Talking about HSBC often drags me into political controversy. For example, when I criticised the bank for not making a stand over the Hong Kong protests, I got a lot of pushback. Frankly, I don’t like to dip my feet into political waters unless forced to and, in the spirit of that thinking, I was prompted to shine a light on the Huawei issues with HSBC by a Chinese friend.

As many of you should know by now, the USA regime under Donald Trump dictated that Huawei could have no involvement in 5G developments. This has been a fine line. For example, the UK wants to please both America and China – do they ban Huawei from 5G developments? The UK ended up saying that non-critical data areas could be supported by Huawei developments but, even then, had to step up further to maintain friendly relations with America. Bearing in mind Brexit was happening, the trade talks with America were and are key to Britain’s future. But what about China?

Well, it ends up being a political game of chess. For those who love the game Risk, let’s move this to a chess board. President Xi is King of the Chinese team; President Biden is King of the American team. So, who are the Queen’s, Bishop’s, Knight’s and Castle’s?

On the Chinese team, Huawei would definitely be on the board – you can choose which position – as their Chief Financial Officer (CFO) and Deputy Chair is a pawn in the game. Their CFO and Deputy Chair is Meng Wanzhou.

On December 1, 2018, while transferring planes at Vancouver International Airport en route to Mexico from Hong Kong, Meng was arrested by the Royal Canadian Mounted Police (RCMP) at the request of the United States, pursuant to the extradition treaty between Canada and the United States.

Since December 2018, Meng Wanzhou has been held under house arrest with an extradition order to be released to America. Who is Meng Wanzhou? At the time, Chief Financial Officer for the Huawei Group; also its Deputy Chair; oh, and daughter of Huawei’s founder, Ren Zhengei. Her conditions aren’t so bad ...

Ms. Meng receives regular private painting lessons and massages at the mansion. She has gone on private shopping sprees at stores reserved for her and her entourage, albeit with a GPS tracker on her left ankle. She spent Christmas Day at a restaurant that opened just for her, her husband, her two children and 10 other guests.

... but she is living in a gilded cage with an ankleband reporting her movements to authorities and no freedom to do as she wishes. No wonder this case has sullied the waters of international trade and co-operation between America, Canada and China. For example, American and Canadian travellers through China were suddenly arbitrarily detained, in retaliation for the actions against Ms. Meng.

OK, OK, we know that America has been turning against China for years – I personally experienced such feelings in 2005 when I told the US audience that the future was China – but what are the facts in this case?

Apart from being a game of chess, the key facts revolve around a 2013 PowerPoint presentation that Ms. Meng gave to HSBC. This presentation included discussions around Skycom, a Huawei division, who are charged with being a front for Huawei’s activities in Iran which, at the time, were banned under US sanctions from any technology activities.

The US alleges that in the meeting - the one with the PowerPoint presentation - Ms Meng misled HSBC over the true nature of Huawei's relationship with Skycom and this, in turn, put the bank at risk of violating sanctions against Iran. Her lawyers say the US misled the court, in particular about the PowerPoint, by omitting key information on two slides which showed HSBC was not, in fact, being kept in the dark about the true nature of the Skycom/Huawei relationship … HSBC has been put in a difficult position with Chinese media questioning how far the bank co-operated with the US in building a case they describe as a politically driven trap.

Funnily enough, it’s HSBC’s fault that Ms. Meng was arrested, some would say. This is because HSBC has been caught in collusion with dark money corridors over an extended period of time. For example, HSBC were ordered to pay $1.9 billion as a fine for breaching US money laundering rules back in 2012. The head of compliance for HSBC, David Bagley, fell on his sword over that one, and HSBC entered into a Deferred Prosecution Agreement (DPA) with the U.S. Justice Department.

If HSBC breached the DPA, then it would be subject to criminal prosecution for all of the charged acts to which HSBC had already stipulated. On the other hand, if HSBC fully complied with the terms of the DPA, all related charges would be dropped at the end of the term.

The issue in this case is that HSBC were involved in a Huawei agreement after the December 2012 DPA agreement.

In January 2013, Reuters published two articles implicating Huawei in possible Iran sanctions violations. The first article indicated that Huawei had “close ties” to Skycom, which had offered to sell embargoed Hewlett Packard computer equipment to Mobile Telecommunications Co of Iran (MCI), Iran’s largest mobile phone operator … in the second article, Reuters reported that a review of publicly available corporate documents suggested that ties between Huawei and Skycom were even closer than originally reported. Specifically, the article stated that Ms. Meng had served on Skycom’s board from February 2008 to April 2009, and that in 2007 she served as company secretary for a Huawei holding subsidiary that held 100% of the shares of Skycom.

Then there was that fateful day in August 2013, where a presentation was given by Huawei to justify future operations and investment from HSBC. The presentation, entitled “Trust, Compliance & Cooperation” is comprised of 16 slides ...

... most of which outlined Huawei’s understanding of the applicable sanctions regimes together with a description of its compliance policies and practices generally and with respect to Iran specifically.

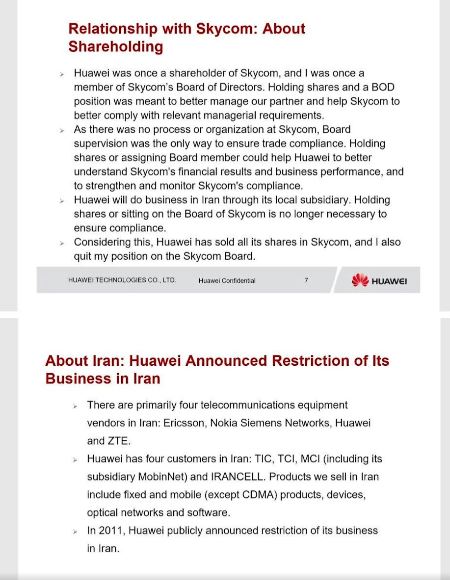

Given the centrality of the PowerPoint in the overall proceedings, pertinent portions of the presentation relating to the relationship with Skycom and Huawei’s business activities in Iran are set out below.

Slide 2 set out the following introductory statements:

Huawei operates in Iran in strict compliance with applicable laws, regulations and sanctions of UN, US and EU.

Huawei’s engagement with Skycom is normal business cooperation. Through its trade compliance organization and process, Huawei requires Skycom to make commitments on observing applicable laws, regulations and export control requirements.

A description of the business relationship between Huawei and Skycom was provided on slide 6, which sets out the following bullet points:

- As a business partner of Huawei, Skycom works with Huawei in sales and services in Iran.

- Huawei conducts normal business activities in Iran and provides civilian telecommunications solutions in line with global standards (e.g. ITU/3GPP) and export control requirements of the US and the EU. Huawei works with local suppliers, distributors and carriers in strict compliance with its well-established business conduct guidelines.

Slide 7 sets out a description of the shareholding relationship between Huawei and Skycom, listing the following bullet points:

- Huawei was once a shareholder of Skycom, and I [Ms. Meng] was once a member of Skycom’s Board of Directors. Holding shares and a BOD position was meant to better comply with relevant managerial requirements.

- As there was no process of organization at Skycom, Board supervision was the only way to ensure trade compliance. Holding shares or assigning Board member could help Huawei better understand Skycom’s financial results and business performance, and to strengthen and monitor Skycom’s compliance.

- Huawei will do business in Iran through its local subsidiary. Holding shares or sitting on the Board of Skycom is no longer necessary to ensure compliance.

- Considering this, Huawei has sold all its shares in Skycom, and I [Ms. Meng] also quit my position on the Skycom Board.

Source: South China Morning Post

There’s more, but the key point is whether transparency was presented or was it a intended deceit?

In this instance, the US authorities have said that there were only junior people who attended the meeting, but that would not be the correct protocol for a meeting in Asia. I always remember arriving at a meeting in Singapore to sign our contracts and it was myself, a Senior Vice President; my boss, the Global Head of Financial Services; and his boss, the CEO. I heard afterwards that the bank had been watching our arrival and the titles on registration. As a result, the boardroom which had forty executives from the bank waiting for the contract-signing ceremony, was cleared of 37 executives. The three remaining were the Senior Vice President, President and CEO. Direct equivalents of our levels.

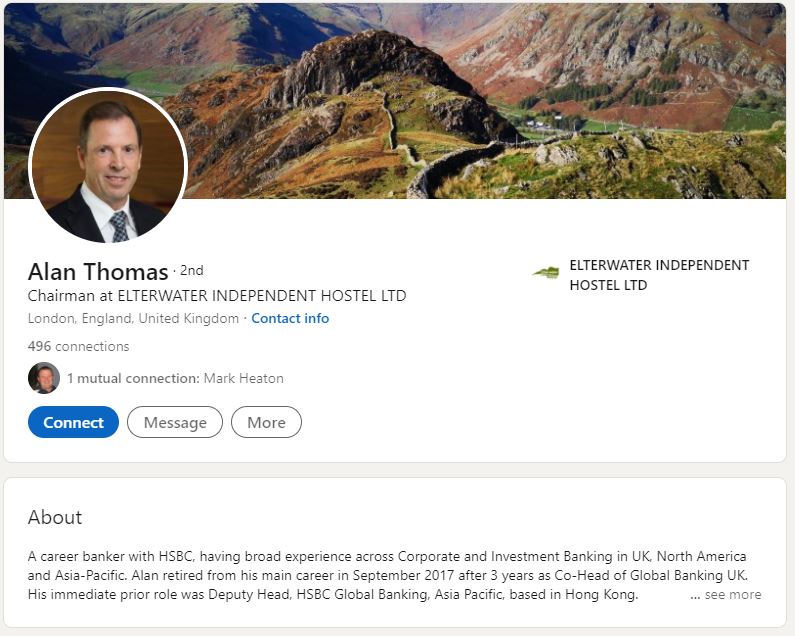

Do you seriously believe that HSBC would place a bunch of junior executives in a meeting in Hong Kong with their best global corporate customer – in the top 20 of all HSBC clients at the time – and not respect such protocol? It would be impossible. In fact, it turns out that Alan Thomas, who was then Deputy Head of Global Banking for APAC at HSBC, was a key attendee at the meeting. What happened at the 22 August meeting with Mr. Thomas and Ms. Meng?

The US is seeking her extradition on charges of violating US sanctions when a company controlled by Huawei sold telecoms equipment to Iran. The US claims Meng did not tell the truth to HSBC about Huawei’s true links to Skycom, a firm that was active in Iran and allegedly a shell company for Huawei. Meng, the daughter of Huawei’s founder, is alleged to have told HSBC senior executives in a PowerPoint presentation in August 2013 that Skycom was a simple partner and not a subsidiary. She held the meeting in Hong Kong with HSBC’s Asia-Pacific director of global banking, Alan Thomas.

This is where the issue lies between the USA, Canada and China and, more importantly, between HSBC and Huawei. Who is lying? What documents are HSBC withholding? Who else attended that meeting? Were they really juniors? What was HSBC privy to that they are not sharing?

Of equal importance is the question of what process was followed by Canada in detaining a Chinese citizen on a warrant from the USA? On this point, Ms. Meng’s legal counsel has presented a four-pronged attack:

- The first prong (or branch) focuses on the politicization of the prosecution as evidenced by the statements made by President Trump (as referenced by Ambassador McCallum in his original comments, for which he was later sacked).

- The second branch challenges the manner in which the arrest was made, highlighting years of alleged harassment of Chinese executives to conduct illegal searches.

- The third branch claims that U.S. prosecutors have made material misstatements and omissions in the record of the case.

- The fourth branch challenges the assertion of U.S. jurisdiction over her as the alleged conduct had no substantial and genuine connection to the U.S.

All four prongs may be grouped under the general heading of abuse of process, which is conduct which offends the Canadian sense of fair play and decency, compromises the fairness of the proceedings or undermines the integrity of the judicial process.

Then, add to this the then President Trump had a long-held mistrust of China’s globalisation, and was using Ms. Meng as a bargaining chip.

President Trump’s stated desire to use Meng’s criminal prosecution as a bargaining chip in trade negotiations with China violates long held policies and norms, enshrined in over 50 years of administration policy against political intervention in individual criminal cases.

Finally, there is a question as to whether the Record of the Case (ROC) is accurate or biased against Ms. Meng.

Ms. Meng’s legal counsel assert that the ROC included only selected slides from the PowerPoint presentation, omitting other highly relevant information on other slides which clearly confirmed that Huawei and Skycom were business partners in Iran and arguably showed that Huawei controlled Skycom’s operations in Iran. Moreover, the ROC suggested that only junior HSBC employees knew that Huawei controlled Skycom’s bank accounts at HSBC, when in fact two senior executives in the global banking operations of HSBC were also aware of this fact. Finally, HSBC had already been processing U.S. dollar payments for Skycom for three years prior to the August 2013 meeting. In summary, Ms. Meng’s counsel argue that there was no deception, no material omission, no conduct by Huawei or Ms. Meng placing HSBC at risk, and thus there was no fraud.

In other words, the slides in that August 2013 PowerPoint, for some reason, are not all included in the Record of the Case. In recent developments, Ms. Meng’s team took the case to Hong Kong and she and HSBC have told a Hong Kong court that they have reached an agreement over the documents. If they are released, it is expected that they will prove that HSBC did know the full disclosures over Skycom and, moreover that the US has no jurisdiction in the matter, as HSBC is a UK-registered bank. The US says it does have jurisdiction because the transactions were in US dollars.

The issue at stake is whether the USA can win its game of chess with Huawei as a key piece on the chess board, and Ms. Meng a pawn or, if not, does it bring down HSBC? HSBC’s behaviours are clearly of a bank caught between the devil and the deep blue sea. Do they appease America, to avoid further fines and criminal actions, or do they kowtow to China, to ensure their expanding Asian business expands further? Unfortunately, they tried to do both and failed at every gate. Will this destroy the world’s local bank? Probably not, but it will send a rocket up its ass as, even if it doesn’t destroy the bank, would you trust this bank? As a global corporation, one which was a key top tier global client, would you trust them to look after you if they would just throw you under a bus when asked?

This is exactly what they appear to be doing in the case of Huawei. Huawei's lawyers are reportedly arguing that HSBC did a deal with the US Department of Justice (DoJ) whereby, in exchange for its cooperation in the campaign against Huawei, the DoJ would turn a blind eye to HSBC's other misdemeanours, which allegedly include the processing of Iran-related transactions though its New York offices.

Equally, as we look forward, the US actions may be seen as a further nail in the coffin of the US dollar, as it is only the fact that transactions are in dollars that allows such dominance of US laws and sanctions in global markets. What if there were a move away from the dollar to a central-bank digital currency, such as the digital yuan or, even more interestingly, towards other currencies? As The Diplomat states:

Regardless of the outcome of this particular case, setting a precedent in the extradition context for dollar clearing jurisdiction over high-profile foreign citizens may encourage a further push for certain nations to distance themselves from the dollar.

And the outcome for Ms. Meng?

If Meng ends up on U.S. soil, she will face up to 30 years in prison on bank and wire fraud charges. Her case would then be in the hands of the Eastern District of New York to try and decide, where proceedings would undoubtedly draw a media frenzy. Based on the current case calendar, we are approaching the long-awaited finish line of the extradition proceedings

On the positive side, if the Meng case is dropped either way, a major obstacle to troubled Canada-China relations of the past two years could be removed and the “two Michaels” could be back home in Canada. The bilateral relations between Canada and China could then be back on track.

On the negative side, however, this will put Canada in an awkward position because it supports the assertion that there was more at play than just legalities.

If you would rather watch further news on the case, then Cyrus Janssen provides a great analytic:

Finally, if you are interested in this kind of stuff, I will publish a full timeline of events about the case tomorrow, just so we have the complete picture.

In conclusion, there is so much at stake here about global trade and international operations that the case is one to watch, not just for Huawei and HSBC, but also for you and me. The case for extradition from Canada to the USA is due to start on August 3 2021: who will win, who will lose? Heads or tails ... your choice.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...