I haven’t commented much on bitcoin’s (BTC) recent surge, as I’ve been watching and waiting, but it is something. Just in case you didn’t notice, the value has moved from a low of under $5,000 per BTC in March 2020 to around $50,000 per BTC today. But it's not just BTC: it's Ether, Bitcoin Cash, Ripple and even Dogecoins, which are meant to be a joke.

Part of the reason for the surge is the pandemic – a rush to safe harbours? – but it’s also the movement of companies who are leading-edge innovators like PayPal, Square and others along with a big wallop from Elon Musk as Tesla's annual report reveals a $1.5 billion stake in BTC and he endorses it (along with doggy coins, which undermined such endorsement imho). Then there are views of academics and traditional financial institutions who, having decried bitcoin for years …

See The Finanser (2020)

See The Finanser (2017)

… are now kind of endorsing BTC.

When MasterCard and BNY Mellon start offering crypto-related services, and JPMorgan and Citibank predict the price of bitcoin will increase massively over the next years, there’s something going on. The main thing that’s going on is that bitcoin and cryptocurrencies in general are becoming mainstream. Mainstream what’s is still to be decided, but they have moved from on the edge to near the middle.

But then you have several camps of bitcoinistas. Those who believe it is a religion and decry my god as a false god at your peril; those who say it is diseased and should be placed in the bin of history alongside tulip bulbs; and those who think it is worth looking at what customers want and need, and serve them if they want and need bitcoins and crypto.

Those who were early to the Church of Crypto are now billionaires, and I know a number of them. Can't say I've known many billionaires personally before. Their belief is based upon the new decentralised network of money, as discussed in depth in ValueWeb. In fact, I’ve interviewed and met several of these crypto millionaires and billionaires one-on-one and their consistent message is the same: the construct of money was built on principles that are now defunct.

Governments don’t work in a borderless world of the decentralised network, is a specific nuance of that debate. However, for me, that’s like saying the Church of Crypto trumps (or is that Trumps?) the United States of America.

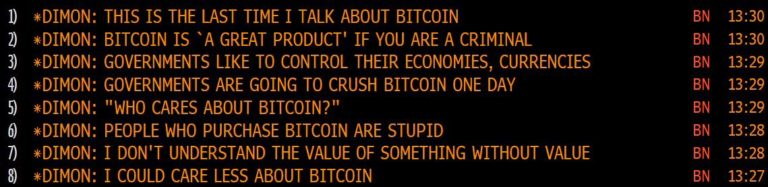

The second group are equally blinkered. They see bitcoin and crypto destabilising governments and continually argue that such currencies are purely for those who engage in criminal activities. They announce that the currencies are worthless and should be avoided. They announce that you will lose all of your money if you invest in them, as they are unregulated and unprotected. These are mainly the central bankers, like Christine Lagarde, who have their own agenda.

A specific part of that agenda is maintaining the construct of the last few centuries, where banks support governments, governments manage countries and the two work hand-in-hand to maintain their bases of power.

The libertarians in the first construct want to break the control of the statists in the second; the statists in the second want to keep the libertarians or, more importantly, society at large under their wing.

The third group, which is actually where I sit, enjoys the friction of the two extremes. We can see both sides of the coin and the pros and cons of each. I’ve argued on many occasions that crypto is a Wild West of mavericks, some of whom are bad actors and many who play with this market are playing with fire.

However, as I see most central banks moving towards Central Bank Digital Currencies issuance, it begs the question: why would I trust a digital dollar or euro or yuan more than a digital DeFi currency, especially when the latter can be traded and transacted without interference or intermediaries.

It is this balance between total freedom of value exchange and value exchange with control – the libertarian versus statist debate – that is where the issues of crypto and digital currencies of the future lie.

The thing is, being in the third camp, maybe I want both. It is not libertarian versus statist; it is libertarian when I don’t care about protections, regulations and controls; and statist when I want protection and insurance against loss from governments and institutions. That is why I trade crypto on regulated exchanges but use crypto wherever, whenever. What do you do?

Similarly, when I want to HODL (buy and hold) BTC, maybe I want a custodian to do that, which is why Deutsche Bank and Morgan Stanley, alongside the BNY Mellon's and JP Morgan Chase's of this world, are getting in on the act. After all, if that's what the customer wants, we aren't going to tell them NO anymore. No wonder the price has started rocketing.

Meantime, if you’re wondering where bitcoin is going, there are various predictions. Leading analysts from leading banks are saying over $150,000 for a bitcoin in the near future. My own view? Well, I asked twitter to tell me. Here is the result:

Oh, and the comment that the question should have been: What will be the price of a USD in terms of BTC, did make me laugh.

Meantime, if you're really interested in this subject and use Clubhouse, join me for a chat about it at 17:30GMT tomorrow.

Postnote:

This blog structure was stolen from Simon Taylor of 11FS, but giving my own take on it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...