Over a decade ago, I curated a book about MiFID – the Markets in Financial Instruments Directive. I don’t blog about this much these days, as my audience is firmly in the retail and payments technology space, but I still keep close track of the investment markets, clearing and settlement, custodial banks and central counterparty clearing movements.

The first MiFID regs were introduced in 2007 and aimed to break the concentration rules of national exchanges across Europe, whilst increasing client representation by enforcing the best execution rules for their trading instructions. All well and good. It did achieve some of those aims – BATS Trading now runs a quarter of equities investments in some European markets and high frequency trading is now standard – but it also left a bit to be desired. Like most regulations, there’s always something they didn’t quite right.

That’s why MiFID II was implemented in January 2018. The aim of MiFID II was to address competition issues, where foreign firms outside the EU potentially had advantage over EU firms, and also the method of price formation and proprietary research.

A year after implementation, there are now lots of reviews of the effect of MiFID II and whether it is achieving its stated intentions to increase transparency and reduce costs for the end investor.

Writing for The Financial Times Julian Hull, Head of Sales at independent fundamental research firm Stockviews, states:

One way the regulation achieved this was by unbundling research payments from trading commissions, therefore inviting greater scrutiny of what constituted research spend. This forced most asset managers to decide to swallow the cost of research on to their P&L, and no longer pass it on to the end investor.

At the same time buyside firms have looked to bolster their own internal analyst numbers, citing proprietary research and a lack of reliance on the sell side to justify fees. However, internal analysts tend to have much broader coverage remits, meaning it is hard to generate focused research.

The high level results from MiFID II have been pretty staggering. Andrew Bailey, head of the FCA, highlighted a 20–30 per cent cut in spending from 2018 levels during a speech to EuroIRP, the equivalent to £180m saved.

But he goes on to warn of the unintended consequences which include weaker research, more focus on cost cutting, and a move to corporate business away from other sectors.

MiFID II has meant that sell-side analysts have less time to do proper independent research on the interesting companies and instead spend their time making sure they are ticking the right KPI boxes, or bending over backwards for new broking relationships. Meanwhile the buy side are in lock down, closed to any new providers, and are shrinking research costs, potentially blocking out any potential new sources of information. In short, inefficiencies are abundant.

Let’s look out for MiFID III.

There are many other reviews of MiFID II’s effectiveness, but I was interested in whether MiFID II had created any openings for new FinTech firms.

Interestingly, the EU has been quite active in working with national regulators to encourage FinTech innovation across all markets. There’s a European Commission paper to encourage such change.

The paper specifically states that national authorities must focus upon:

- Enabling innovative business models to reach EU scale

- Supporting the uptake of technological innovation in the financial sector

- Enhancing security and integrity of the financial sector

Following up on this, the European Securities and Markets Authority (ESMA), jointly with the EBA and EIOPA, published the Report on FinTech: Regulatory Sandboxes and Innovation Hubs in January 2019 and, more recently, a report on the status of licencing regimes of FinTech firms across the European Union (EU). The report makes no recommendations for further regulation at this stage, and shows that FinTech is working reasonably well in a post-MiFID II environment. This is because MiFID II’s unbundling mandate puts data at the front and centre for traders. That’s why FinTech start-ups like Nucleus Financial Group assets under administration pushed past £15 billion in the second quarter 2019, up 6.9 per cent year-on-year and 3.9 per cent from the previous quarter.

As previously blogged, FinTech is transforming every part of finance dramatically, and that applies as much to wholesale and investment banking, as it does to retail and commercial finance.

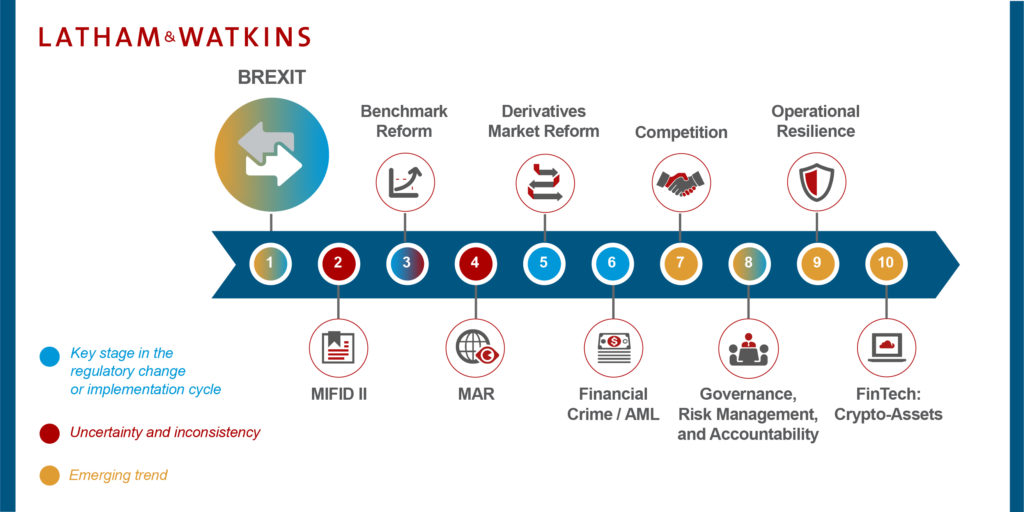

Meantime, for those in the wholesale markets, here’s a great summary of ten key regulatory focus areas for UK and EU firms from the law firm Latham & Watkins.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...