I saw an interesting article the other day:

I Don't Feel Like Buying Stuff Anymore ... our economy is built on Americans of all class levels buying things. What happens when the ability — and desire — to do so goes away?

It’s theme is that when stuck at home with nothing to go out for, who needs to buy clothes, make-up or anything. Rich, pampered stars are complaining about the fact they can’t get a decent Botox or liposuction right now, but who needs one? Who’s looking?

Most of us are pigging out at home, drinking too much and changing our look from beautifully presented business person …

Source: BBC

… to massive couch potato.

Source: Hello!

Anyhow, if this is the case, what is all of this having as an impact on payments?

It struck me that if no one is buying anything, then our card and payments companies must have seen a massive drop in volume and value of processing in April. In fact, in my own case, I’m getting far more refund transactions in April than ever before as flights, hotels and theatre trips are cancelled.

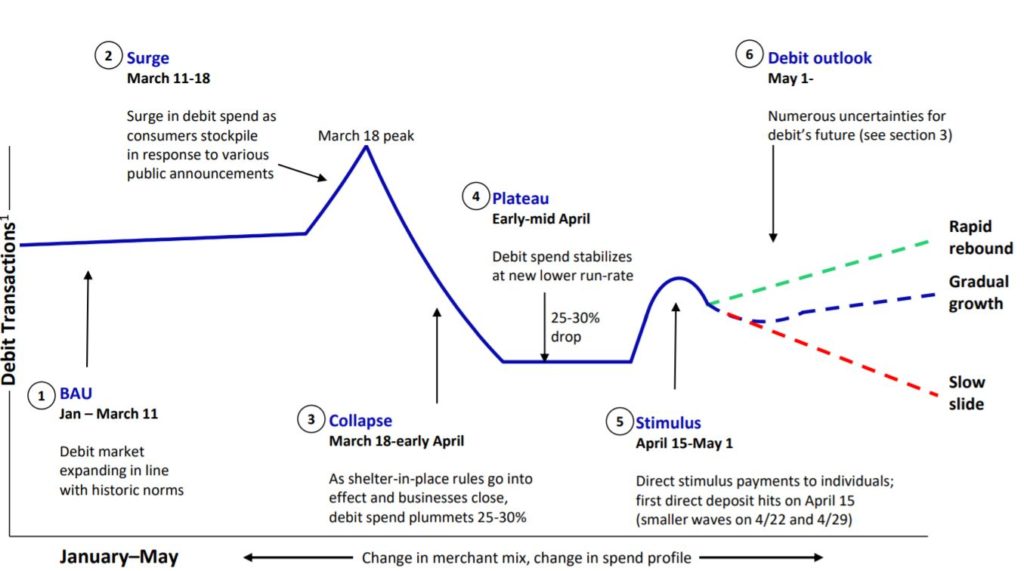

According to Oliver Wyman, U.S. debit card transactions are down by up to 30 percent since the lockdown started.

With people losing their jobs left, right and centre, no savings and an incredibly uncertain future, who’s going to be running out and spending? Well, apart from Warren Buffett and his billionaire brethren. American retailers saw sales slump by 8.7% in March 2020, the largest decline since the study began in 1992, and I’m pretty sure April was even worse.

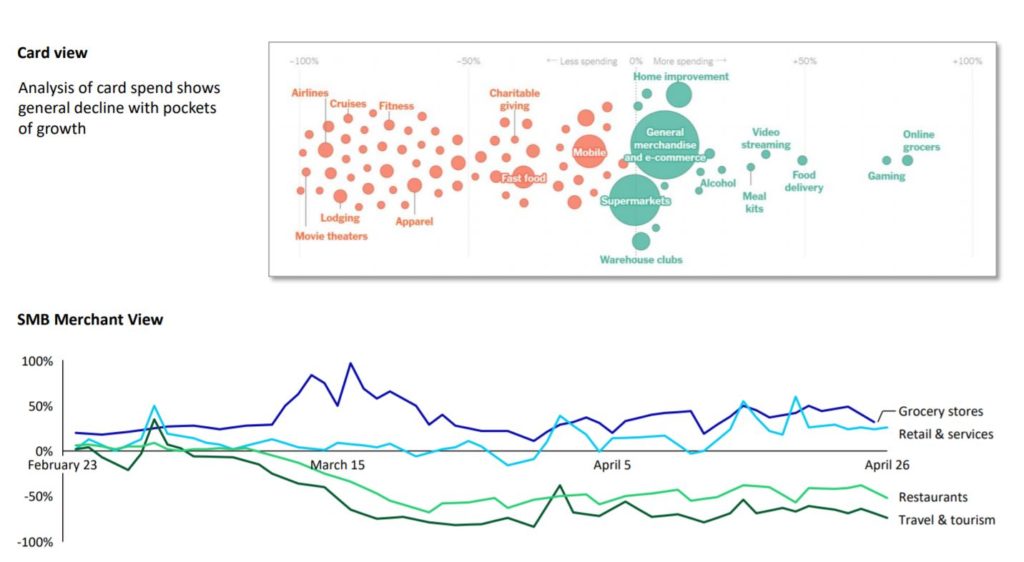

Not everyone is losing out of course: online is booming. Oliver Wyman note that eating at home has led to massive increases in supermarket shopping, alcohol consumption, gaming and home improvement.

This is reinforced by research performed by PYMNTS.com.

5.1 percent of the 12,000 consumers we studied say that they are shifting the retail spend once done in physical stores, to digital channels ... it took about 15 years for 5 percent of retail sales to shift online, then another 10 to shift another 5 percent. It has taken 10 weeks for another 5 percent of retail sales to shift online by consumers who say that they will never return to doing those activities in a physical world.

And it is not just an American phenomenon, as similar trends are seen globally:

The COVID-19 crisis continued to drive global eCommerce sales in April, with the general retail sector experiencing 209 percent growth compared to the same period last year, according to an analysis by ACI Worldwide of hundreds of millions of eCommerce transactions from global online retailers. Following general retail, the gaming segment saw the biggest bump, up 126 percent in April.

It is why Amazon saw online retail sales surge 24 percent in Q1 2020 and why PayPal saw a record day of processing on May 1.

PayPal experienced the largest single day of transactions in the company’s history — bigger than both Black Friday and Cyber Monday of 2019. April 2020 was also a record-breaking month for PayPal in terms of enrolment and use. PayPal added 7.4 million net new active accounts. PayPal also hit a record in Q1, CEO Dan Schulman noted, adding 10 million net new accounts — though that pick-up was rapidly outshined in April, when its daily net new customer rate averaged roughly 250,000 per day and counting.

India shows the major impact lockdown is having their on the national infrastructures:

Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) transactions in April declined by 54.31% and 32.92% respectively, in comparison to March, as the country remained under a lockdown for the month. Transaction values on RTGS and NEFT both further fell by a whopping 46.51% and 42.79% respectively as well.

It just goes to show that when money is meaningless and capitalism dies, then payments and payment systems also become irrelevant … for now.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...