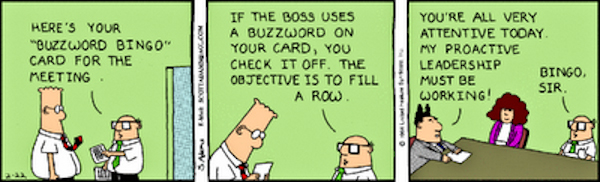

I encounter lots of banter about platforms, marketplaces and ecosystems, and do wonder in the flippant way people use them interchangeably whether they really understand what they are talking about. I’m sure many do but I'm also sure some people throw them into the conversation like a buzzword bingo game. Add AI, blockchain and open banking and you've got the win! So, just in case, I thought I would write for the record how I see them.

Probably the most important start point is the platform. A platform allows anyone to develop and deploy code that can then be integrated and used by others, and is generally seen as the owner of the marketplace. In the case of the internet, which is the world’s largest platform, there is no owner. Then there are other platforms that offer opportunity. Apple owns the App Store, which is a platform; Alibaba and Amazon offer a platform; Facebook is not really a platform, although it has attributes of one. The reason I make the distinction in the last category is that Facebook’s business model is based upon advertising whilst Apple, Alibaba and Amazon are commerce. A platform should really offer the opportunity for developers to make money. Sure, you can make money from ads, but downloads and purchases are better as then you have to pay for them, which is when banks and FinTechs get interested.

The marketplace is then all of the companies who have turned up on the platform to offer their services. Stripe, Adyen, Square, iZettle, eToro, PayPal, Plaid, Finicity and more are all API FinTech firms that play on platforms, mainly on the internet but some can be found in the App Store and elsewhere. They are all store holders on the platform’s marketplace vying for business, and you find them via Google, their websites, an advert on Facebook or a download from Apple.

The ecosystem is then the partners in the marketplace who work with each other to leverage business for each other. The Stripe market stall gets far more business when its known to work with key players like Indiegogo, Lyft, Square and more; Adyen’s success is based upon big names like Uber, Tiffany and Spotify; and so on and so forth. Each time these store holders get a big name, they get more revenue as the big name generates transactions, and it also lowers costs as the big name does the plug-and-play drop of the code into their apps and online services.

The key aim for any store holder is therefore to get traction in the marketplace by demonstrating they are more attractive than the next store, just as you find in any marketplace.

I’ll come back to that point in a future blog post – as it’s a key one – but given the definitions above, where does a bank fit? Banks talk about owning platforms, they don’t own any; they talk about marketplaces, but find it hard to work out where they fit into the marketplace; they believe they manage an ecosystem, or even own one, when they’re typically part of one.

In fact, in my discussions of banks becoming curators of ecosystems, what they really need to do is first work out which platforms they play on. Today, most play on the internet, the App Store, Facebook and more. Then they need to work out what store they want to create on those platform’s marketplaces. The platform owns the marketplace, and the bank is just a store holder. How can it make its store better than other banks and FinTech firms? Finally, it may be better not to be better than other banks and FinTech firms, but to partner with them. At this point, the bank needs to build an ecosystem of win-win partners who can all work together on the platform’s marketplace to get business in a mutually beneficial way.

This is not easy, but I am getting tempted to call out any presenter from a bank, or other firm, who talks about platforms, marketplace or ecosystems, and ask them exactly what they mean. Just to check. You are warned.scuppered not because the intentions were honourable, but because the reality is that aligning two distinctly different organisations of thousands of people to work together in harmony just does not hold true.

Meantime, I’m thinking that within the IT industry, we have decades of experience of doing these ecosystem relationships and marriages, so it would do banks no harm to hire a bunch of system integrators from the technology world to become their leads in developing banks as value integrators in the financial world.

Happy partnering.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...