Everyone was talking about a V-shaped recovery in March 2020. Then it went onto a dialogue about whether it might be U-shaped or even W-shaped.

Now, some economists are talking about a K-shaped economy. Some say this is all about the haves and have nots – the upper half are those with investments, equities and stocks in fast-moving firms whilst the lower half are those working in restaurants, theatres, entertainment, conferences, airlines and hotels.

I disagree with this definition, however. My contention would be that the upper part of the K is digital; the lower part is physical. Those firms dependent upon physical engagement – those I just named – are suffering; those who can engage digitally are thriving.

Maybe this is well illustrated by retail sales. In Q2, Amazon reported a 43.4% increase in North American sales and 33.5% worldwide revenue growth; WHSmith reported revenues from travel shops fell by 92% year-on-year at the peak of the UK’s lockdown in April and revenues across the group were down 57% in July compared with 2019.

Similarly, in hospitality. Pizza Express is closing 73 restaurants, putting 1,100 jobs at risk whilst Domino’s Pizza is hiring 5,000 people as Brits eat at home more.

We do everything from home more. We shop from home, order from home, receive at home, eat at home and bank at home. However, do we all now do digital banking at home? Not necessarily.

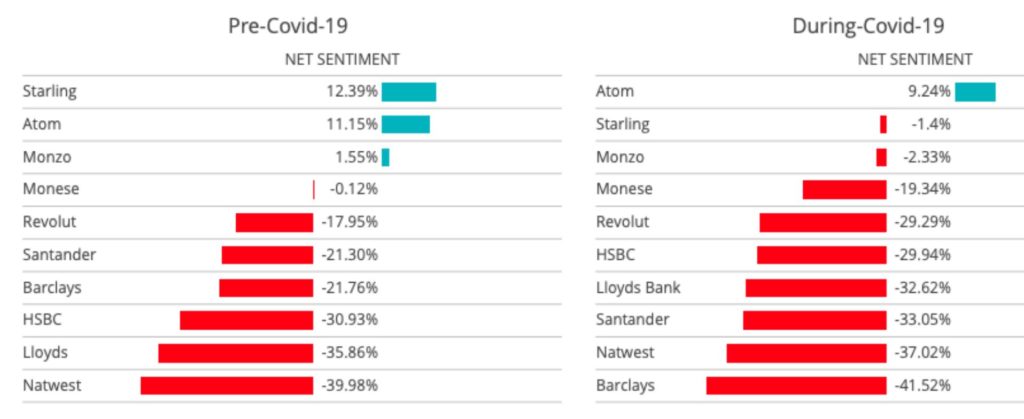

In the UK, customer sentiment towards for digital-only banks fell by 14 percentage points compared to just 5 percentage points for high-street banks. While this may sound bad, digital-only banks started in a better place, and continue to have a much higher sentiment overall (-13% vs -35% on a scale of +100% to -100%).

According to social analytics specialist BrandsEye, Monese suffered the worst drop in sentiment of digital only banks whilst Barclays had the biggest drop in customer sentiment overall.

I find this intriguing, when all other digital businesses are doing so well, but maybe it’s a reflection of the key aspect of finance, which is communication. If you can only deal with the bank through an app, then sentiment deteriorates during a nervous time when you’re worried about money. If you can usually deal with a bank through a call centre and that call centre disappears – as it did with one UK bank, where the majority of calls are routed offshore to India which shutdown with four hours’ notice – then customer sentiment drops through the floor.

This is why, in this K-shaped recovery, I fully expect to see two differing routes for digital-only banks and high street banks. The digital-only banks who depended upon growth in account openings for success, like Monzo, will have a tough year. I think they will survive and continue to thrive, just at a much slower pace. This is because they will have to realign from being a growth-fuelled bank, sitting on deposits, to being a full-service bank with a balance between deposits and loans that is far more balanced. Meantime, as mentioned the other day, banks that have a very specific niche such as OakNorth, are already on the upward K-curve because of their focus.

For high street banks, there are those that have continued to serve customers effectively by phone and in branch, as well as online and by app, throughout this crisis whilst there are others, such as Barclays, who have really suffered. Will they get that customer sentiment back? Will they still be trusted? It’s hard to say as it is likely that there are a huge number of potential switchers out there who haven’t switched because they feel nervous about switching whilst they can’t go out. What happens when the great lockdown is unlocked? Personally, I think there’s a huge untapped sentiment of customers who are desperate to change and leave the bank they’re with and, when the great unlock occurs, they will.

In other words, we will see a huge change of market structure post-COVID19. Some customers will rush to the digital-only banks that did well during the crisis, and where friends and family tell them how great they are; some customers will switch to a full-service bank that offers all opportunities for engagement throughout the crisis, including a call centre that works and an online access that doesn’t break every five minutes.

In conclusion, the K-shaped recovery in banking is not homogeneous. It varies by country and is different in every country. In every country, some banks were digital already and are on the upper K-curve; some were not ready for WFH at all, and are sinking fast down the lower K-curve.

POSTNOTE:

I asked folks on twitter when they thought air travel, entertainment and hospitality might get back to normal. Here’s the result:

As coronavirus decimates airlines, travel, hotels, restaurants, entertainment, shows, concerts, conferences, events, exhibitions ... when will these things come back?

— Chris Skinner (@Chris_Skinner) September 14, 2020

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...