Another few articles I’ve picked up this week have focused upon the new generation of consumer: Gen Z. I would call them the iGen but that’s too branded, so marketers call them Gen Z. Who are the Z Gen?

As of 2019, the breakdown by age looks like this:

Baby Boomers: Baby boomers were born between 1944 and 1964. They're currently between 55-75 years old (76 million in U.S.)

Gen X: Gen X was born between 1965 - 1979 and are currently between 40-54 years old (82 million people in U.S.)

Gen Y: Gen Y, or Millennials, were born between 1980 and 1994. They are currently between 25-39 years old.

Gen Y.1 = 25-29 years old (31 million people in U.S.)

Gen Y.2 = 29-39 (42 million people in U.S.)

Gen Z: Gen Z is the newest generation to be named and were born between 1995 and 2015. They are currently between 4-24 years old (nearly 74 million in U.S.)

It’s funny that we bankers talk about reaching the millennials when the millennials are now our managers. Millennials are no longer the target. The target is Gen Z. Get them young, keep them for life … or that’s the way it used to be in banking. Is that changing? Probably.

If you turn 18 this year, you are younger than Amazon and Google. You turned three with Facebook’s arrival, four with YouTube, five with Spotify, six with the iPhone and eight with WhatsApp.

In other words, Gen Z grew up digital. They don’t have any idea of a landline or a time before the mobile telephone and internet.

And yet they have money. A lot of it. In January 2018, it was estimated that Gen Z have $143 billion of direct spending power in the USA. It’s going to be more today.

And they influence at least $600 billion of parental spending, if not more, according to these estimates in America. Worldwide, you can probably triple those amounts.

So, let’s say there’s a $2 trillion market here. How well are companies addressing this opportunity?

Hmmm. Some good but not a lot. That’s why retailers Woolworths, Debenhams, House of Fraser, Maplins, Jessops, HMV and more have gone down in the UK, whilst Toys R Us, Charlotte Russe, Wet Seal, Claire’s and Payless ShoeSource have gone under in America.

Like bank branches, physical stores are disappearing fast as main street becomes a ghost town.

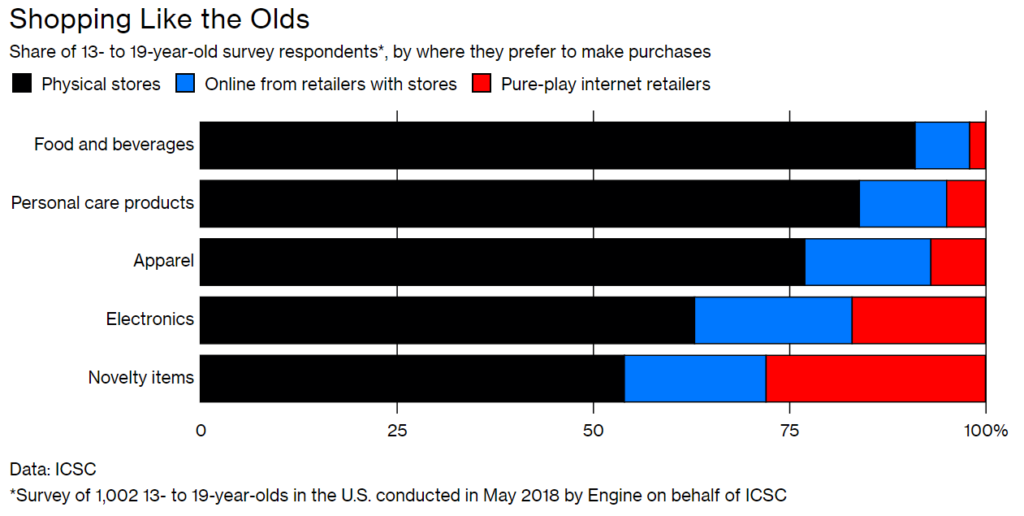

But it may surprise you to hear that this is not what Gen Z want. Gen Z like shops and shopping in the shopping mall. 95% of Gen Zers visited a physical shopping centre during a three-month analysis in 2018, compared with 75% of Gen Yers and 58% of Gen Xers.

These stats are from a Bloomberg article which explains why:

For companies that embrace [the fact that Gen Z live in their smartphone] instead of fight it, the payoff can be huge.

Forever 21, consistently ranked among American teenagers’ top brands, rewards phone-in-hand shopping by offering customers 21 percent off if they snap a picture of themselves in a Forever 21 outfit and post it with designated hashtags—then show the cashier at the register. And they do it: On Instagram, the #F21PROMO has been used about 20,000 times, mostly by teenage girls striking a range of poses from sitting on a bench with a Starbucks drink in hand to throwing up peace signs. One poster on Twitter, who hid her face with her baseball cap, wrote “my mom is making me do this for 21% off.”

RetailMeNot, a digital coupon provider, is able to send push notifications to shoppers when they’re in a mall to alert them to potential discounts. A recent survey from the start-up found that an overwhelming 91 percent of Gen Z shoppers are searching for deals on their mobile phones while inside retail locations.

Nimble retailers are making their stores more Instagram-worthy in a bid to appeal to this connected crowd. About a third of Gen Z consumers say shopping should also be entertaining, according to data from Cassandra, a cultural insights and strategy agency. With these Gen Z shoppers in mind, old-guard department store Macy’s Inc. earlier this month rolled out in 36 of its locations “Story,” a colorful themed shop-in-shop. In its behemoth Herald Square store, the 7,500-square-foot space is brightly painted with primary colors, a pillar completely made of Crayola crayons, a pingpong table and a rainbow tunnel.

In other words, it had created a prime Instagram space.

What’s this got to do with banking?

Well, a lot. How are you reaching the Gen Z consumer? How can you onboard them early and target to retain their relationship for life?

This is the classical view of a bank marketer as, in olden days, no one changed their bank account. They were more likely to keep their bank account than their partner. Although that’s not true anymore, it still has some relevance.

The Economist cites research by a consulting firm called Raddon, who “found that 85% of American millennials used mobile banking, and predicted that the share would be higher still for Gen Z. The main reason people choose a bank is convenience, the consultancy says. For older people that means a nearby branch; for younger ones it means an excellent app.”

Sure.

But the real bottom-line here is that this is the generation creating the future of finance. Don’t believe me? Well, John and Patrick Collison were 19 and 21 years old when they started Stripe (in 2010); Vitalik Buterin was 19 years old when he created the code that is becoming the backbone of the next generation internet (Ethereum); and Olly Purdue was 21 years old when he dropped out of university to launch a challenger bank in the UK (Loot).

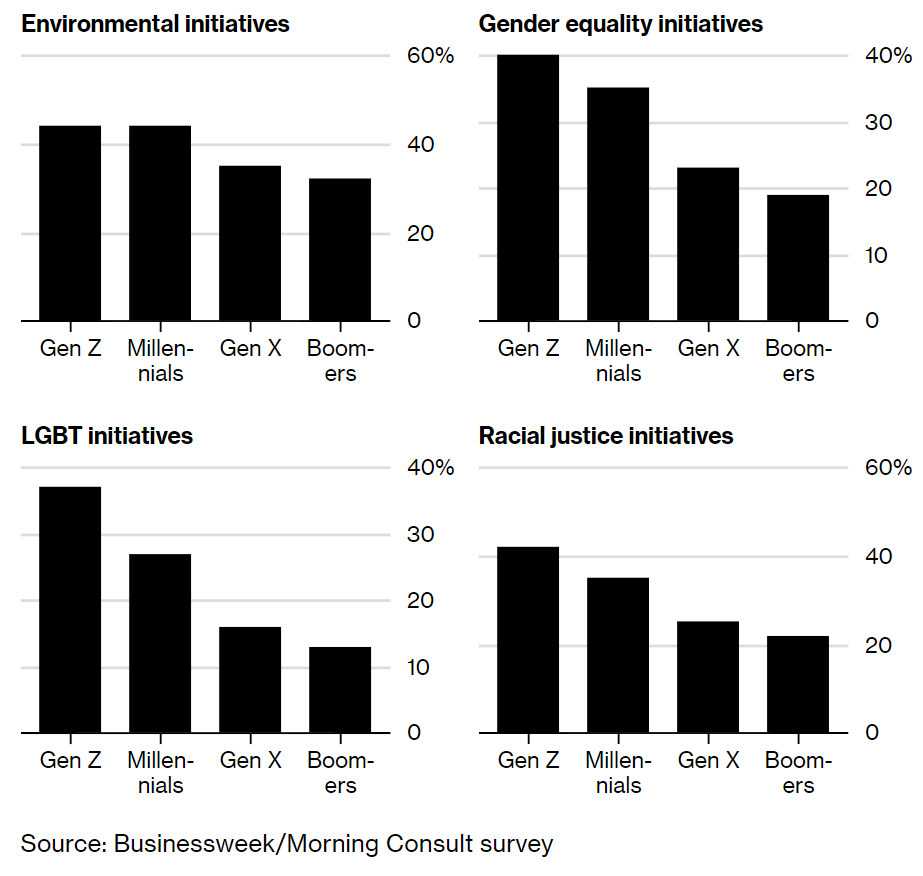

Kids who can code are creating the next generation of financial services, and they don’t like the last generation. This is because they’ve been polluted by the financial crisis, environmental rape and hate crimes. They hate hate crimes, climate damage and big banks.

Would you pay more for a product if the brand or retailer promotes:

Source: BusinessWeek

They “demand more from financial institutions than older people do, and care more about values-based investing and corporate social responsibility. The young expect an answer to the question: “’Why are you in banking?’, says Rick Spitler of Novantas, a financial consultancy. ‘They think bankers should care about helping people to become wealthier, not just about their own bottom line.’” The Economist

Hmmm. That’s not so good for the banks doing bad for Planet Earth or that only have shareholder interests at heart.

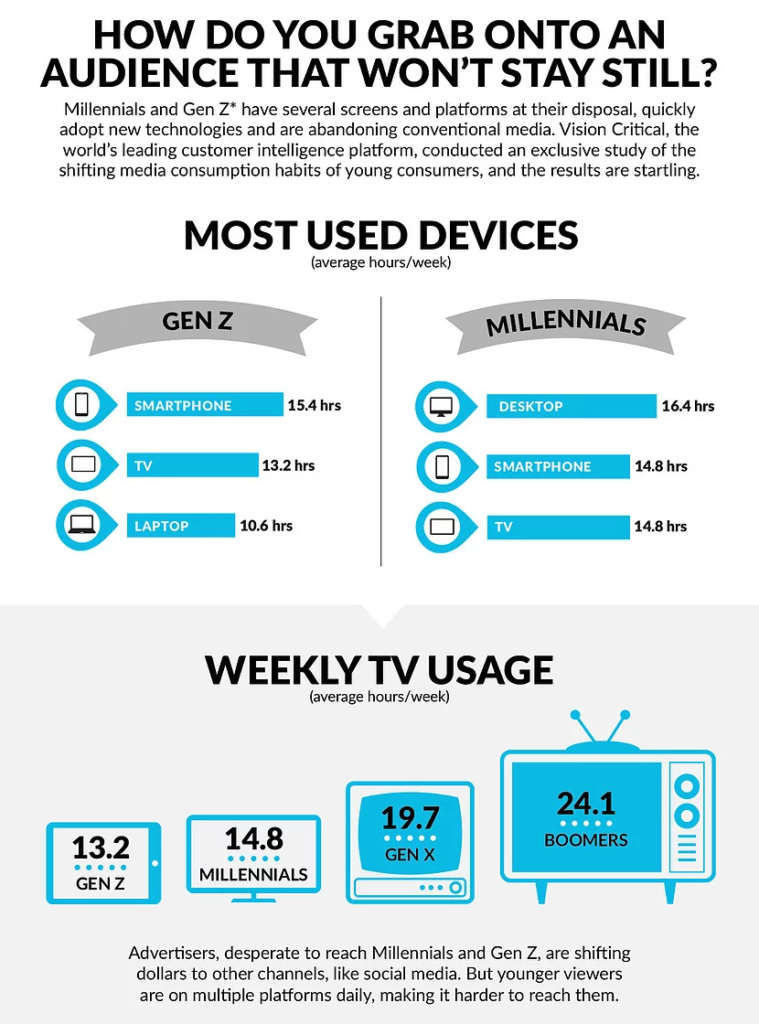

Equally, reaching these Gen Zers is much harder than it used to be, as their major influence is social media.

Source: Vision Critical

My conclusion is that Gen Zers are going to be key to the talent war for coders and innovators so you can’t ignore them. The problem is that they can easily ignore you.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...