A year ago I blogged about invisible banking and that I have some issues with it, namely that the bank brand disappears and the customer finds it too easy to spend without thinking. Now, I read more and more about embedded banking, contextual banking, frictionless banking and more, and I think people have got this all wrong. What they really mean is embedded payments, contextual payments and frictionless payments, and they have to realise that banking is different to payments.

Equally, many throw this into a big heap of homogenous mess that they call banking, when banking is heaped with complexity and granularity that moves far further and deeper than just a payment or a deposit account. There’s asset and fund management, market makers and brokers, investment banking and wealth management, trading, investing, saving, payments, credit, mortgages, insurance, assurance and, oh yes, retail banking.

This is an issue in general with most commentators. They lump the whole lot as though it is one space and call it disrupted and unbundled, but I disagree with that. I agree with one thing only, which is that the world of digital which combines mobile, social, internet, open platforms, marketplaces, plug and play code and more, has enabled thousands of specialist firms to remove friction from bank processes.

This is best exemplified by a firm like Stripe who launched seven lines of code in 2011 that is now worth over $20 billion. This is because Stripe focused on one key area – merchant checkout online – and made it so simple that dropping their code into my app is a no-brainer. That’s why Apple Pay, Uber, Kickstarter and more use Stripe for their in-app checkout processing.

But that’s just for payment, and too often people mistake frictionless payments for frictionless banking. Frictionless banking is built of 1000s of processes, of which merchant checkout online is just one. However, what interests me is the 1000s of start-ups, often started up by former bankers involved in these processes, who are automating all of the other processes.

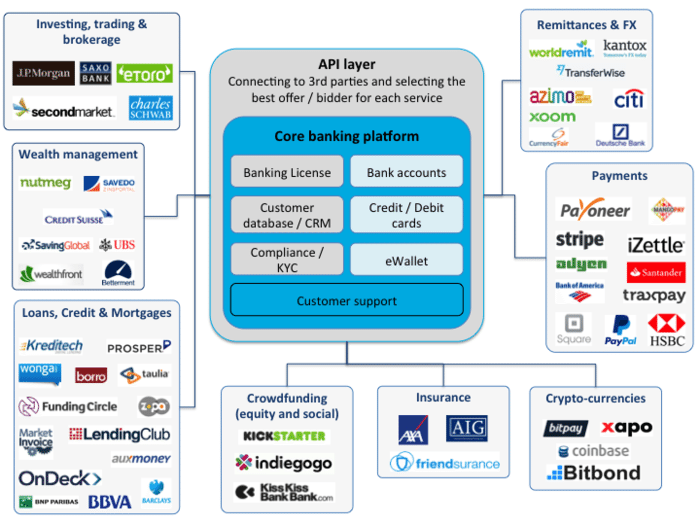

When I look at today’s FinTech start-up – of which some are quite mature – marketplace, there are 1000s of start-ups doing one thing brilliantly well across the whole gamut of financial services. In fact Philippe Gelis, co-founder and CEO of FX firm Kantox, wrote about this very thing four years ago on my blog but, like Banking-as-a-Service, it can take years for these visions to become reality.

What Philippe said back then:

All services (investing, trading & brokerage; wealth management; loans, credit & mortgages; crowdfunding; insurance; crypto-currencies; payments; remittances & FX …) will be provided by third parties through API, including old-school banks, financial institutions and fintech companies.

is gradually becoming a reality. That’s what Open Banking is all about.

And my rallying call is for large, traditional banks to wake up and find the 1000s of firms removing friction from bank processes and bring those to their corporate, retail and institutional clients. Customers should not have to go and find the 1000s of APIs in the Open Banking marketplace that might be relevant to them or that might work for them. The bank should do this for the customer.

Customers should not have to go and perform due diligence on 1000s of start-up firms that are light regulation, little history, restricted capital and no trust. Banks should do this for them.

Customers should not have to work out how to take 1000s of APIs and integrate them into their ecosystems. Banks should do this for them.

In other words, it’s my old rallying call that banks need to be curators of open marketplaces that removes friction from bank processes, rather than developers of end-to-end services for customers aimed at controlling and retaining their relationship in exclusion to all others.

This is the only path for the future and the banks that think they have to control the supply chain and value chain of finance, their future is bleak.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...