Building on yesterday's blog where I mentioned Monzo's issues of client onboarding, I mentioned that, for the past few months, I’ve noticed many tweets from Monzo customers about accounts being closed suddenly, with no explanation.

Each time, I’ve shared the information and copied Monzo and asked them to explain.

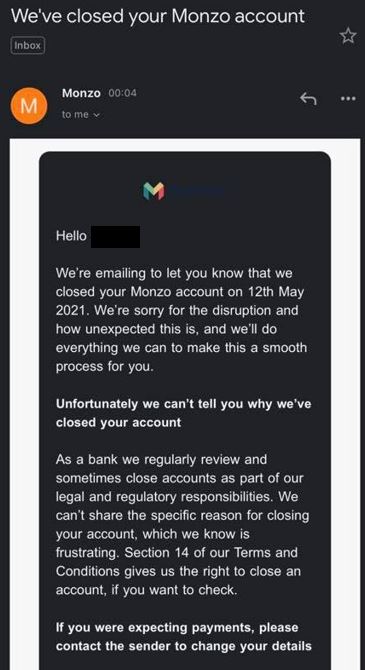

Their standard response to all customers is that they cannot tell them why their accounts are closed. Fair enough. Now the UK media picked up the story. Again, I gave Monzo the chance to reply, but had no response ...

There you go.

Now, bear in mind that these guys are friends of mine, I was surprised at the silence but then, maybe not. They don’t want to declare their internal issues, yet I can hazard a guess as to what they are, and think the main one is around the rules for client onboarding.

Bear in mind, this is a company that started as prepaid card and became a bank. When they became a bank, they asked prepaid card customers to switch-over. However, getting a prepaid card does not require the regulatory detail that relates to opening a bank account. Therefore, when Monzo became a bank, they switched customers easily from prepaid cards to bank accounts but didn’t have all of the documentation required under UK law to offer accounts to those prepaid card customers.

Failure to comply with due diligence requirements when onboarding customers has led to an FCA (UK regulatory body) investigation into Monzo’s accounts and structure. As a result, they are suddenly closing customer accounts as they now realise the exposures of non-compliance. I could have told them in 2015 when they started, but hey. Now, the issue is they do close accounts without warning and don't return funds. This has led to a major Facebook group with over 9,000 members as of now, all talking about how Monzo stole their money. This is happening more and more often – I’ve noticed many tweets about it – and Bella Ciao, the administrator of the Facebook Group, articulates the issues this raises well:

“I had one woman calling me up crying. She was suicidal. She had bills to pay and children to feed and she just didn’t know what to do. It’s heart-breaking. I tell everyone I know to steer clear of Monzo.”

Equally, as reported in i:

Most cases “involve problems accessing an account or an account being frozen … [because] the newer start-up banks have automated their checks for suspicious transactions, so the computer is literally ‘saying no’ and freezing accounts – and then people can’t get an answer as to why. I’ve seen people’s accounts frozen for just £200, so we’re not talking about major payments into the account either. The whole thing causes immense distress and if money is tight, it can be a nightmare.

It’s such a shame that they are dealing with customers so badly – treating customers unfairly – and really should sort their act out and make a public statement … but they’re just doing it on the QT and hope they won’t get found out. As a bank that claims to be open and transparent, the very least I would have expected would be some blog https://monzo.com/blog/ to explain what’s going on, but they haven’t gone there. Sure, they refer to the procedural aspect of closing accounts which, personally, I don't think cuts the mustard.

Why? Because it does not outline what happens next. It should show clearly that if they freeze or close an account, what it means for the customers' money and what happens next. They're missing a trick.

Maybe, as this is now a tidal wave of account closures - or that's my impression - they think no-one will notice? Well, you’ve been found out, and I’ve given you many opportunities to explain to me what’s going on, and you haven’t taken them.

Having joined the Facebook Group, which asks that members do not share posts, I can just summarise a few facts:

- Accounts are being closed with no explanation

- The freeze is often because a large amount is transferred into the account, but even small suspicious transactions creates an automatic closure

- Some accounts are being frozen for dealing with cryptocurrencies

- Often the account closure is happening with funds being frozen and not returned to the accountholder for months, if at all

- People’s credit scores are being trashed as a result of the Monzo systems

- Other banks are challenging customers who had their accounts shut by Monzo because of this

- Many people are thinking they should leave Monzo because of what’s going on

I see many similarities between what’s happening with Monzo and what’s happening with N26, the German challenger bank. N26 has similarly fallen foul of money laundering rules related to client onboarding, and have been berated by several regulators across Europe including their very own BaFin, the German regulator. After the Wirecard collapse, BaFin has just slapped N26 with an order to pull its socks up around this issue:

BaFin said that it made the decision after it found that deficiencies in money-laundering prevention remained two years after it ordered the bank to make improvements. It cited problems in customer due diligence and information-technology monitoring. It also told the bank it needs to have adequate staff and resources to comply with its obligations.

Monzo is going through the same growing pains with the FCA ...

... yet now I’ve spotted another issue with Monzo: processing multiple or duplicate transactions. Many twitterati have been sharing their frustration with the challenger bank processing transactions multiple times ...

If you have any issues with Monzo, just join this Facebook Group, who provide a clear point by point view of what to do to get your money back and get your issues resolved thanks to Bella.

Meantime, I look forward to when it gets its act back together. Talking of which, if you haven't noticed, the challenger has pretty much replaced its founding team with a new leadership structure, and some of the issues raised by account closures and system issues of multiple transactions may be a result of this.

Of the original five Monzo founders, only Jonas Templestein remains. And as the new guard is ushered in, the challenge will be to keep the culture of the bank, which propelled it from a niche start-up to a five million-strong customer base in just over six years …

[TS Anil, the new CEO] says this sense of company culture has raised some challenging questions. “Someone will challenge me and say, do you think that being profitable as a borrowing business is somehow counter to our mission?”

This is a telling question: Blomfield [the former CEO] long struggled with an internal cultural pushback against charging customers, and that issue has clearly not gone away. “The problem with Monzo is that they had an idea of where to go, but it wasn't going to make any money at all. And now they're kind of stuck between whether to be virtuous or whether to be business-like,” says Katherine Long, banking analyst at data analytics company GlobalData ...

“The problem is that Monzo doesn't do much lending,” Long explains. She argues that the bank doesn’t get much revenue from commission or interchange fees. With no credit card or mortgage offering, Long says she “fails to see how it's going to make that much money”. “It's not only that it struggles to make money, it's actually struggling to make enough money to even justify its growing costs.” She points to costs trebling from £60m in February 2019 to £151m in February 2020. “I've called it an increasingly expensive charitable cause, because that's basically what it is.” Long says she doesn’t see how Monzo can become profitable without a “radical change” to its business model.

The mix of the needs of compliance with regulatory requirements as a bank and the need to create a profitable model is a huge challenge for a challenger bank. It will be interesting to see how TS Anil and the Monzo team deal with these challenges without losing customer trust and regulator support.

Finally, take note:

MoneyTransfers analysed recent YouGov data about trust in banking institutions and online banking. Here are a few key findings:

- 83% of Britons think that challenger banks are not as reliable and trustworthy as 'traditional' banks

- However, challenger banks rank higher for customer satisfaction than traditional banks (88% vs. 69%)

- 74% of British people trust online banking - more than any other country

You can see the full report by downloading the document.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...