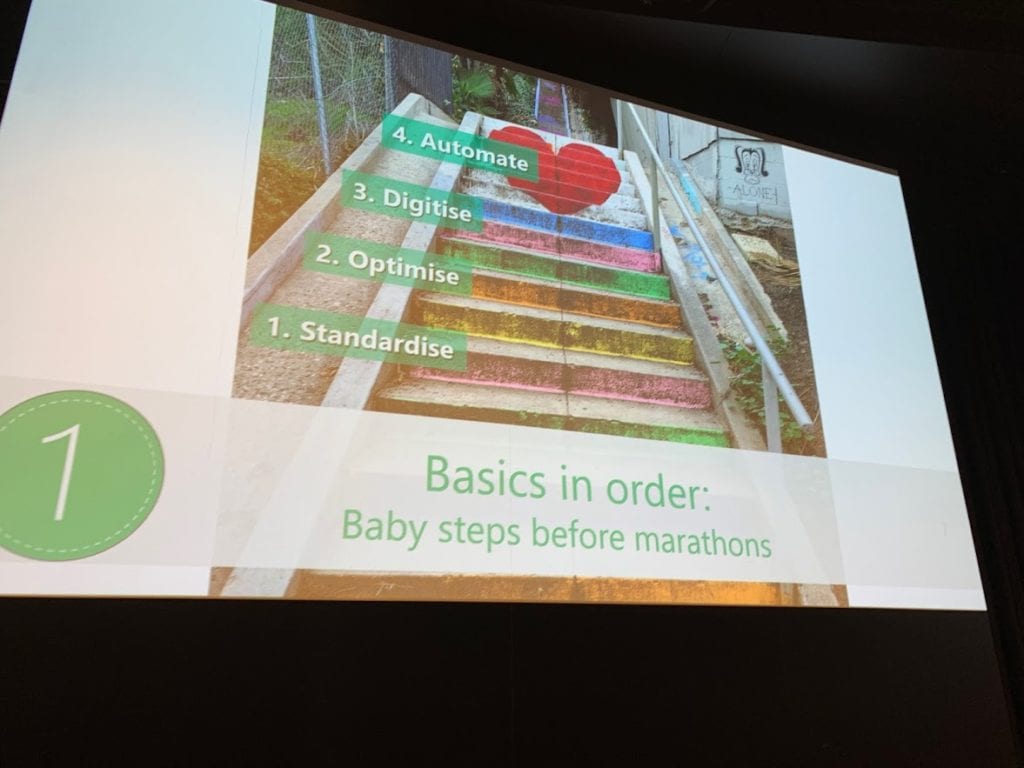

Lesson #1: Basics

The first lesson is to get your house in order before you start. Get the basics done and take baby steps towards change by standardising operations and optimising processes. You cannot run a marathon on day one. To start, you just need to take the first steps, then start running, then start running a mile or two and eventually you will get to that 26.2 mile marker. Just don’t try to get there on day one.

Lesson #2: Digital Lipstick is Expensive

We often talk about the lipstick on the pig. Adding nice front-end apps to rotten back-end systems is never going to work, and can often be an expensive mistake. If you don’t tackle the big issues and just roll-out the easy-to-do stuff, you may find yourself in a bigger mess than where you started. DNB found this out with the roll-out of VIPPS, the Norwegian mobile payments wallet. It was all shiny, sexy and new, but it was glaringly unworkable when the bank’s back office systems couldn’t keep up.

Lesson #3: People with different skill sets solve different problems

You need diversity in the organisation to go digital. If you have a homogenous group of people, they will never address the needs of change in the right way, because they will only look at it one way. You need people who can see all the angles, not just one.

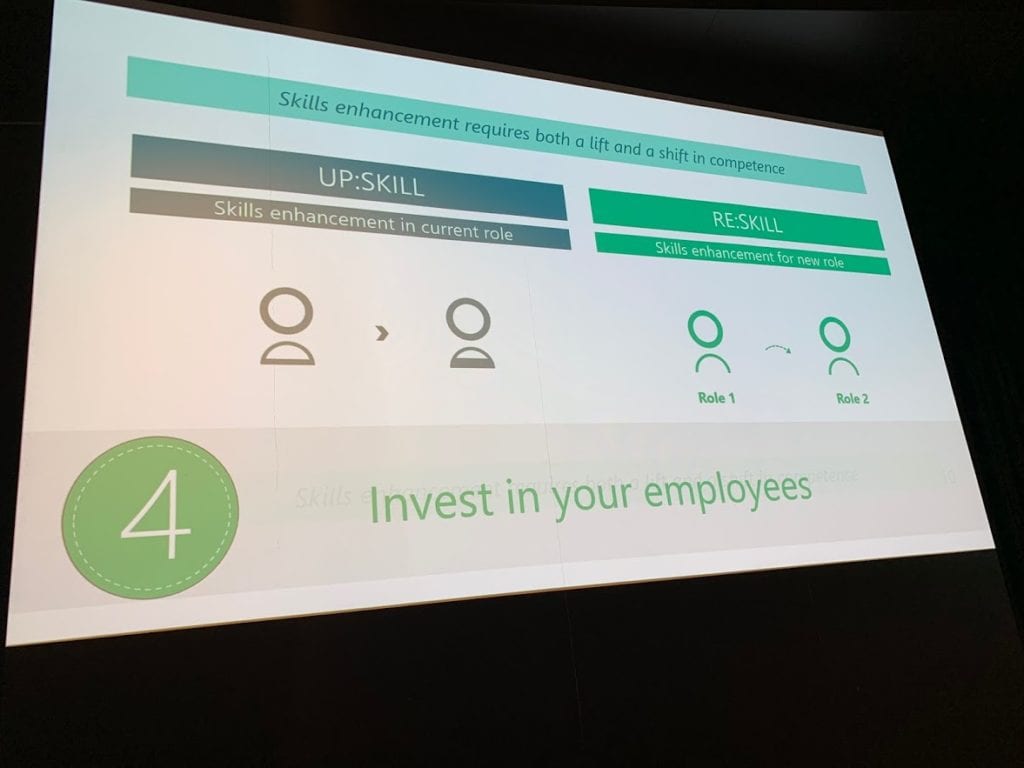

Lesson #4: Invest in your People

The biggest mistake a bank can make is to discard employees because their jobs have gone. Find them new jobs. Upskill and reskill them. Sometimes bank leadership teams believe it’s good to downsize the workforce, but often that workforce can be good at something else and it takes a lot longer to find a new employee who fits than to reskill an old employee who already gets it.

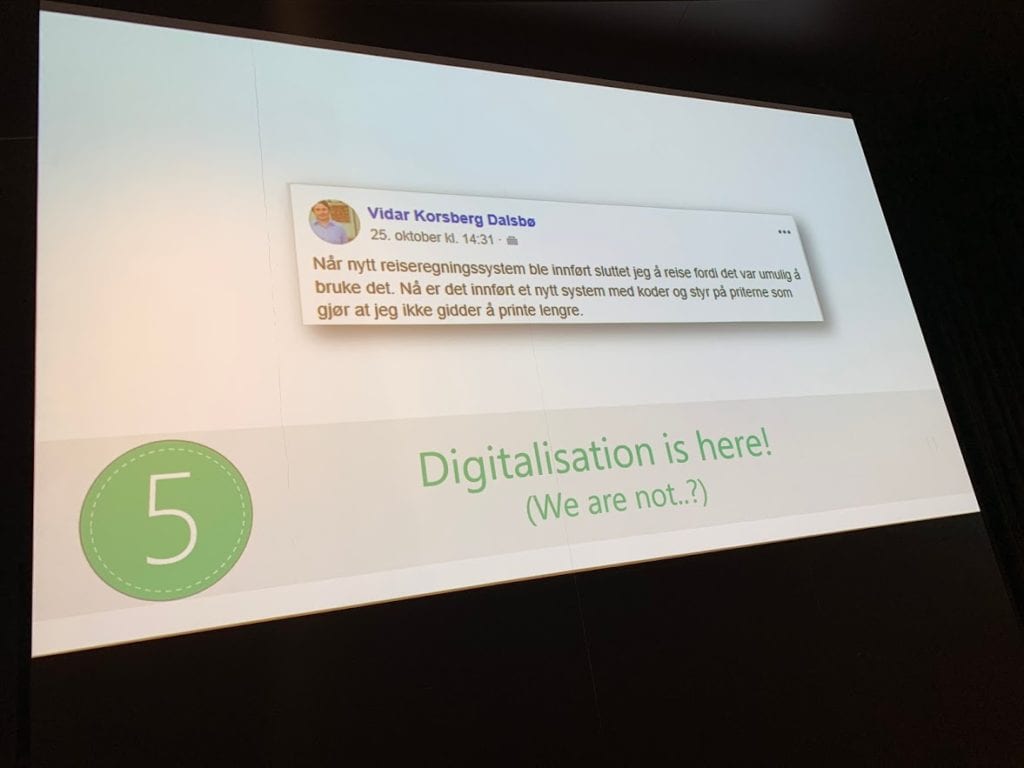

Lesson #5: Don’t believe you are Digital because we tell you

Often the customer knows best and you may believe you are doing digital well, but there’s nothing like hearing direct feedback from the user and their user experience. In this case the guy is tweeting that he had to print out and fill in forms to get the action done and couldn’t be bothered. Form filling paper documents in the digital age just doesn’t make sense. Listen to the customer.

I really liked Solveig’s honesty and have paraphrased her presentation here with my own slant and bias. Nevertheless, I think these five points are good points to remember, and always test yourself with them to see if you’ve started to get a little complacent. Always challenge yourself. Always change, as change is the only constant.

Good luck guys.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...