Being British with a British accent, everyone asks me about what life will be like with Brexit … and my answer is that I have no idea. I can see that the country is divided, and we have real issues, but then don’t most countries? I can also see that the government is completely divided between Remainers and Leavers …

… as is the country. And with last nights crucial vote rejecting the deal Theresa May agreed with the EU at the last minute – was that a big surprise? – then it looks like we are moving ahead.

The next question is what does it all mean to the banking industry?

The answer to that question was provided by a report from New Financial released this week. This report finds that over $1 trillion of bank assets have moved out of the UK and that London has been worst hit. Dublin, Ireland has gained the most, as I suspected, becoming the new EU entry point for banks from around the world.

The report shows that 275 financial institutions have moved out of the UK in preparations for Brexit, and highlights that Dublin is by far the biggest beneficiary with 100 relocations, well ahead of Luxembourg (60), Paris (41), Frankfurt (40) and Amsterdam (32).

The report concludes that:

The good news is that the contingency planning by banks, exchanges and asset managers – combined with recent agreements between UK and EU regulators – means that the industry is pretty well-prepared for whatever happens between now and March 29th.

The bad news is that the impact of Brexit is bigger than we expected, and we think the report understates the full picture. Many firms will have quietly moved parts of their staff or business below the radar, others will have held off making a formal move – and we think plenty of other firms aren’t yet ready.

And the worse news is that we expect the headline numbers to increase significantly in the next few years as local regulators across the EU require firms to increase the substance of their local operations. We also identified hundreds of firms that we think will have to move something somewhere to retain access to EU markets, but which haven’t yet done so.

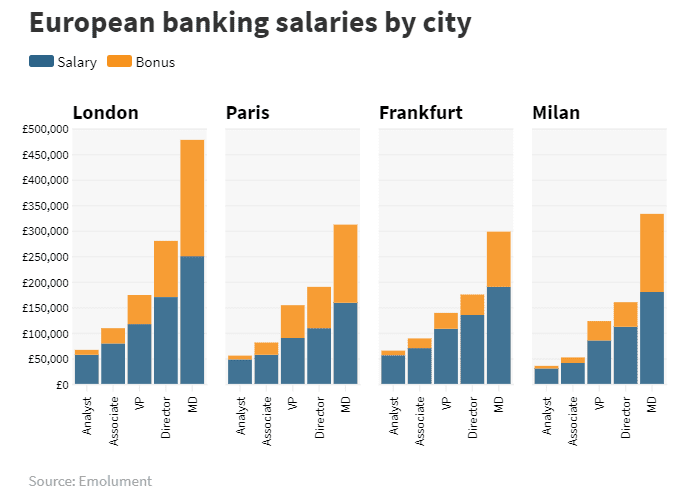

Oh dear. Mind you, the people who work for banks are not so keen to be moved. Data published from human resources firm Emolument, which analysed 4,475 salaries and bonuses from front-office bankers (traders) working in London, Paris, Frankfurt and Milan, found that the U.K. capital was the most rewarding in terms of pay.

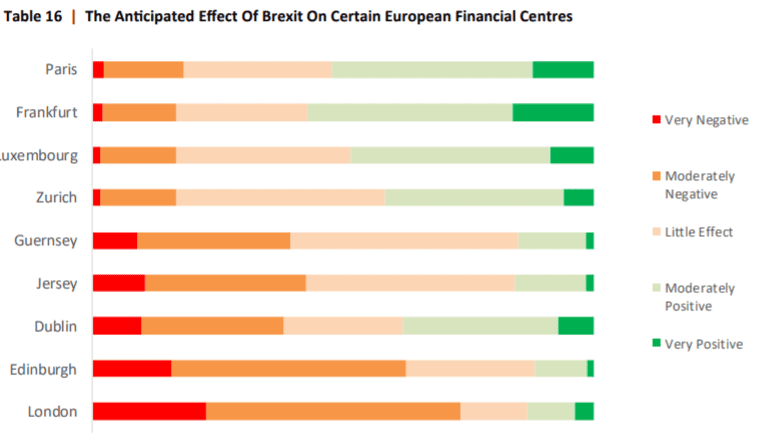

Equally, according to Z/Yen’s six-monthly tracking of the leading Financial Centres of the World finds London still leading, just behind New York. In the latest results published this month, they note that Brexit is impacting London as a financial centre however.

Oh dear, dear.

Then the other question is what does it mean to UK FinTech? Forbes writer Madhvi Mavadiya recently took the pulse of a variety of views on this around the FinTech community and the overwhelming view seems to be that UK FinTech will remain as strong as ever, Brexit or no Brexit or no deal Brexit. This is due to the talent pool, investment funds available, tax breaks and ability to get things done.

I hope that’s true.

My own feeling is that Brexit is a blip. A short-term blip. Is it a long-term hit? I'm not so sure.

Britain built its position as a global financial centre over years, decades and centuries. That does not disappear overnight. That centre is based upon not just a large talent pool of over a million specialists, but all of the associated trades of technology, consultancy, regulations, audit and compliance.

Then there is the global infrastructure, connectivity and trading capabilities, as well as language and relationships. None of that disappears overnight.

In particular, London as a global financial centre is not a European financial centre. It is a global one. New York is a global financial centre ... and is not part of Europe. Hong Kong is a global financial centre ... and not part of Europe. In other words, London can retain its crown whether in Europe or not.

Too much is attributed to being part of Europe for the UK, and London, to maintain its position as a financial centre but, if you look at the assets and people moving out of London, most of it is euro-specific trading operations. Eurobonds, euro clearing, euro trading and all things euro might move to Dublin, Frankfurt or Paris, but global trading remains firmly in London for all the reasons given above ... for the moment.

Long-term? Well, who knows but, for the moment, my bet is here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...