I just received a report from Deloitte about credit and debit cards. It says the future is not so bright: “more payment choices, along with changing consumer preferences, are threatening the long-term viability of the credit card business model.”

Damn. I said that fifteen years ago.

It made me think about what I was presenting back in the early 2000’s so I dug out my PowerPoint deck from 2005. I remember it well as it was called “The Death of Cards”.

I was predicting that everything was moving digital, and payments were going to be made by contactless wearable devices, mobile telephones and smart biometrics. The result would be the end of cash, cards, usernames and passwords.

Fifteen years later, we still have cash, cards, usernames and passwords, but I would still predict that it’s going to decline and eventually disappear.

Fifteen years ago I used to joke that MasterCard has got its name wrong and should be called MasterChip. Fifteen years later, I would still say the same.

I could go on but the net:net is that a physical token – card – is being replaced by a digital token – chip.

It’s also interesting to look back fifteen years ago and see what else was being discussed. For example, I’m a lover of statistics to reinforce points. Back in 2005, my main statistical point was PayPal. PayPal had $27.5 billion of transactions in 2005, up 45% year over year (2004, $18.5 billion; 2003, $12.2 billion). Today, PayPal is nearing $1 trillion of payments a year. The firm processed $199 billion of payments volume in Q4 2019, still growing 22% year-on-year, and $66 billion of that volume was mobile.

Mobile commerce was predicted to grow to $68 billion by 2009. By 2019, the actuality is that mobile commerce is worth trillions. According to the latest Global Payment Trends report from Worldpay, mobile commerce sales are growing at an average of 16 per cent every year, well outpacing desktop sales growth, creating a market worth $2.29 trillion by 2022.

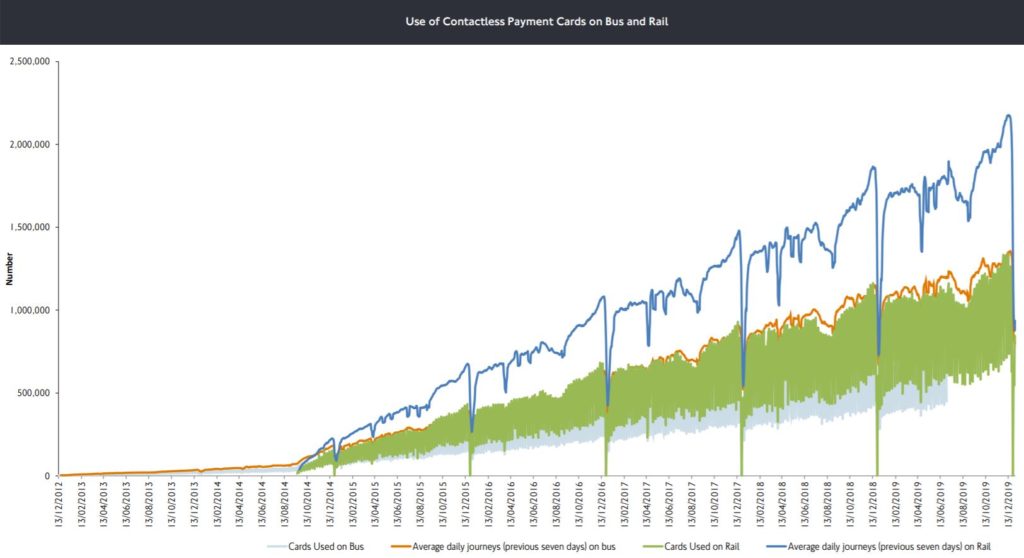

In 2005, contactless payments were just emerging. I cited many examples, with one of the most interesting being London’s Oyster Card as Transport for London (TfL) had only launched it a few years earlier. The statistical points: Oyster Card was launched in 2002 and, by 2005, had 2.5 million users.

Today, Oyster Card is no longer needed – you can just use any contactless service – and contactless travel has become a standard. Visa Research for example found that:

- UK commuters see contactless payments as the single most significant improvement to their overall travel experience (49%)

- The majority of those who have used contactless payments (77%) say it has improved their experience of travel on public transport

- Over a third (35%) of British public transport users feel contactless payments across the entire UK public transport network would improve the service

No wonder TfL are seeing a surge of contactless payments.

Source: Transport for London

Contactless payments were introduced to the UK in 2012 and now make up half of all payments across Europe, according to Statista.

Meantime, wearable is still only just emerging. According to MasterCard research, one in five adults have a contactless wearable with them but the market is only processing around €30 billion a year.

Either way, I am still adamant that contactless, wearable, mobile payments will end the use of cash and cards in the future. It’s just taking a long time to kill them.

Anyways, if you like looking back in time, here’s my 2005 presentation.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...