I’m a simple guy. I don’t trade or invest much. That may seem surprising for a FinTech guy, but most of what I’ve invested in seems to lose value. As a result, I collect rare comics instead as Batman, Spiderman and Ironman are forever.

That being said, I do follow some of the leading figures like Warren Buffett and respect them immensely for their sound sense. Warren said years ago buy when everyone else is selling and sell when everyone else is buying. That makes so much sense and is so true. So, it’s weird to see right now that he’s such a loser.

Warren Buffett? A loser?

Yep! OK, the oracle of Omaha is getting on in years – he is 90 this year – but take away the ageism and look at the record. Keys that I remember to Warren’s investment approach is know the numbers and buy companies that own markets. This is why he’s been big in some banks, media and airline investments, but he seems to have lost his touch.

The Financial Times summarises it well:

The famed stockpicker had his worst performance versus the S&P 500 in a decade in 2019, and 2020 is shaping up to be nearly as bad. Instead of taking advantage of the coronavirus crisis that hit markets in March, Mr Buffett was a casualty. Instead of highlighting Berkshire’s balance sheet strength, the crisis exacerbated longstanding concerns over the company’s direction.

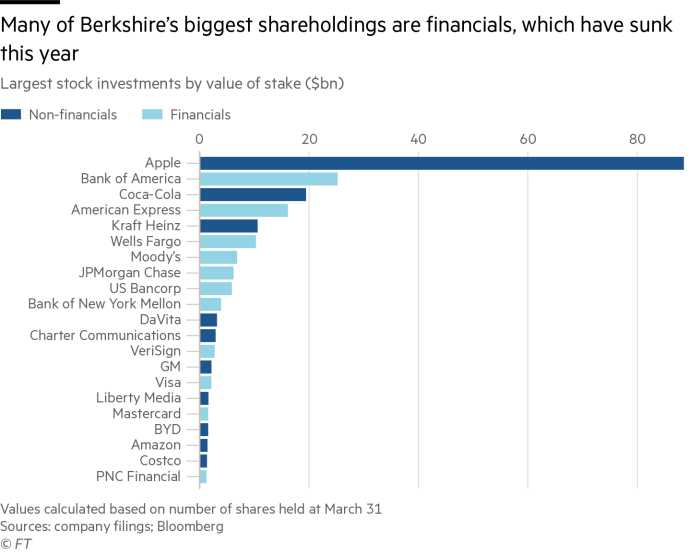

What’s gone wrong? Well, he’s heavy on banks and light on tech.

In other words, he doesn’t get today’s world of value but understands well yesterday’s world of value. It’s all about value investing. If you’re not familiar with Warren Buffett’s value investing method, then please read about it over here. The gist is that the business must be easy to analyse, the management trusted to do right, the financial metrics sit well and the future earning value is high.

Interestingly, based upon those metrics, he has little faith in Amazon and Facebook. And this is where the business is failing. From the FT article:

“If Berkshire is to have the prospects of generating the value it has in the past, it has to adapt by buying these companies that will generate significant value over the next 25 years,” said Christopher Rossbach, chief investment officer of J Stern & Co. “Both Warren and Charlie [Munger, Berkshire’s vice-chairman] have acknowledged that they have missed Amazon and that they should be looking at these companies but they have also said they don’t understand them. They have kept them in the box that Warren has on his desk that says ‘Too hard’. What will it take for them to take these stocks out of the box?”

In fact, Buffett has so missed the tech boom that he’s being insulted by a day trader called barstool.

Barstool, otherwise known as Dave Partnoy, is a guy who makes money by being an internet celebrity and blogger. Oh yea, one of those. And he’s now doing better than Warren Buffett.

Intriguingly, another Partnoy is more worrying for Warren Buffett. The other Partnoy is Frank. He’s a guy who wrote a book years ago about banks, finance and a system based upon infectious greed. If you haven’t read it or heard of it, it’s another book I can recommend. Here’s the summary:

One by one, major corporations such as Enron, Global Crossing, and Worldcom imploded all around us, prey to a greed-driven culture and dubious or illegal corporate finance and accounting.

In a compelling and disturbing narrative, Frank Partnoy's Infectious Greed brings to bear all of his skills and experience as a securities attorney, financial analyst, law professor, and bestselling author to tell the story of the rise of the trading instruments and corporate financial structures that imperil the economic health of the country. Starting in the mid-1980s with the introduction of the first proto-derivatives, and taking us through such high-profile disasters as Barings Bank and Long Term Capital Management, Partnoy traces a seamless progression to today's dangerous manipulations. He documents how each new level of financial risk and complexity obscured the sickness of the company in question, and required ever more ingenious deceptions. It's an alarming story, but Partnoy offers a clear vision of how we can step back from the precipice.

Interestingly it was published way back in 2003, and I used it as the basis of a presentation I gave way back when called: “all bankers are criminals” (at the time, I was freelancing with Tower Group, now part of Gartner).

It’s a presentation I gave in 2006, and followed with various updates. It’s all about how the financial systems can corrupt and destroy. However, conversely, they can also create and develop. I’m not saying all bankers are criminals … just some.

Frank Partnoy inspired a lot of that presentation and now he’s saying the banking system is about to collapse. Writing and speaking with The Atlantic:

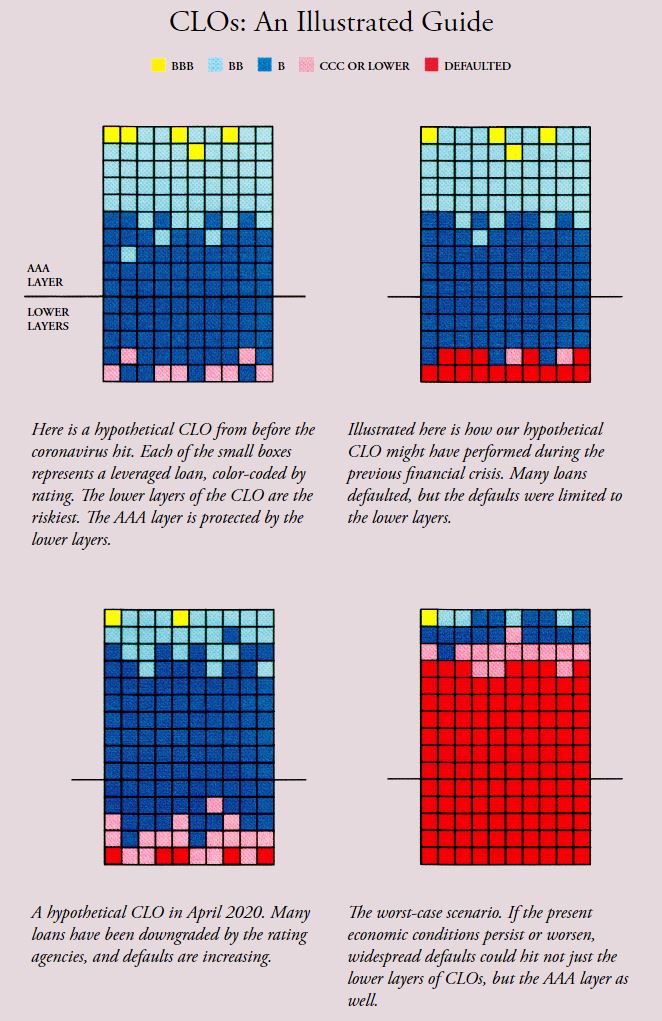

After the [2008] housing crisis, subprime CDOs naturally fell out of favor. Demand shifted to a similar—and similarly risky—instrument, one that even has a similar name: the CLO, or collateralized loan obligation. A CLO walks and talks like a CDO, but in place of loans made to home buyers are loans made to businesses—specifically, troubled businesses. CLOs bundle together so-called leveraged loans, the subprime mortgages of the corporate world. These are loans made to companies that have maxed out their borrowing and can no longer sell bonds directly to investors or qualify for a traditional bank loan. There are more than $1 trillion worth of leveraged loans currently outstanding. The majority are held in CLOs.

It's a long article that shows huge exposures within many banks to loans that will default due to the pandemic. For example, Partnoy noses around Wells Fargo’s annual report and finds that this one bank alone has $29.7 billion of CLOs on its balance sheet. If these all fail, what happens? Collapse.

And if Wells, BoA and other banks fail, Warren Buffett fails and everything fails.

Too big to fail? Too costly to bail? Too hard to jail? Too many males?

Whatever.

The future is uncertain. Economically and politically, I have no idea. All I hope is that Frank Partnoy is wrong and Dave Partnoy continues to share his investment strategy.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...