Name the company that strikes fear into everyone’s hearts in business?

In the 1980s, it was IBM. You never get fired if you buy IBM, even though It’s a Bloody Mess.

In the 1990s, it was Microsoft. Sure, Most Intelligent Creatures Realise Our Software Only Fools Teenagers, but yes, they were taking over the planet.

In the 2000s, it was Google. Everyone searching for something and finding a platform that connected them through the Global Object-Oriented Group Language of Earth.

And in this decade, it is Amazon. Amazon, the platform with tentacles everywhere that is just Amazing Everyone, or Amazon for short.

Amazon comes up almost once a month as the beast that will break into banking, and I’ve regularly covered them on the blog as an interesting example of adjacency. They will move into any space that grows online business but not full, deposit account banking imho. The reason I feel this is what does it add to their business model? Nothing. Payments and lending for sure, as that helps merchants, but the over-regulated deposit account marketplace. Nah.

Nevertheless, when you put Amazon in the headline with banking, it gets clicks. A good example of that was the guest article from David Birch last year:

which turned out to be one of the most well-read columns of the Finanser for 2018.

So why am I launching some clickbait on Amazon here today?

Well, mainly because I got two very interesting alerts this week which you may not have seen. The first was from CB Insights who have produced a 64-page report on Amazon’s strategy. Interesting note on page 60:

Amazon has been experimenting with financial technology that could widen its reach. In India, the company is offering thousands of loans to e-sellers so suppliers can expand their operations and manage seasonal spikes. The company’s acquisition of Emvantage Payments has also made it easier for Amazon’s India-based customer to pay online, which is always a key focus for the e-commerce giant. Amazon is also expanding its financial reach by launching Amazon Cash, which allows users to add to their Amazon.com balance by showing barcodes at brick-and-mortar checkout locations. The move is reportedly a bid to better appeal to underbanked users who are accustomed to dealing with cash and might be new to online commerce. The company has also improved its own line of credit cards, partnering with Chase to release the Amazon Rewards Visa Signature Card. The no-fee card offers an instant $70 Amazon gift card for sign up, in addition to 5% back on all Amazon.com and Whole Foods purchases for Prime members. In addition to targeting adults, Amazon’s investment in Greenlight Financial allows parents to issue and manage smart debit cards for their children. Parents can control spending limits and reload the card with the use of a mobile app.

More interesting to note that in a 64-page report, that’s about it for Amazon’s strategy in finance.

Then I got a note from Bloomberg saying that an Amazon master plan emerges. It wasn’t so insightful, as it’s main thrust was around Amazon moving into running its own transportation and logistics firm, but it did have a nice paragraph to start:

It can be tough to keep track of all the industries in which Amazon.com Inc. wants to spread its tentacles. There are groceries and healthcare and business computing and banking and entertainment and advertising and gadgets for the home and -- oh, shopping.

I clicked on the banking link and found this article from a year ago, which is just saying that Federal Reserve is watching Amazon. Again, nothing so insightful about launching a full-scale attack on banking.

In fact, for all of the media headlines, I find little in Amazon to justify them opening a full-service bank. In the same way that everyone thought Microsoft and Google would get into banking, they haven’t; and I feel the same way about Amazon. Why would they?

p.s. the reason Amazon won’t get into full service banking is for the reasons I pointed out the other day: dealing with technology is very different to dealing with money; furthermore, dealing with money through technology is very different to dealing with technology through money.

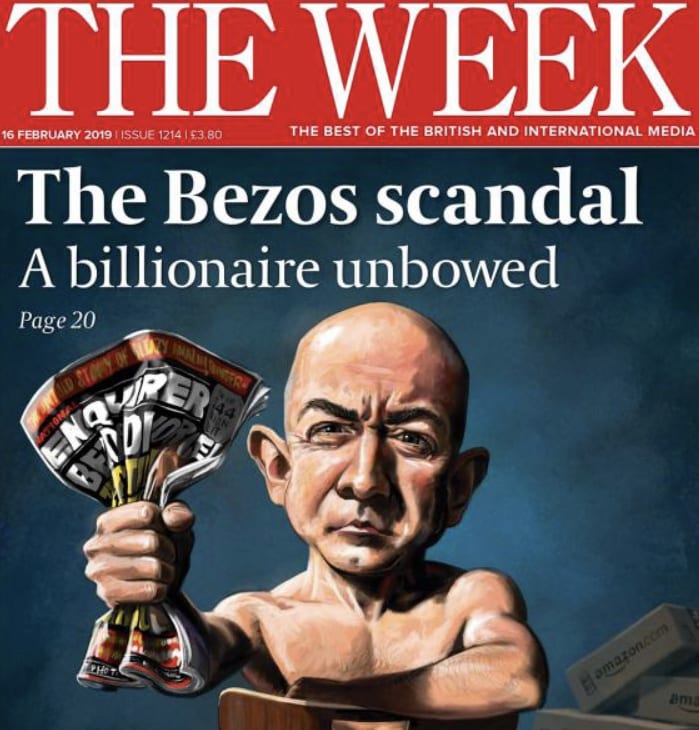

p.p.s. note I have not posted any nude photos of Jeff Bezos

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...