Welcome to the World of Next

A few years ago, a friend of mine had an idea. It was to create a digital exchange between anything that anyone believed was of value. You may value USD, €, CN¥ or other currencies. Equally you may value BTC, ETH, XRP or other cryptocurrencies. For some, we value World of Warcraft Gold, Ace Gold, V-Bucks or similar. In my case, before the pandemic, my currencies of value included Avios points, Flying Club points, Miles&More and more. I also collected things like Nectar points, Club points, Starbucks and others.

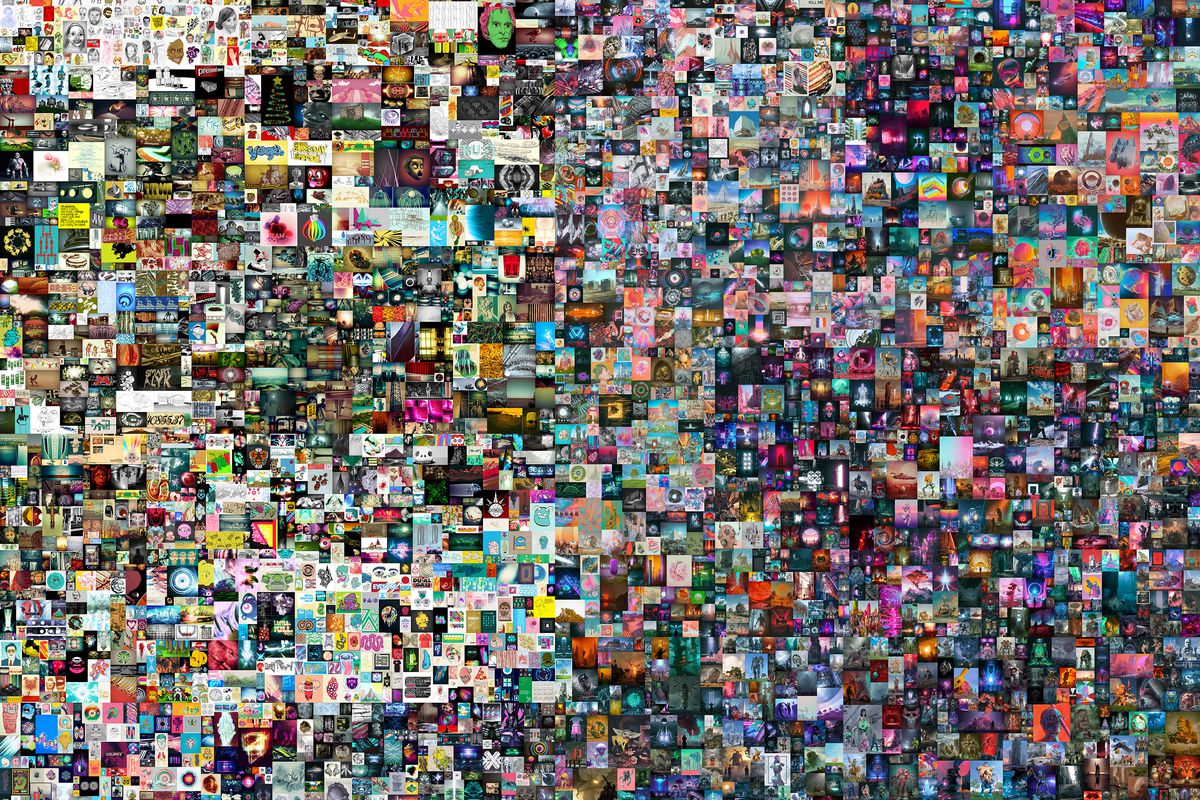

In other words, there are many different forms of value and value exchange and his idea was to create a platform where, if I stopped playing World of Warcraft and switched to PUBG, I could trade my Gold between the two online gaming systems, rather than just lose them. He never got the idea off the ground, but it was a good idea. For example, having had the debates about Non-Fungible Tokens (NFTs), it extends beyond NFTs. Some people can value a piece of digital art as being worth $70 million; others can see it as just a JPEG. It's your point of value about everything and anything of value to you, online and offline. It's your view of value that prices something. That's the basic law of demand and supply.

Look at any auction and the price of something is purely the price of who is in the room and online. The market determines value.

What do you value? Why do you value it? How much is it worth to you? Where do you keep it?

These four questions will become more and more important as we digitise humanity and so it’s worth looking at each question in its own light.

What do you value?

What you value highly may be worthless to me. I value food, shelter and entertainment, but my needs are different to yours. You may be a massive fan of the Foo Fighters. For you, an autographed album by Dave Grohl might be your most prized possession. To me? I don’t care as I’m not a fan. What people value is different for every person and, once you cover the basic needs of shelter and food, the aspirational needs are served by money. In fact, if you consider this in the context of Maslow’s hierarchy of needs, it is only when you get past the first two levels – physiological and safety – that we start thinking about other needs. Our other needs – belonging, esteem and self-actualisation – are where we start assigning values and value on a scale that differs by every individual. Your most valuable item might be that Star Wars R2-D2 original film set prop. Me? I’m not a Star Wars fan, so it doesn’t matter. To me, it is worthless; to you, it is everything.

Why do you value it?

Which brings us to this question around why do you value this? I find that the things I value the most are memories. Things related to growing up, childhood, births, deaths, marriages and such like. This is why my most valuable possession is a piece of cotton. It’s the hat my son had on his head in the neonatal intensive care unit. Born prematurely, he struggled for several weeks to survive and prosper. Now, five years old, he’s a healthy big boy but, for a while, it was touch and go. He might not be here today if not for the care of the doctors and nurses back then … or for the cotton hat on his head that kept him warm at night. What you value is different for everyone but I value that hat more than anything.

How much is it worth to you?

So, if someone stole that hat, what would I pay to get it back? I don’t know. It’s just a bit of worthless cotton. It means nothing to anyone, except me. It has no real value. But, apply to anything you own, it may only have value for you. Obviously, your house has value, if you have or own one. But the things that fill your house are worthless except to you and people who think like you. You may have that Star Wars prop, but I have this Barbie doll. What? You don’t care about my Barbie doll? Well, I don’t care about your Star Wars prop. This is a key: the only things you value, and the price you apply to them, are purely based upon the things you value. This is something you can see every day in auctions. Auctioneers know that tastes and interests change year by year. Today’s Lalique is yesterday’s Clarisse Cliffe and tomorrow’s Banksy. The value is purely based upon taste and fashion and its’ worth is purely based upon who follows that taste and fashion.

Where do you keep it?

Most of the things people value are in the home. That’s why we have insurance. We take out insurance to ensure we do not lose the things we value or, if lost, we can get reimbursed. We used to keep the things we value in safe deposit boxes but, today, most banks do not offer such services. Should they?

Well, this is where it gets interesting as, today, we have NFTs and my Star Wars prop, autographed Dave Grohl album, baby’s cotton hat and Banksy might just be held as a digital record as a physical record. Maybe I have a QR code of the digital record to these things. Do I need the physical record?

The reason for debating these points is to provide context around digital wallets and exchanges. What you value, why, how and where has historically been in physical contexts and constructs; what you value, why, how and where will be, or are now, in digital contexts and constructs. I value my digital memories as much as my physical memories. My baby’s hat is as valuable to me as my first digital video of holding him on my chest. Those things cannot be taken away, removed or lost. They are of great value to me.

Therefore, I first need a trusted store of value, for the things that are of most value to me; and then I need to be able to exchange the things of value to me with others, when needed or necessary; and, third, I need to be able to work out the value of things when I need to trade them.

These are all fabrics of the banking system and sound so simple and easy but, as outlined, what is of value to me may be worthless to you. That’s why we have currencies, as it sets a basis of value for all. A dollar is a dollar, unless it’s a Zimbabwe dollar.

The reason for this dialogue is that there is an idea of creating digital exchanges where value can be exchanged through digital wallets with anyone worldwide. In this digital exchange, some people want dollars, and some want Zimbabwe dollars (the trillion dollar note is quite valuable); some want euro coins and some want Roman coins; some want bitcoins and some want dogecoins; some want World of Warcraft Gold and some want real gold; some want airmiles and some want square miles. Do you get the idea?

If we can digitise anything and everything, then we can exchange anything and everything digitally. The value of digital assets and their method of exchange is still to be determined, but there is a growing market for digital assets and digital exchange. If you ignore this market, you ignore the developing World of Next. Is that you?

With bitcoin, ether, Mode and more, we are investing in the digital exchange of value and the World of Next. This is why that discussion of value, worth and store is so important, as the World of Next will see people value, worth and store things very differently to the World of Past.

Postnote

By the way, this is interesting if you haven’t seen it. A guy from South India became a bitcoin billionaire and paid almost $70 million for an NFT piece of digital art by Beeple … because he can!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...