There are lots and lots and lots of reports and predictions for 2021 in banking. The one I liked the best is the report from Standard & Poor's (S&P, see end of blog) about the impact of the crisis in 2020 and the outlook for banking in 2021. It's a difficult discussion, as the only certain is uncertain, but at least they give a stab and highlight four key exposures:

- Economic disruption from COVID-19 gets worse or lasts longer

- Short-term supports to banks and borrowers leave longer-term overhangs

- A likely surge in leverage and anticipated higher corporate insolvencies

- A weakening in property markets which is the age-old nemesis for bank credit quality

They also offer key takeaways from their report, and this one is worth highlighting: "we believe many banking jurisdictions globally will not recover to pre-pandemic financial strength until 2023 or beyond".

The full report is inserted at the end of this blog entry, but here are a few other forecasts.

Banks will lose a shed-load of money

The Deloitte Center for Financial Services estimates that the US banking industry may have to provision for a total of US$318 billion in net loan losses from 2020 to 2022, representing 3.2% of loans. While losses can be expected in every loan category, they may be most acute within credit cards, commercial real estate, and small business loans. Generally, these losses are smaller than during the GFC, when US banks recorded a loss ratio of 6.6% from 2008 to 2010.

Digital banking is on steroids

Chase recently released the results of its Digital Banking Attitudes Study, which revealed Americans have largely adjusted to—and are ready for—a primarily digital banking environment:

- Four in five customers prefer to manage their finances digitally rather than in person.

- Roughly eight in 10 use a smartphone and/or desktop/laptop to complete banking activities.

- The vast majority of Chase (89%) and non-Chase (85%) customers feel they save time by managing their finances digitally.

- Nearly 70% of Chase customers, and 60% of non-Chase customers, completely or somewhat agree that they feel confident about the safety and security of making payments through digital apps or sending money through peer-to-peer apps.

- Only 10% of Chase customers and 14% of non-Chase customers completely or somewhat agree they do not typically manage their finances digitally because technology overwhelms them.

Add to this that, in the two years prior to the pandemic, the number of customers leaving their financial institution for another was around 12%—whereas this survey suggests it will jump to 27% for large banks between 2020 and 2022.

And a new normal where payments are all digital too!

“No part of the payments ecosystem will escape the effects of the pandemic,” Accenture asserts. The consulting firm predicts that a total of 2.7 trillion transactions worth $48 trillion will shift from cash to cards, interbank payments and alternative payment instruments such as person-to-person (P2P) and point-of-sale finance (buy now, pay later). This represents a $300 billion opportunity for payment providers. However, Accenture states that banks are scrambling to respond as the scale of disruption and tempo of change have grown dramatically.

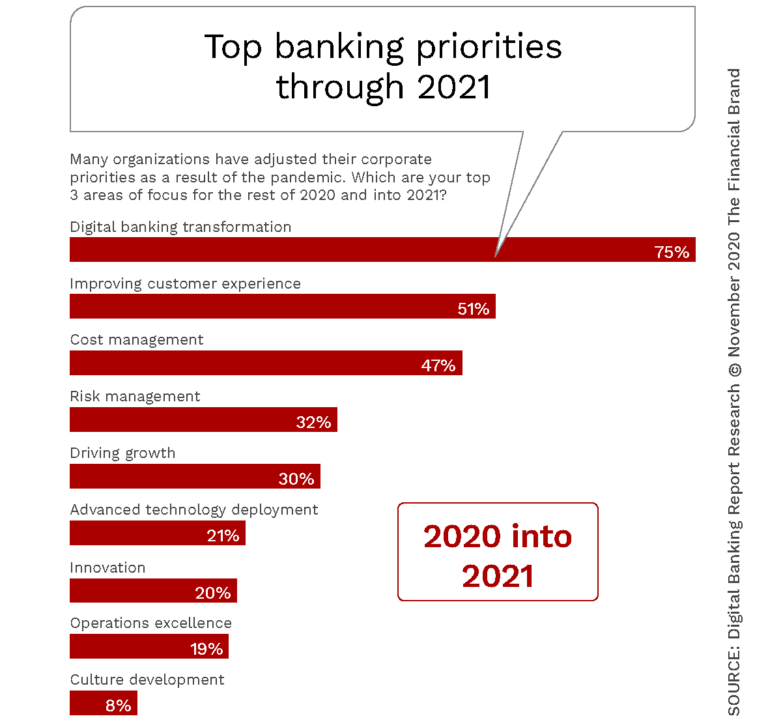

Which is why banks will spend a shed-load of money on digital transformation

With a laser focus on user experience.

Truly great financial products are based on great usability in sync with specific user needs inside a well-developed digital ecosystem.

And more integration and acquisition of FinTech firms

We have seen nothing short of the start of a boom in fintech M&A this year. This trend will play out for the next 5-10 years. Visa’s eyebrow-raising $5.3bn play for Plaid in January and Intuit’s $7.1bn Credit Karma purchase in February are going to look less jaw-dropping in 12 months time following a string of big deals and digital banks will play an interesting role within that.

[I] expect 2021 to see strong demand for three types of fintech providers in particular:

- Core integration providers. Companies like Constellation, Sherpa Technologies, and Sandbox Banking have been offering core integration platforms for the past few years enabling banks and credit unions to better integrate with—but potentially migrate away from—their core systems.

- Payment hubs. Fintechs like Payrailz and Finzly (which recently won two best-of-show awards at Finovate) not only enable financial institutions to intelligently route payments to the optimal payment mechanism, but allow them to offload transactions from core processing.

- Digital cores. Companies like Finxact, Q2, and NYMBUS have been helping financial institutions deploy digital banks. For some of these institutions, these are weak attempts to recreate the success of some of the challenger banks. The smart ones, however, recognize that the digital cores are good ways to create and deploy new products and services that would take years if they tried to do it with their existing core system.

I'm sure there's more out there, but this is my curated list. The embedded links give you far more detail and are worth a clickthrough btw and, oh, lest I forget, here is the S&P PowerPoint ...

And the full report ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...