For those fooled by yesterday's spoof news about Alipay and Visa, did you notice it was April 1? If not, you should have clicked the link in the blog.

Talking about spoof news, I think my blog Blockchain is dead upset a few blockchain enthusiasts. Don’t get me wrong, as it’s not me saying blockchain is dead. It’s just a healthy reality check that came from ANZ, who are joined by Bank of America, the World Bank and many others in saying blockchain is useful but complicated.

It’s complicated.

Blockchain combines all the things we don’t understand about technology with all the things we don’t understand about money to create something new and different.

A lot of what the technology is brilliant for is provenance, recording something on a shared database maintained by the network and, consequently, immutable.

A $95 million Picasso artwork was lost for twenty years, but would have been impossible to lose if recorded on a distributed ledger claims Thomas Crown Art, who use blockchain technology for art and antiquities provenance, recording each art piece under their custody and linking its Certificate of Provenance to a smart contract running off a blockchain.

London-based jeweller Taylor & Hart has reached a milestone in the jewellery scene by crafting and delivering its first bespoke engagement ring set with a blockchain diamond.

And big players like Mark Zuckerberg and Jack Dorsey have recently been warming to the technology. Mark Zuckerberg recently commented that Facebook might use a blockchain model to enable decentralised logins, without its servers acting as authenticators; and Jack Dorsey recently said that bitcoin will be the “native currency of the Internet” whilst investing in Lightning Labs, which is developing payment channels for bitcoin.

The problem is that it has been over-hyped and, thank goodness now, the hype is dead. We are in the trough of disillusionment during which times, a lot of great work takes off, no more so than in banking and finance.

In finance, there are many examples of where the technology is taking off.

ANZ made clear that blockchain is useful for trade finance.

“Don’t peg us as philistines; blockchain is a technology with a huge number of benefits and it is particularly proving useful in the trade finance space,” says Maria Bellmas, ANZ associate director for trade and supply chain. “ANZ is one of seven banks participating in the eTradeConnect in Hong Kong, an innovative project led by the Hong Kong Monetary Authority which makes use of blockchain technology.”

She adds that ANZ Banking Services Domain Lead, Nigel Dobson has stated that eTradeConnect is “an endorsement not only of the technology but also a broad digitisation strategy within the trade finance world, which is overdue.”

What’s interesting here is that there are many other trade finance start-ups focused upon using distributed ledgers to get rid of bills of lading and letters of credit, such as Marco Polo and We.Trade.

Some claim that blockchain is to payments what 5G is to telecoms: revolutionary.

In November 2018, CLS and IBM announced that investment banking giants Goldman Sachs and Morgan Stanley were the first to use its CLSNet, using Distributed Ledger Technology (DLT), and six more participants are said to be committed. IBM also recently launched the Blockchain World Wire, which will enable banks to transfer tokens and cryptocurrency in near-real time, cutting out banking intermediaries and lowering capital costs and clearing fees.

Meantime, JPMorgan has been particularly active in this space. Forbes reports:

According to results released by job-hunting site Indeed.com, JPMorgan Chase was the only financial firm in the top ten companies posting jobs with the words “blockchain,” “cryptocurrency,” or “bitcoin” over the past year.

In February 2019, JPMorgan Chase unveiled JPM Coin, a plan to use blockchain to simplify payments between its clients, after earlier creating a version of the ethereum blockchain, called Quorum, designed to let enterprises capitalize on the benefits of using a shared ledger similar to bitcoin’s blockchain, but with more control over privacy and faster speeds.

The only companies to post more jobs than JPMorgan Chase were tech firms IBM and Cisco, and consulting firms Accenture, EY, KPMG, and Deloitte, the last of which posted more jobs than any other company. Wrapping up the top ten list was Microsoft, ethereum incubator ConsenSys, and little-known Conduent, which spun off from Xerox in 2017 and builds platforms for big businesses and governments.

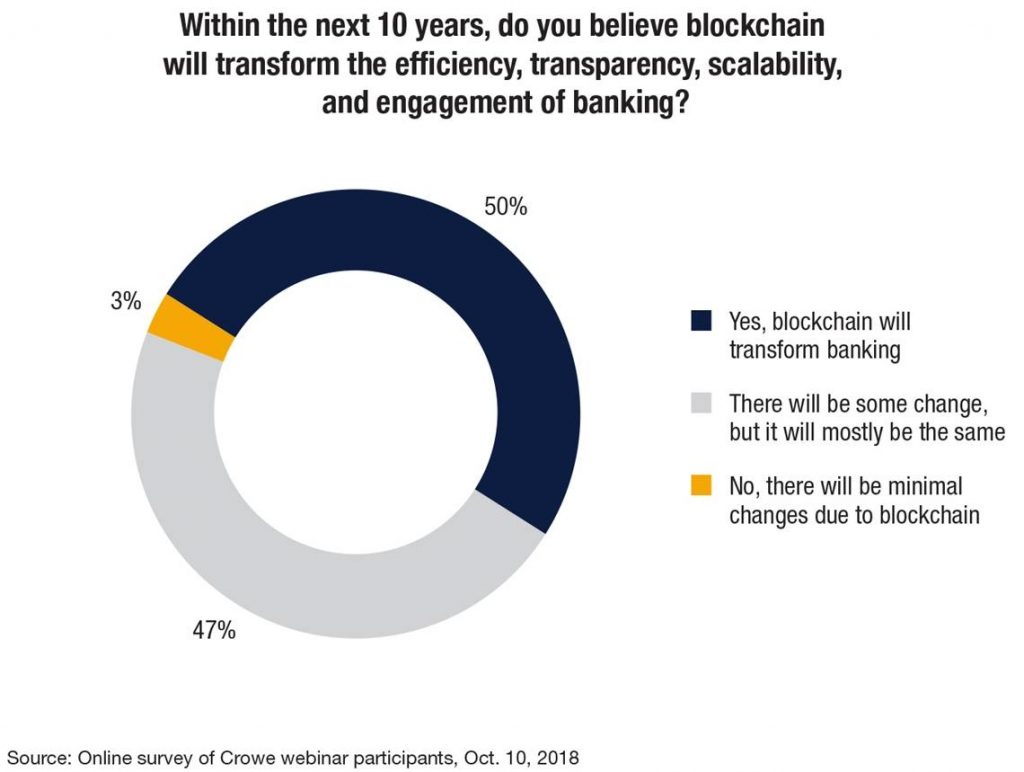

In fact, most bank executives think this technology will be transformational. 97% of bank executives surveyed during a webinar by Crowe believe that there will be significant change thanks to this technology, with half believing it will be transformational.

The insurance industry in America has created the RBA Alliance, a collaborative experiment in which dozens of insurance companies plan to share specified automobile policyholder data in a blockchain network.

In healthcare, one in ten claims are rejected, according to a 2017 analysis of more than 300 hospitals. There is a belief that blockchain could instantly reconcile whether or not a claim matches its specified contract terms and conditions, reducing delays and human error.

Nevertheless, and I keep coming back to this, the issue with blockchain and DLT in financial services is that its real benefits are replacing centralised infrastructures with lots of participants with decentralised infrastructure. To do that, the decentralised infrastructure has to be completely trusted to work for all participants if the trusted central counterparty is replaced. That is then the core issue as to why blockchain infrastructures are taking so long to appear.

Rolling out an infrastructure between a few corporate clients and one bank, or between one art gallery and its customers is easy; rolling out an infrastructure that covers 9,000 banks across five continents with over 200 central banks involved is far more difficult.

That’s why blockchain is taking so long to appear as a revolution but, when it does (and it will), it will be truly transformational.

Thanks to Russ Banham’s Forbes article, which provided the links to Crowe and a few others.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...