FinTech investment numbers are variable dependent upon how they are counted. The number I’ve been using for most of last year is that headline amount of $111.8 billion invested worldwide in over 12,000 start-ups. That number came from KPMG in 2019, who noted that most of that investment was flowing through Asia and China. The thing is you then see other number crunchers, like Accenture, who say that FinTech investments in 2018 rose to $55 billion, half of KPMG’s number. Therefore, I always take these numbers with a pinch of salt. There’s lies, darned lies and statistics.

However, there are also numbers that count and, either way you read it, 2018 was a phenomenal year for FinTech investment, with China leading the way.

In 2019, it’s not the same. China’s booming market plateaued and therefore the funding was not as huge as 2018. Nevertheless, Innovate Finance came out with some interesting numbers yesterday

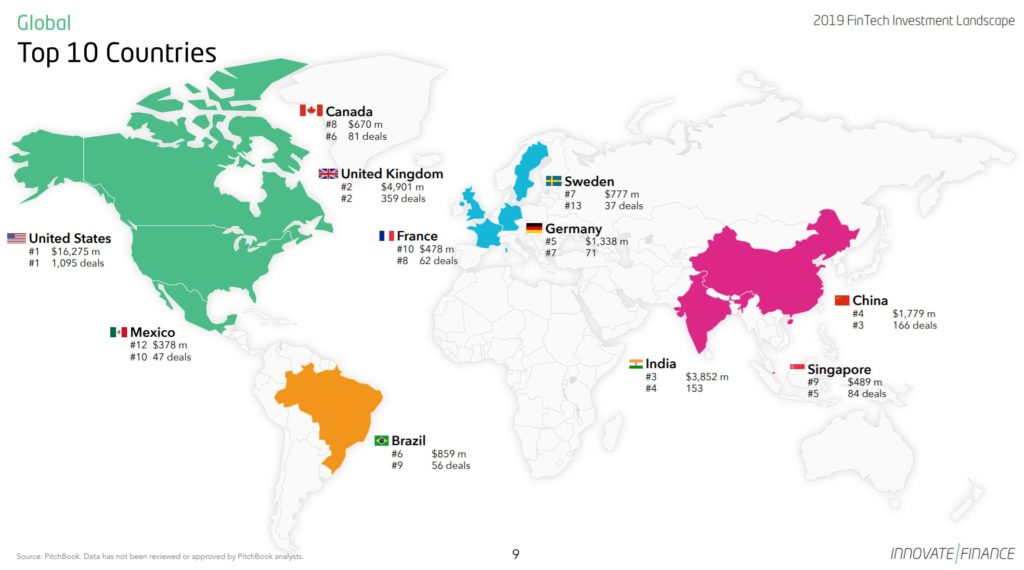

Global investment in FinTech decreased 28% in 2019 to $35.7 billion, dragged down by a sharp fall in funding to Chinese FinTechs. The relative value of the top five deals in 2019 has decreased to its lowest level in the past five years at 11% of the total investment, versus 40% in 2018.

Asia decreased 73% from $28.8 billion to $7.8 billion due to a significant drop in large deals in China. Investment increased 25% in North America to $17.3 billion, and 49% in Europe to $8.5 billion. North America received nearly half (49%) and Europe a quarter (24%) of total global investment in 2019.

2019 continued the trend of an ever increasing total number of big fundraises. Globally, there were 86 mega deals in 2019 (deals exceeding $100m in value), an increase of 23% from 70 mega deals in 2018. Over half of all mega deals occurred in North America (56%) and a fifth in Europe (20%). The largest three deals globally were Paytm ($1.7 bn, India), Greensill Capital ($800m, UK), Chime ($500m, USA), SoFi ($500m, USA) and Mission Lane ($500m, USA). Corporate participation in global FinTech investment continues to increase, rising to 20% in 2019 from 18% of all deals in 2018.

The United Kingdom ranked second globally (and number one in Europe) with $4.9 bn of investment (up 38% on 2018) across 359 deals (down 9%). The top five deals in Europe were Greensill Capital ($800m, UK), N26 ($470m, Germany), Klarna ($460m, Sweden), WeFox ($235m, Germany) and Checkout.com ($230m, UK). The UK saw significant fundraises in 2019, accounting for 7 of the 10 largest deals in Europe.

Looking more closely at trends within the UK, investment in female-led businesses stands at only 10% of all investment and 11% of deals. London remains the incumbent centre of investment receiving 88% of investment and 78% of all deals.

The report is well worth a read, and reinforces the position of London as the second largest FinTech centre of the world and Europe's leading FinTech centre. On this Brexit day, I wonder if I'll still be blogging that line a decade from now ...

... I suspect I will.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...