The prospect of a cashless economy is excellent news. Cash is inefficient. In rich countries, minting, sorting, storing and distributing it is estimated to cost about 0.5% of GDP. But that does not begin to capture the gains. When payments dematerialise, people and shops are less vulnerable to theft. Governments can keep closer tabs on fraud or tax evasion. Digitalisation vastly expands the playground of small businesses and sole traders by enabling them to sell beyond their borders. It also creates a credit history, helping consumers borrow.

I was taken in by an article on the BBC yesterday due to the headline:

‘I wasn’t allowed to buy my burrito with cash’

The article recounts the story of Nicholas Duggan, a construction worker, who tried to buy his lunch with cash, but the store refused and demanded payment by electronic means. Interesting. Specifically the article gives some perspective on what is happening with cash:

Americans used cash for an estimated 26% of transactions last year, down from 40% in 2012, according to surveys by the US central bank. The decline is not unique to the US. In the UK, the proportion of cash payments has dropped by more than half since 2008, sinking from 60% to 28% in 2018. In Sweden, cash accounts for just 6% of transactions, down from more than 35% in 2012.

The move away from cash has been a bonanza for credit card companies and newer firms such as Square, which handle electronic transactions. Consulting firm McKinsey expects revenue in the global payments industry to grow 6% annually over the next five years, to more than $2.7 trillion.

But about 6.5% of American households do not even have bank accounts - let alone “digital wallets”, according to the most recent US government estimates. That compares to less than 2% in the UK, and less than 1% in Sweden.

Funnily enough, on the same day, The Economist also had a write up about the world becoming cashless.

Yet set against these benefits are a bundle of worries. Electronic payment systems may be vulnerable to technical failures, power blackouts and cyber-attacks—this week Capital One, an American bank, became the latest firm to be hacked. In a cashless economy the poor, the elderly and country folk may be left behind. And eradicating cash, an anonymous payment method, for a digital system could let governments snoop on people’s shopping habits and private titans exploit their personal data.

They go on to give some interesting insights on the numbers too, and equally warn of the dangers of digital money for the poor who get scammed all the time.

It's not just the poor though. As the paragraph above outlines, the elderly can be impacted heavily too. I remembered a clip I saw a while ago about an older Chinese man who tried to pay with cash and was refused.

It caused quite a scene.

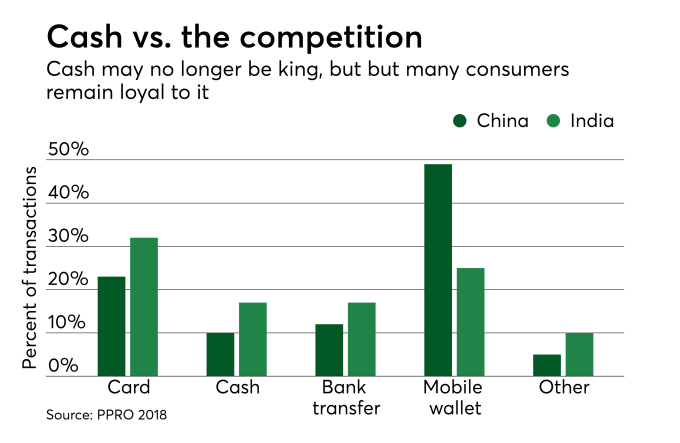

Interestingly China and India are ahead of the USA in the move to cashless, primarily due to the march of mobile wallets.

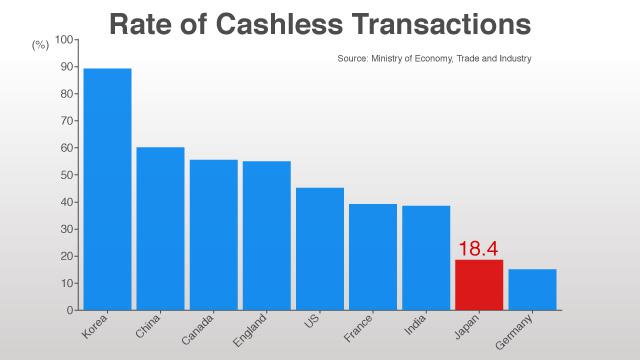

In fact, there are many countries ahead of the USA in the race to cashless, with South Korea being the most cashless country in the world.

Note: this chart shows USA using less cash than India, but that’s due to lies, darned lies and statistics

But that doesn’t mean that Korea is cashless. Far from it in fact. According to a survey by the Bank of Korea in 2018, only 1.7 percent of people in their 60s and 2.5 percent of those in their 70s had made mobile payments.

There’s the rub. You cannot have a cashless society if it excludes people from being able ot make payments in that society. That is why many governments are introducing statutory laws to ensure that any firms dealing with consumers are forced to accept cash payments, if that is the payment preference offered.

This then gets interesting as, over the next decade, I’m sure that firms will try to find ways around those laws, particularly as more and more payments are taken by mobile.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...