I was struck by a comment made on LinkedIn that most media miss what’s going on in the rest of the world. In this case, it was a comment about Starling Bank getting plaudits for being the first challenger to be profitable. What it should have said is the first challenger to be profitable in the UK.

There are many challenger banks around the world, and I’ve cited many of them like Tinkoff and Nubank, but it is sobering to realise how parochial we can be, sometimes. For example, I am conscious that I talk a lot about Monzo, Revolut and co. But there’s a reason for that which is … many of the most innovative FinTech ideas originate in Europe, and specifically London, and are then replicated in different forms worldwide.

I have to then counter that view with the fact that the most innovative ideas are not coming from London, but from Asia and Africa in the form of Alipay and MPesa. The difference? The European and UK based FinTechs are evolving banking ideas into technology whilst the Asian and African companies start with no idea of how banking works, they just start with how technology could change things.

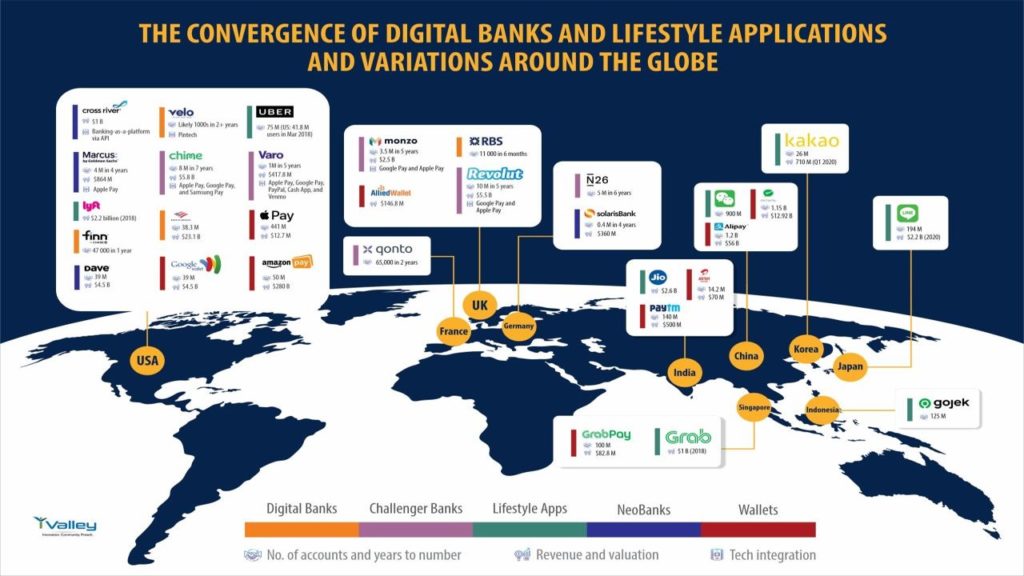

Anyways, I thought I’d post these two charts. First, there are many innovations worldwide:

And second, it’s not all about mobile wallets and neobanks and third, many of them are at a more granular level than just being a neobank or challenger bank. For example, this chart of neobanks worldwide that just focus on small businesses:

Key message: remember that it’s not all about your market and your firms; it’s about all markets and all firms.

I learned this long ago, and it’s the reason I travelled the world (before lockdown) as I love exploring and discovering other ideas in other regions. Every country has a different view and a different approach; a different innovation and a different idea. That’s what I love.

Then, the question is, can we bring those ideas to our location and the way we work?

This is why when someone says branches are dead, you may find that is true in Denmark but it may definitely not be true in Ethiopia. In some countries, branches are increasing in numbers. In some countries, call centres are not trusted. In some countries, there are no mobile banking apps. In some countries, there are no neobanks or challenger banks.

So, if we are talking about stuff, sure, make headlines about what’s happening in your country but, just remember, there are lots of other places in the world that might be different.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...