I saw a few people talking about the challenges of working from home over the last few days, particularly if you work for a bank. As a tech guy, I’ve been used to working from home for over two decades. However, most people don’t work remote or from home. For example, a US Census of 2017 found that only 5.2% of American people worked from home.

In financial services, this is even less as bank workers have to work in an office for security and risk reasons. That means this move to home working during the coronavirus outbreak is quite a radical thing.

For example, just a few months ago, BNY Mellon in the UK banned all remote and home working. Why? The bank said: “We have been conducting a comprehensive review of how we work together to increase collaboration, enable faster decision-making and better serve our clients. As part of that process, we are reviewing all remote working arrangements in order to maximise the benefits of people working closely together while maintaining some degree of flexibility.”

Hmmm …

Even worse is dealing with some of the banks.

One major UK bank has been unable to service any customers for the past 24 hours as their call centre is based in India, which closed yesterday, and their UK staff are all being told to stay at home. Another major UK bank has a hotline for small businesses to call for coronavirus help, which I called a few times but it never picks up. Another major bank helpline number that I tried tells me that, due to staff being told to stay at home, my call will not be answered for at least an hour or two.

Hmmm ...

So many banks are not ready for this. In fact, it amazes me how not ready they are for this. Basic services are not available: a person to talk to, a way to clear a blocked payments card, a way to get an emergency loan authorised by the government, a way to get anything done ... because their people are being told to stay at home and the bank has never thought of that.

They don't understand the basic concept of home working.

Hmmm ...

They're not ready for many reasons, but a specific one is that banks don't like staff working from home. They work in branches and in offices. Their model is physical, not digital. Jim Marous did a nice write up about this on The Financial Brand, which makes clear that banks don't just dislike staff working from home but they don't like customers banking from home much either.

There’s another reason why banks don’t like staff working remotely: security. Does the employee keep data secure? What device are they using at home? Who else has access to that device? What are the identiification and authentication processes for remote access?

There’s a whole raft of questions here which, if a bank is uncomfortable with remote working, will have been left unanswered. Now, we are in a critical moment where staff are being told they have to remote work, is the bank ready for this? Is it cloud based with appropriate cyber security? Probably not. How will it cope with this?

Interestingly, the challenger banks claim to be ready for this. In a City AM report, the digital banks say that “most staff at both Monzo and Revolut’s offices around the world are now working from home, while at Starling Bank it is an approximate 50 per cent split. Monzo has around 1,500 employees, while Revolut has more than 2,000 and Starling has 800 staff. Monzo chief Tom Blomfield told City A.M. the bank ran a full-scale shutdown rehearsal earlier this year to evaluate if it could continue to run smoothly in the event of an entire staff quarantine.”

Nevertheless, these are the exceptions and not the rule. For example, JPMorgan announced Project Kennedy, where 10 percent of their workers will be asked to work remote. That still means over 100,000 US staff are being asked to go into the office and is why the UK Government has included people who work for banks as ‘key workers’.

Key workers are allowed to go to their offices and are not forced to self-isolate and stay at home. They are also allowed to send their children to school, when most of us are being forced to keep children at home too.

These two factors combine to make remote working hard:

(a) it’s new and not been tried before (it took me two years to get used to it); and

(b) it’s not normal to have the whole family at home and forced to stay inside together 24*7.

Will working from home become the new normal? For some, yes; for many, no. Working at home is not easy, even if you have got to do it. You don’t have the social interactions with other workers and you have to discipline yourself, and your family, to allow it to happen.

In my own case, here’s how I got used to it:

- Everything is cloud-based, so that when I’m not at home, I have the same consistency of documents and data that I have at home;

- Focus upon keeping a routine and discipline to your day, for example, being in that office room before 09:00 and ending at 18:00;

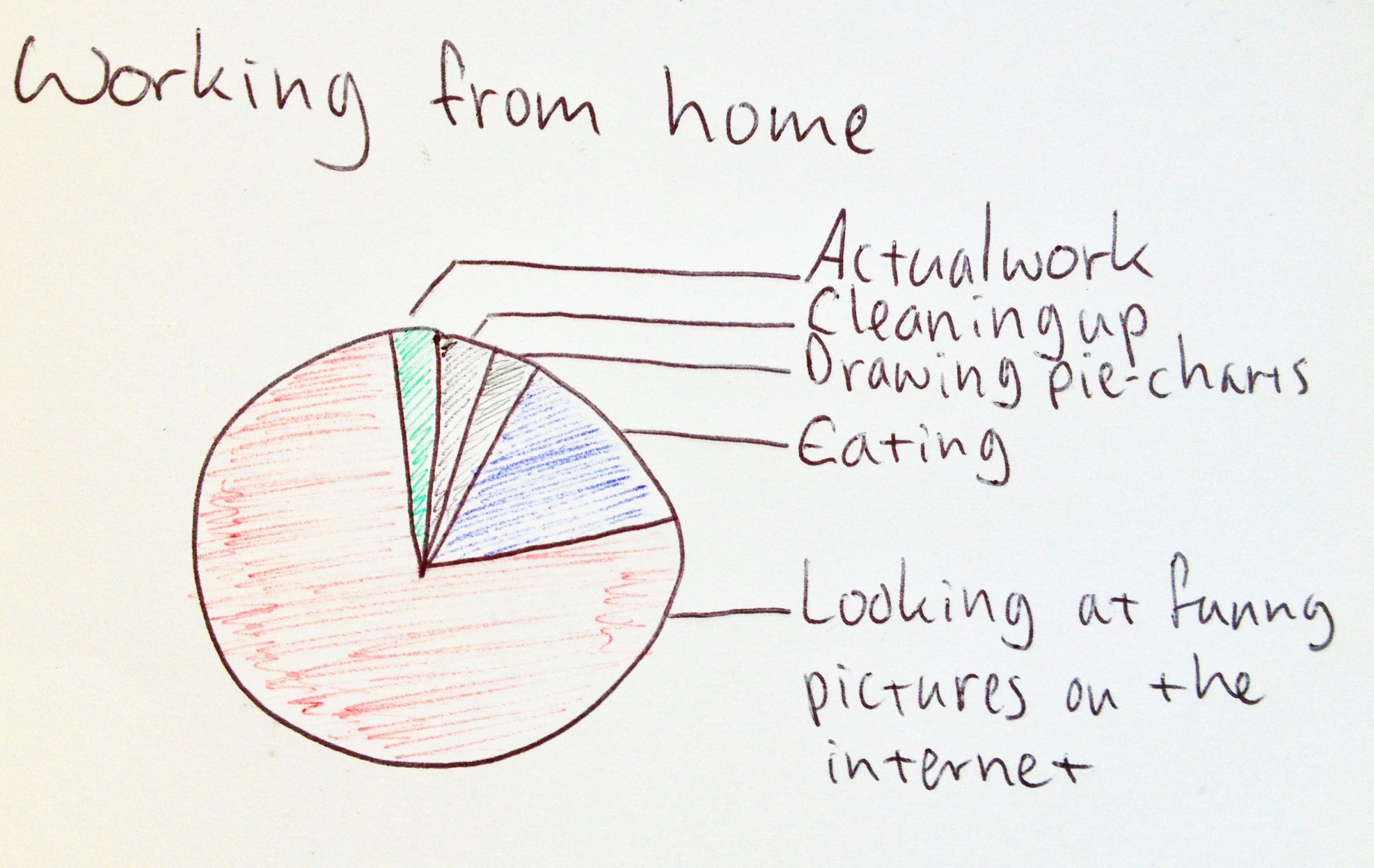

- Don’t allow continual interruptions and distractions, as it is way too easy to waste your day looking at stuff on Amazon and listening to Spotify; and

- Make sure you have a lockable office room, to ensure zero interruptions from the family;

- Keep the news channel on the TV or radio on in the background to create office noise, as having people talking in the background makes you feel less isolated; and

- Focus upon outcomes and objectives: you need to always achieve something every day and tick off an item list of things to be done.

There’s just a few tips from my own experiences, but there’s loads of others out there (these two from the BBC and Nextiva are particularly good).

Best of luck out there and enjoy the new normal.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...