Yet again, I’m returning to the story of branches. There are so many reports about the branch of the future and the end of branch banking out there that you would think the world of branches had no future. The debate is pretty pointless to be honest, as there will always be some who think we need them and some who think we do not, and we have that debate often and there are no real winners. Just views.

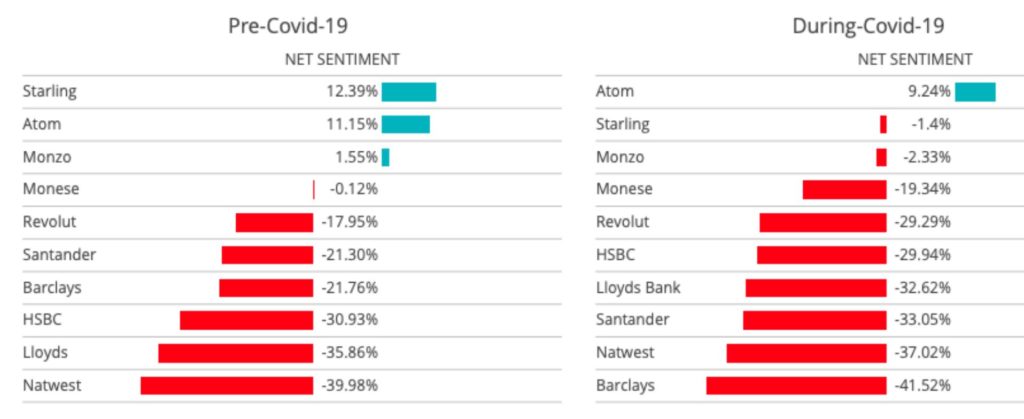

Therefore, I thought I would pivot this story a little and ask what the future role of a branch will be, if you have one. This is a more interesting discussion as, for example, Brandseye reckoned that digital-first banks lost a lot of customer sentiment during the pandemic, because they don’t have a branch. Interesting idea.

What’s all that about?

…

It’s all about trust. Banks don’t need branches anymore. They’re not transactional centres, as they used to be; they’re not even service centres, as customers can do most services in-app; they’re not even advisory centres, as who would trust a bank to give a customer decent advice that is in the customer’s interest?; they’re not even business centres or small business centres, as large corporates have bankers visit them and small businesses usually find the bank’s computer says no.

So, what are they there for?

…

Trust. It’s all about trust.

Most banks don’t need branches but I always remember talking with Roberto Ferrari, the then CEO of CheBanca! in Italy, and they were opening branches. I asked him why and he explained that where the bank has a physical presence, they gain three times more assets under management than where they don’t. It’s my marketing investment, he said.

In other words, the bank did not need branches, but customers need them to feel reassured the bank actually exists and there is somewhere they can go to see the money. It’s a psychological thing. Money is emotional. It’s one of the most important and most secret things for most of us. We would rather talk about our sex lives than our financial life.

And because it is such a secretive and emotive thing, we need at least the idea of being able to reach out to a human as a concept, as that means there is something about the bank I can touch. For this reason, there will always be people who want to see people in branches about money. It won’t be for everyone and some may never need to visit the branch, but they will feel reassured just knowing it’s there.

This is why the branch is not a transaction, service or advice centre. It’s a centre of trust.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...