I wrote two years ago about the BS that Blackrock talk about the climate. I mentioned this issue again in my update on the Money Rebellion last week and what really makes me angry is that financial firms like Blackrock sign up to global agreements to protect the environment, and create a load of PR spin, whilst they trash the world.

Larry Fink, CEO of Blackrock, is a great example. Did you see his shareholder newsletter this year? Here’s a few extracts …

I believe that the pandemic has presented such an existential crisis – such a stark reminder of our fragility – that it has driven us to confront the global threat of climate change more forcefully and to consider how, like the pandemic, it will alter our lives. It has reminded us how the biggest crises, whether medical or environmental, demand a global and ambitious response.

In the past year, people have seen the mounting physical toll of climate change in fires, droughts, flooding and hurricanes. They have begun to see the direct financial impact as energy companies take billions in climate-related write-downs on stranded assets and regulators focus on climate risk in the global financial system. They are also increasingly focused on the significant economic opportunity that the transition will create, as well as how to execute it in a just and fair manner. No issue ranks higher than climate change on our clients’ lists of priorities. They ask us about it nearly every day.

In January of last year, I wrote that climate risk is investment risk. I said then that as markets started to price climate risk into the value of securities, it would spark a fundamental reallocation of capital. Then the pandemic took hold – and in March, the conventional wisdom was the crisis would divert attention from climate. But just the opposite took place, and the reallocation of capital accelerated even faster than I anticipated.

From January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019.1 I believe that this is the beginning of a long but rapidly accelerating transition – one that will unfold over many years and reshape asset prices of every type. We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity.

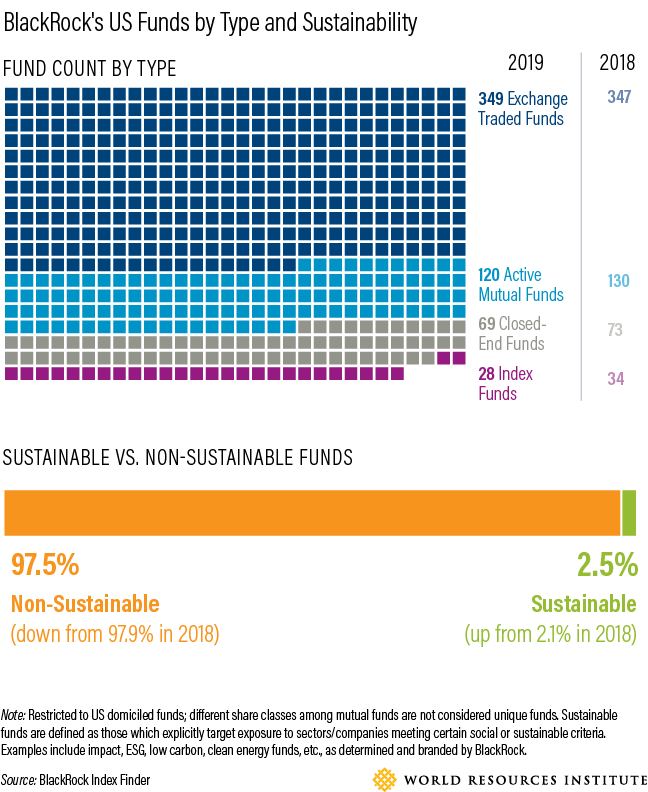

So why are you investing in the death of our planet, Larry? This is the company who invest over 97% of their $8.67 trillion in non-sustainable assets.

Source: Greenbiz

Then Mr. Fink has the audacity to go on a sustainability drive, talking about how important climate risk is, and that their clients ask every day about what the firm is doing to ensure it’s derisked. Really? So, why are your investments doing the opposite of this PR spin? Why are you doing nothing?

When I read the report Five Years Lost, I was not shocked but disappointed to find that Blackrock are the world’s largest funder of fossil fuel projects.

The report finds that financial institutions have provided $1.6 trillion in loans and underwriting since January 2016 and, as of August 2020, invested $1.1 trillion in bonds and shares in the 133 companies driving the 12 fossil fuel expansion projects.5 On the banking side, the companies having received the most funding since the Paris Agreement are BP, ExxonMobil, Petrobras, State Grid Corporation of China and Occidental Petroleum with a total of $358 billion in loans and underwriting from January 2016 to August 2020. The companies in the report with the highest investment value are Chevron, ExxonMobil, Royal Dutch Shell, Total, and BP.

Together, investors hold bonds and shares in value of $394 billion in these five companies, as of August 2020. 20 investors provided almost half of the total investments – $535 billion of the total $1.1 trillion – identified in the report. Among the top investors, US financial institutions are clearly leading the list. With bonds and shares worth $110 billion, BlackRock (USA) is the top investor in the report’s coal, oil and gas companies.

For me, this makes Larry a great villain: two-face.

On the one hand, he talks a lot of talk about climate risk whilst, on the other hand, he gets an 18% pay rise in 2020 by messing up the world investing in fossil fuel projects.

For those who read me regularly, I rarely pick on companies or people as targets, but Larry Fake is on my list. In fact, he rose higher on my list when his former head of sustainability aired his frustrations:

While leading the charge to incorporate environmental, social and governance considerations into all of our $8.7 trillion of investment activities at BlackRock, I started realizing that there’s not a lot of value at all in this data. It didn’t — and it does not — work in most [investment] strategies, since many are short-term and don’t care about long-term issues, and also because, frankly, acting irresponsibly is often profitable. I realized this data was not at all useful to invest in, or at least not nearly as much as [Larry Fink] was implying. It was mainly marketing.

Tariq Fancy, former head of sustainable investing, BlackRock

It is no surprise that Mr. Fancy feels this way when, as shown in the report Five Years Lost, Blackrock is the leader in investments in projects that our destroying our planet. But they are not the only ones ...

12 of the most devastating fossil fuel projects that are currently being planned or under development. These expansion projects alone would use up three-quarters of the total remaining carbon budget if we are to have a 66% probability of limiting global warming to 1.5° Celsius … with bonds and shares worth $110 billion, BlackRock (USA) is the top investor in the report’s coal, oil and gas companies. Vanguard (USA) is following closely behind with $104 billion in bonds and shares. State Street (USA) is in third place with $50.8 billion, followed by Capital Group (USA) with $48.4 billion. Only four of the top 20 investors are not from the US: the Norwegian Government Pension Fund with $31.9 billion in fifth place, UBS (Switzerland) with $11.8 billion in 11th place, Deutsche Bank (Germany) with $10.4 billion in 19th place and Legal & General (UK) with $9.8 billion in 20th place …

The top 20 banks provided more than half of the total funding to the fossil fuel companies involved in the case study projects: $949 billion out of the total $1.6 trillion. The US banks CitiGroup, Bank of America and JPMorgan Chase are leading the field with a cumulative $295 billion. There are eight European banks among the top 20. Together, they provided $308 billion, led by Barclays ($66.4 billion) and HSBC ($55.2 billion), followed by BNP Paribas ($52.7 billion), Deutsche Bank ($27.6 billion), Credit Suisse ($22.5 billion) and Santander ($21.1 billion). The Japanese banks in the top 20, Mitsubishi, Mizuho and SMBC, provided financing worth $149 billion. Also among the top 20 financiers are the Bank of China ($26.5 billion) and the Industrial and Commercial Bank of China ($24.9 billion), and the Royal Bank of Canada ($24.7 billion).

Finally, take note. We use around 40 billion tonnes of carbon a year and have 200-300 billion tonnes left in total on the Planet. By 2030, our planet will no longer exist if we continue this way. Sure, yea, yawn, tree-huggers, but take note of this quote from Greta Thunberg:

“I believe politicians and CEOs are making it look like real action is happening when in fact almost nothing is being done apart from clever accounting and creative PR.”

She is 100% right, as evidenced.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...