I used to blog about blockchain and cryptocurrency almost every day. I stopped as it got too hyped, scammed and boring.

In fact, my last blog was about the blockchain hype being dead, but the blockchain dream is still very much alive.

Now, most people think that blockchain is something to do with bitcoin, but it’s got hardly anything to do with bitcoin. For example, Forbes published a list of the top 50 developments in blockchain last month. Here’s their intro:

Introducing Forbes Blockchain 50

According to International Data Corp, total corporate and government spending on blockchain should hit $2.9 billion in 2019, an increase of 89% over the previous year, and reach $12.4 billion by 2022. When PwC surveyed 600 execs last year, 84% said their companies are involved with blockchain. With assistance from industry consultants and other experts, Forbes' team of reporters and editors identified big companies actively exploring blockchain through industry consortiums and other proprietary projects. Our new list features 50—with minimum revenues or valuations of $1 billion, and U.S. operations— that are currently leading the way in adapting decentralized ledgers to their operating needs.

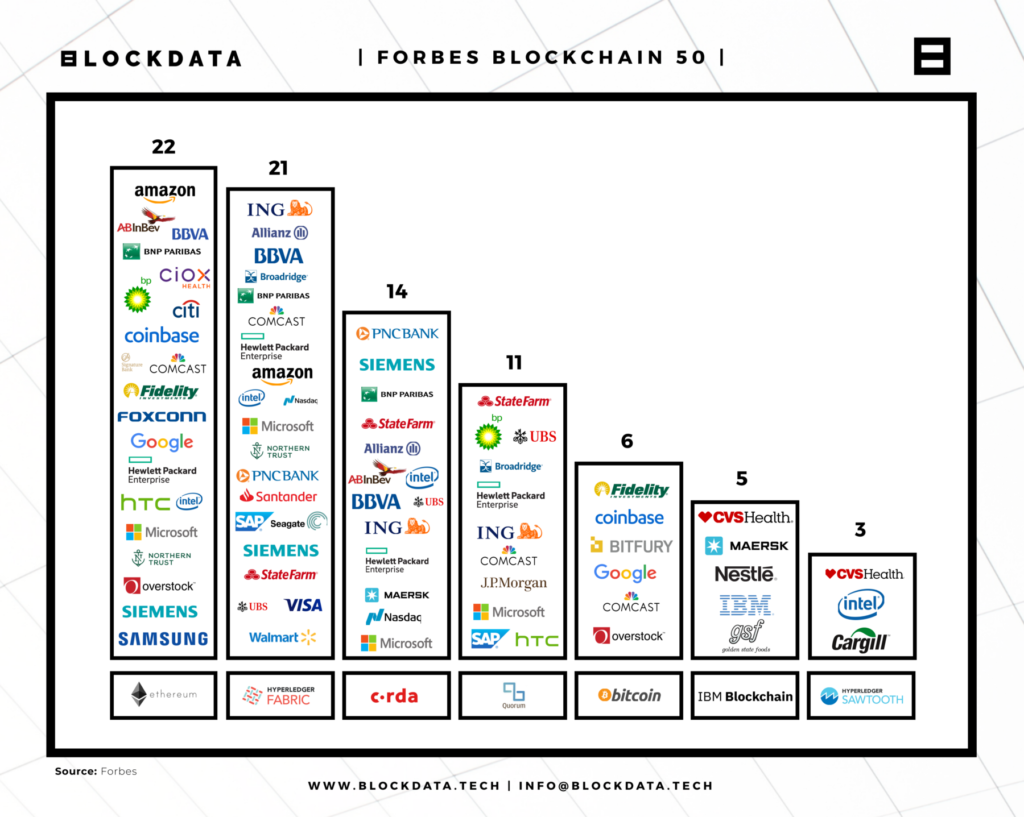

It's an interesting list, analysed by Blockdata on Medium, who found that the top three platforms are Ethereum, Hyperledger Fabric and Corda (note: only Ethereum is technically using blockchain).

But this is not a blog about blockchain, but about bitcoin itself.

bitcoin is being challenged by stablecoin. From Wikipedia:

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some "stable" asset or basket of assets. A stablecoin can be pegged to a currency, or to exchange traded commodities (such as precious metals or industrial metals). Stablecoins redeemable in commodities are said to be backed, whereas those leveraging fiat money or other cryptocurrencies are referred to as unbacked.

So we have IBM developing stablecoins, tied to the US dollar; Facebook about to launch a stablecoin; Tether launching a stablecoin (but not quite); and more. In fact, some claim the stablecoin marketplace is already overloaded.

Nevertheless, it does make sense to have a digital currency backed by real assets. Whether it be US dollars, gold, property or any other asset, true asset-backed stablecoin currencies should win over currencies backed by nothing.

What is the underlying asset in a bitcoin?

Good question and one asked on Quora, to which the #1 answer is: THIN AIR.

That’s the problem. There’s little behind bitcoin except the promise of a global currency without government, and even that’s been pooped. China has successfully banned bitcoin as a currency, bitcoin trading, ICOs, and is now moving on to banning bitcoin mining.

I’ve never been a bull on bitcoin, only on the promise of a global digital currency backed by a basket of real currencies one day. Nevertheless, there’s an interesting chain of tweets here about the next bitcoin reorganisation (clickthrough and read all the responses and replies to get a full understanding).

One of my questions about the proposed #Bitcoin reorg is whether the Veil of Decentralization has now been lifted, such that regulators, policy makers, businesses, adopters, techies, will see #crypto in a new way.

One that recognizes the human agency and power at the core.

— Angela Walch (@angela_walch) May 8, 2019

Reorganisation? More like another fork.

There have been a number of reboots (forks) of bitcoin and ether since their inception, and this demonstrates the experimental nature of where we are today and why cryptocurrencies are not ready for prime time yet. In fact, my view on bitcoin is that it won’t be ready for prime time for some years to come as a payments systems, if ever, so it did amuse me when I got in a taxi the other day that accepts bitcoin payments.

Impressed with #mytaxi today pic.twitter.com/DZ3xZUSSUr

— Chris Skinner (@Chris_Skinner) May 8, 2019

Nothing like marketing hype, is there?

POSTNOTE

For anyone wondering, I define WTF as What's The Future?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...