I used to blog about blockchain and distributed ledger technology (DLT) almost once a week … four years ago. Today, I hardly blog about it at all. I guess it just shows what’s top of mind and what’s not at any time in FinTech and, right now, blockchain is not top of mind. In fact, most of the conferences I go to these days it’s a surprise if anyone is talking about blockchain or DLT at all. It’s a no-no.

How can a rising technology that everyone loved fall so fast? Is DLT dead? Where do we go from here?

Just two years ago, The Wall Street Journal called blockchain a foundational technology as important as electricity and the worldwide web. But here is the most important part of that article:

Blockchain is not a disruptive technology, whose impact, once in the marketplace, is often quite rapid. Blockchain is a foundational technology, like electricity and the internet, whose transformational impact takes much longer - decades rather than years.

It is not a disruptive technology. It will not change things overnight. It takes a long time.

That’s because blockchain and DLT need to get agreement about how to use them before they can work and its use cases involve areas that have the most complex structures, and therefore the most complex agreements. Digital identity involves agreements between governments, corporations, financial institutions and citizens before it can be applied. Similarly, another major use case – clearing and settlement – needs agreements between financial institutions, clearing authorities, cross-border infrastructures, government authorities and central banks before it can be applied.

In fact, if you look at any of the major areas blockchain can make a difference, it involves complex discussions around structural change before it can work. That’s why it takes a long time, and doesn’t happen overnight.

This is why many commentators are now writing negative news about blockchain and DLT which, btw, are not the same. A distributed ledger can work without a blockchain, as demonstrated by Corda from R3 - a blockchain-inspired open source distributed ledger platform.

Furthermore, blockchain and DLT is incredibly complex from both a technological, business and use case viewpoint. Not only does it require in-depth understanding of how databases work and how the network applies consensus to the database through permissioned and non-permissioned structures; but it also requires an in-depth understanding of how to use that database technology in a specific use case that is also complex, such as the clearing of complex derivatives in closed markets. Add onto this that it then requires the authorities, who probably understand the use case and not the technology, to agree how and when to implement such technology for that use case and you can see why it’s such a hazardous playground.

Therefore, the headline:

ANZ rips apart blockchain, catalogues its big list of non-uses

And I immediately clicked, thinking is this the death-knell for DLT?

Answer no, and the article is a bit of a non-headline to be honest.

The article quotes heavily from Maria Bellmas, Associate Director, Trade and Supply Chain Product for ANZ, who said a number of things:

“Blockchain has been the darling of the tech world for some time and increasingly so over the medium term, perhaps in part pushed by scorned crypto fanatics grasping for some justification of their obsession in the wake of the bitcoin collapse … sold as a solution to all of life’s problems, blockchain offers a ton of legitimate solutions for businesses – but raises just as many questions … the reality is a lot of the problems blockchain projects attempt to fix have already been solved by existing technologies. In many cases, a regular database can solve for the problem with more reliability and for much less cost than blockchain …

“Blockchain has only been available in recent times and its scalability is yet to be proven. Some databases offered by leading technology providers have been in the market for years and have a proven record of processing millions of transactions per day without failure. Companies therefore need to do a thorough exercise to analyse the problem they are trying to fix and assess if blockchain really is the technology that best fits the solution …

“Don’t peg us as philistines; blockchain is a technology with a huge number of benefits and it is particularly proving useful in the trade finance space. ANZ is one of seven banks participating in the eTradeConnect in Hong Kong, an innovative project led by the Hong Kong Monetary Authority which makes use of blockchain technology.”

She adds that ANZ Banking Services Domain Lead, Nigel Dobson has stated that eTradeConnect is “an endorsement not only of the technology but also a broad digitisation strategy within the trade finance world, which is overdue … the truth is blockchain is not the solution for every project that needs a database. A 2018 study out of China showed despite the plethora of blockchain-related projects entering the market, 92 per cent failed – and did so in an average of just over a year.”

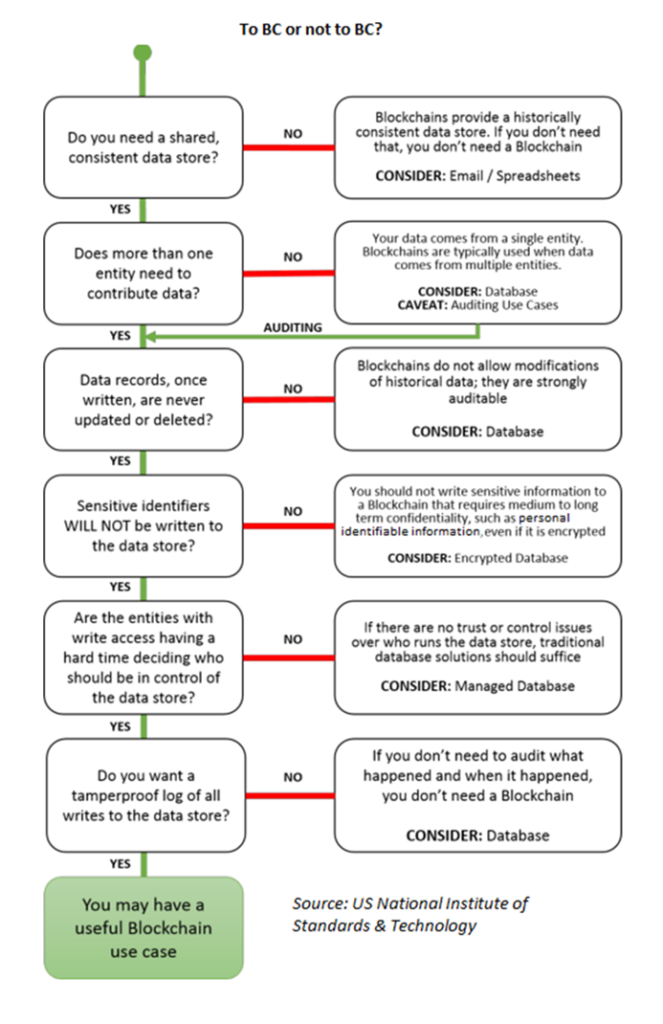

In other words, she’s calling it as it is. If you need a blockchain, it is for a very specific need. That need is to share a database of records with people you do not trust. The records need access and updating by everyone, and yet you do not trust any of them and so the network manages that trust. Sweet and simple. If you do not need to share a database or if you trust the people accessing the database, you do not need a blockchain. We’ve known this for a long time.

Anyway, the most useful part of the article on ANZ is this NIST (the US National Institute for Standards and Technology) flowchart for blockchain decision-making.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...