Last week, MIT (Massachusetts Institute of Technology) issued their top ten technologies for the next decade, one of which is digital money:

- Unhackable internet

- Hyper-personalized medicine

- Digital money

- Anti-aging drugs

- AI-discovered molecules

- Satellite mega-constellations

- Quantum supremacy

- Tiny AI

- Differential privacy

- Climate change attribution

This was selected due to Libra and the digital currency developments in China. What is also interesting is, in January, the same guys wrote a great article about the disappearance of cash:

“Think about the last time you used cash. How much did you spend? What did you buy, and from whom? Was it a one-time thing, or was it something you buy regularly? Was it legal?

“If you’d rather keep all that to yourself, you’re in luck. The person in the store (or on the street corner) may remember your face, but as long as you didn’t reveal any identifying information, there is nothing that links you to the transaction.

“This is a feature of physical cash that payment cards and apps do not have: freedom. Called “bearer instruments,” banknotes and coins are presumed to be owned by whoever holds them. We can use them to transact with another person without a third party getting in the way. Companies cannot build advertising profiles or credit ratings out of our data, and governments cannot track our spending or our movements. And while a credit card can be declined and a check mislaid, handing over money works every time, instantly.

“We shouldn’t take this freedom for granted.”

We certainly should not. Although I predict, as do many, the end of the use of cash, it is not going to disappear soon. It is an integral part of society. Today, it is the only way to exchange an immediate exchange of value anonymously, with trust. What digital service does that?

People talk about bitcoin as digital cash, but it’s not anonymous. It’s not even trusted by many. Why would bitcoin replace cash?

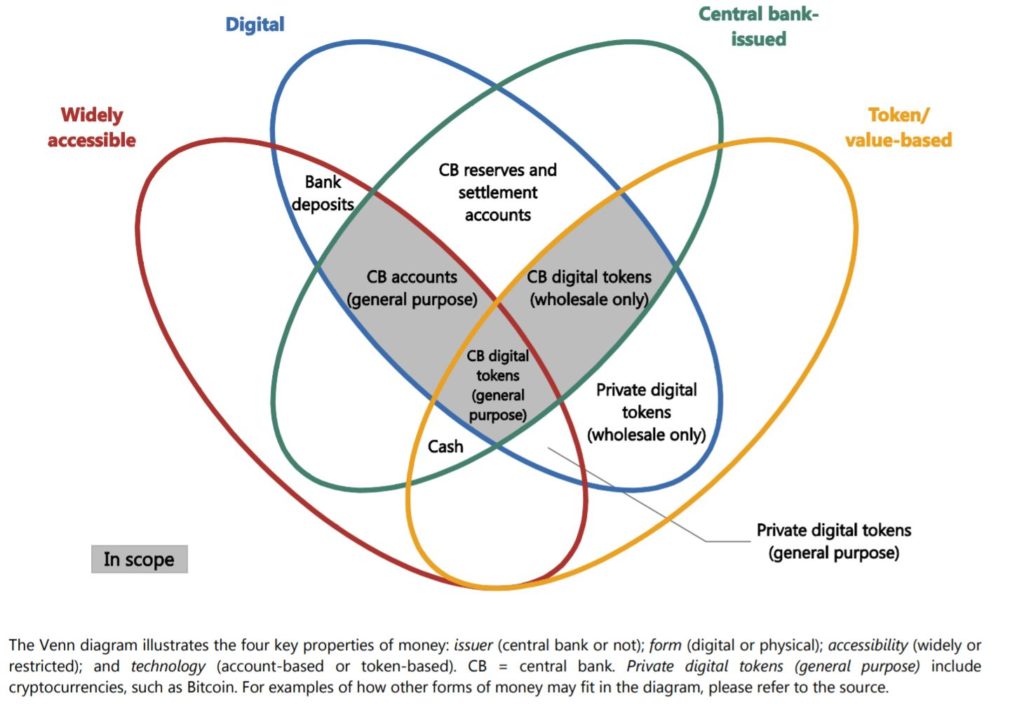

People talk about central bank digital currencies (CBDC’s) replacing cash, but it’s also wrapped in issues, especially the question of why commercial banks are needed if you have CBDC’s. This was discussed in a Bank for International Settlements (BIS) paper a year ago, and you can see the complexities here:

I don’t think CBDC’s are going to replace physical cash in the very near future.

What about Alipay, Square, WeChat Pay, Venmo and such like? Well, yes, they’re reducing the dependency on cash, but haven’t wiped out the use of cash. In fact, where cash is being squeezed the most is at the retail point-of-sale. That’s also where the most protest is being staged to ensure that cash can still be used.

So no, I don’t expect cash to die out soon, and neither does the Bank of England:

“While the future demand for cash is uncertain, it is unlikely that cash will die out any time soon.”

Mind you ... Coronavirus and cash may be an issue.

China started washing all their bank notes, the advice is not to use ATMs or cash if possible, and even leading futurists and payments pundits think it's the nail in the cash coffin. What do you think?

https://metro.co.uk/2020/03/03/avoid-cash-stop-coronavirus-spreading-world-health-organisation-warns-12344199/?ito=cbshare

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...