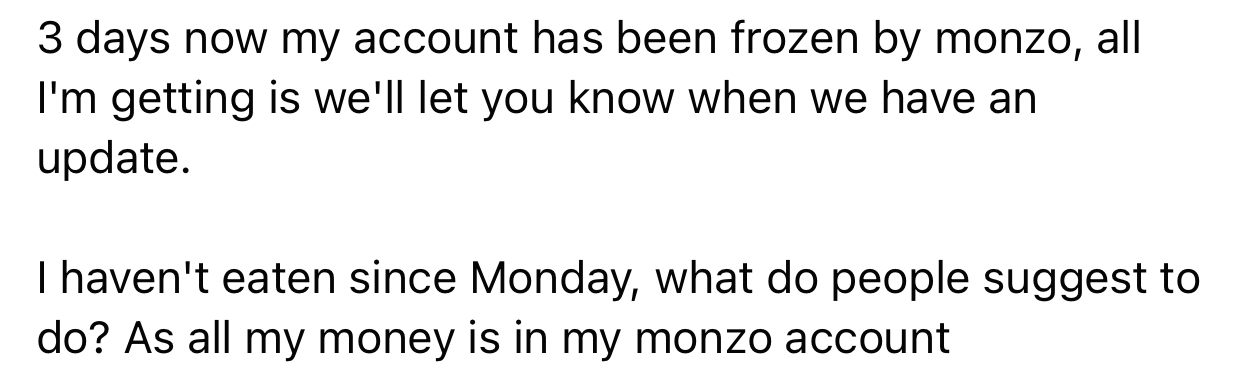

I was thinking about things that are not being dealt with by banks or fintechs. Surprisingly, there are many things that come to mind:

- real-time proof of identity to avoid freezing of accounts

- multiple verifications of a payment to ensure you send to the right person’s account

- better use of FaceID and similar biometrics to ensure you are who you say you are

- the ability to reverse a payment made incorrectly

- a one-click window to trading with confidence and ease

I could go on, but we are still early days in the fintech revolution. This surprises me when we are talking a business that saw $98 billion invested in the first half of 2021 (compared to $112 billion invested in the whole of 2020). Why is it that we are missing a trick or, more importantly, why is it that if companies have solved the above I haven’t heard of them?

In fact, I’m particularly concerned about what’s happening in the UK at the moment where Monzo, HSBC and other banks are freezing customer accounts without explanation. Why no explanation? Oh, it’s a compliance thing. We can’t tell you why we froze your account, because the regulator told us we have to do this.

Fact is the regulator did not. It depends upon how you interpret the regulation.

This is where things get interesting and tricky. What is the letter of the law and how do you interpret it?

Some see it as black and white, A or B, yes or no. You either get through the checkpoint with all ticks in the boxes, or you’re sent home. Some say there is a gray space. We can look at this and make a decision based upon a view.

I’ve dealt with this for so many years that I cannot believe it’s still the case that companies have not built systems which can provide discretion. In the old days, it used to be the boxes. Did you tick all the boxes? If a tick is missing, get lost. Today, it’s the systems. Did you pass all the profiles? Have we checked you?

It’s still box-ticking and button-pushing, but now the machines tick the boxes and push the buttons. The problem with this is that the humans in the machine are getting frustrated. To be honest, this doesn’t just apply to banking and insurance. It applies to any business.

When the computer says no, there needs to be an appeal process that is fast, real-time and human. We need access to something that is not a machine. The machine has been programmed to say yes or no. What about maybe? More importantly, what about the appeal for maybe?

Right now, I am seeing lots of issues in banking, finance and fintech. I’m seeing traditional banks and neobanks ignoring customer pleas to correct mistakes. The core of these issues in most instances appears to be that the company has set up a system that says yes or no. What about maybe?

I am a doctor who runs a busy medical practice with the NHS and privately. Our private clinic account was suspended when one of our patients made an erroneous payment. We have submitted all the documents twice to HSBC now showing this, including once in branch and online. Our account is still suspended and we are unable to pay our nurses and staff, or obtain essential medications/treatments for our patients, some of whom are very ill. What can we do?

Source: Daily Mail

People who clearly aren’t doing anything dodgy are having their accounts frozen for no reason, while cuts to customer service mean you can’t get hold of some banks easily – and when you do, you’re told that they can’t help because they are not allowed to discuss why the account is frozen. The blame lies solely with the banks for their systems and staffing levels.

Source: iNews

I visited a Lloyds branch in Chelsea, southwest London, for an update and spoke to someone in the business banking team. I explained that I had a large deposit to make from PayPal, and we spoke about what I did for a living. Once the account was opened a month later I transferred the £50,000 from my PayPal account. The next morning I got a text message saying that after a review on my account Lloyds had decided to close it. I presumed this was a mistake and called the bank. I was questioned like a criminal and asked if I could prove where the money came from.

Source: The Times

Adam Carr is tired of waiting for NatWest. In May last year he applied for a bank account so he could get a bounce back loan from the government. He waited four months for it to be opened. In September — days after the account was opened — NatWest closed it, alongside two others his family had with the bank. He waited six months to access his money. Now, a year and three months after he applied for his account, although the partly state-owned bank says it has processed the compensation money the ombudsman ruled Carr was owed for poor communication, he is waiting for it to appear in his account.

Source: The Times

I could go on and on and on with illustrations of what’s happening here, but the basics are that the UK regulator (the Financial Conduct Authority, FCA) has clamped down on Know Your Customer (KYC) and Anti-Money Laundering (AML) rules for bank accounts in Britain. Banks – both incumbent and challengers – have interpreted these rules in black and white, yea or nay, stay or go. There’s no leeway, no service, no challenge process, no customer focus.

Result: 1000s of people telling me how Monzo, NatWest and more are rubbish.

Fix the system guys. This isn’t working.

See: Monzo stole our money on Facebook (over 10,000 members)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...