One of the things over-looked by many is how banks invest in the Finverse. According to Toptal’s data, 63% of banks invest in startups or set up accelerators, and many are instrumental in FinTech companies’ operations, fund raising and IPOs. Bear in mind that start-ups need bank accounts too, which creates a multi-dependency in the Finverse between those trying to disrupt banks whilst relying on banks. They rely on banks for their funding, ability to move across borders, relationships with investors and more. It’s a weird parent-child thing (my constant metaphor). You spend years raising, nurturing, mentoring, supporting, investing and building your child. Then they turn around and say I hate you, and disappear. Well, some do anyway.

Nevertheless, banks are heavily active in raising their FinTech children. For example, last year, German fintech solarisBank AG raised €60 million in a Series C funding round in June, with participation from BBVA and ABN AMRO; Santander participated in a funding round for German credit scoring fintech Forteil GmbH; Crédit Agricole and Nordea invested €10 million into Financial Transaction Services BV — which trades as Cobase, a platform that allows international bank customers to manage multiple accounts; Caixa Central de Crédito Agrícola Mútuo joined UniCredit and Groupe BPCE in a €8.5 million funding round for British fintech Meniga Ltd., which provides white label digital banking services …

… the list goes on.

In America, CBInsights produce regular reports on this space and find major banks like JPMorgan Chase, Citi and Goldman Sachs have created their own Finverse of mutual dependencies:

Goldman Sachs and Citigroup are the most active investors, with Citi participating in 22 fintech deals in 2020, and Goldman backing 18. Goldman Sachs spent $750 million on wealth management firm United Capital. More recently, it snapped up boutique wealth management custodian and technology provider Folio Investing in May 2020. The bank has also aimed its sights on alternative lending and capital markets. Betting on these sub-industries aligns with Goldman’s digital strategy of scaling its consumer offering, Marcus, and enhancing its digital wealth capabilities. In February 2021, the bank launched Marcus Invest, a robo-advisor to compete with the likes of startups Betterment and Wealthfront as well as a growing cadre of incumbents offering robo-advisors.

Citi has also had a capital markets focus, backing 13 startups in this area from 2018 to 2020. The bank has also made deals to 6 wealth & asset management startups, 5 real estate startups, and 5 small business-focused startups, over the same period. Generally, these investments fit into Citi’s efforts to enhance its Institutional Clients Group business, specifically the Investment Banking and Markets & Securities Services functions.

JPMorgan, meanwhile, remains focused on supporting its capital markets and small business offerings. The bank backed 12 companies in capital markets and 7 in small- and medium-sized business (SMB) solutions from 2018 to 2020. Over the same time period, JPMorgan also made 4 investments in wealth & asset management and 4 in payments.

I don’t have exact figures but am aware that banks invested $27 billion in FinTech ventures during 2015-2017, according to KPMG.

The same company’s Pulse of Fintech report (which I quote regularly) estimated that the overall amount invested in fintech dropped from $46.7 billion in 2015 to $24.7 billion in 2016; and this figure remains constant, according to all I read. If that is the case, then around a third of all FinTech funding is coming directly from banks.

It’s a virtuous circle, not a disruptive market. It’s a circle where banks recognise they need to cannibalise themselves and what better way to do it than by investing and acquiring FinTechs?

Talking about acquiring, I mentioned this the other day too:

The world is getting interesting. Circle announces plans to become a fully registered bank; Lending Club buys a credit union; Credijusto (Mexico) buys a bank; Raisin (Germany) acquires a bank … the list has, is and will go on. Meantime, JPMorgan snaps up OpenInvest; US Bank buys Bento; Lloyds (UK) acquire Embark Group; Visa eats CurrencyCloud … the list has, is and will go on. Oh, and don’t forget Starling Bank (UK) swallowed Fleet; Nexi (Italy) merged with NETS; Railsbank munched on the left-overs of Wirecard; Solarisbank (Germany) swooped down on Contis … the list has, is and will go on. What’s the point? The point is that we are actively seeing a time of consolidation.

Consolidation.

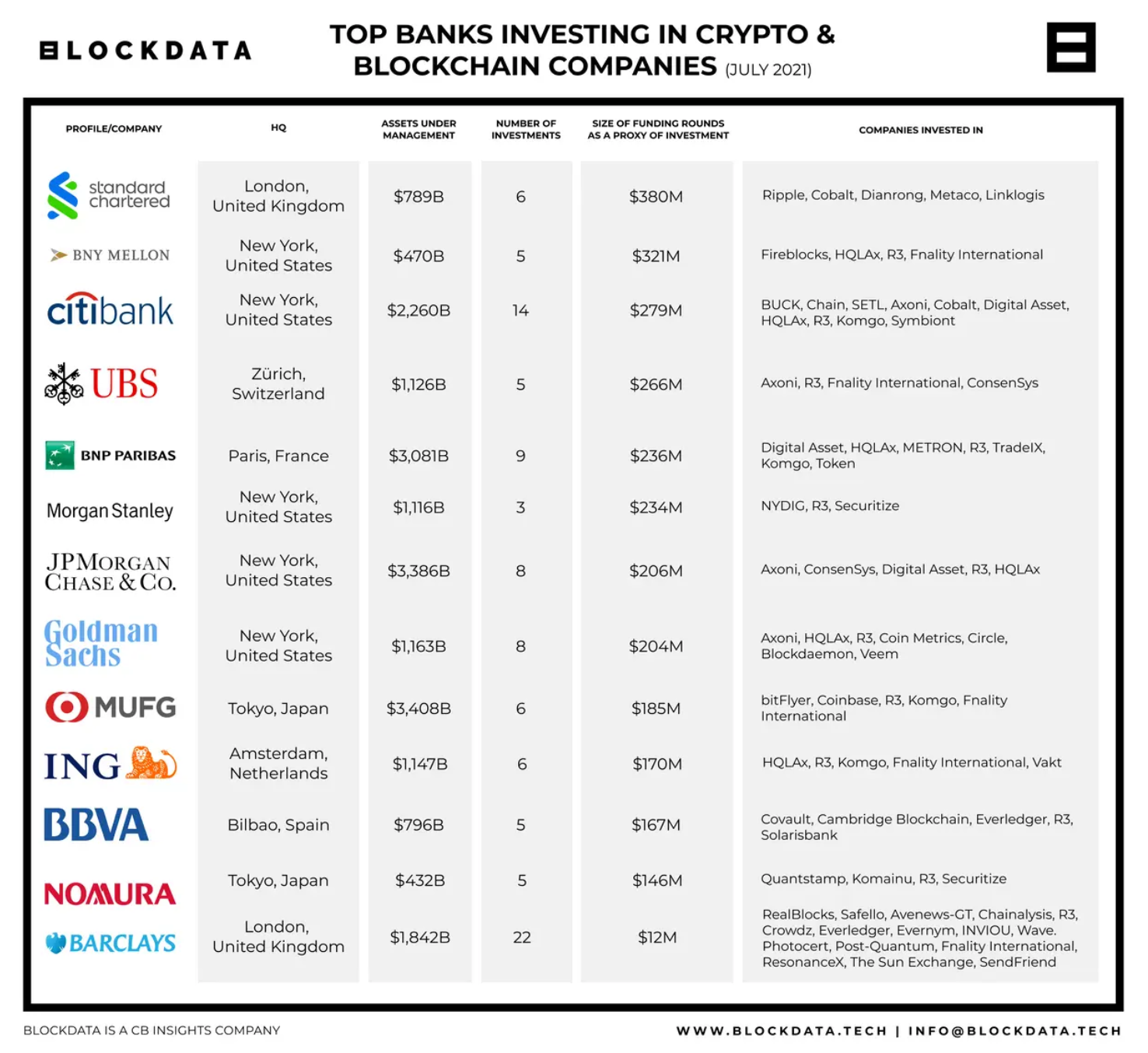

As we reconstruct banking for the 21st century, banks are using FinTechs to reconstruct themselves. This is why they are so enamoured by blockchain. Just take a look at those investments. The top 10 banks investing in blockchain and crypto technologies are Barclays (19), Citigroup (9), Goldman Sachs (8), J.P. Morgan Chase (7) and BNP Paribas (6). The investors active in the biggest funding rounds are Standard Chartered ($380M in 6 rounds), BNY Mellon ($320.69M in 5 rounds), Citigroup ($279.49M in 9 rounds), UBS Group ($266.2M in 5 rounds) and BNP Paribas ($236.05M in 9 rounds). Out of the top 100 banks by assets under management, 55 have invested in cryptocurrency and/or blockchain-related companies. Either directly, or through subsidiaries.

Banks are not being disintermediated, disrupted or destroyed by technology. They are actively investing, nurturing and mentoring the next generation of finance and behaving as good parents to the children creating their future. They are creating the finverse.

Disagree?

Give me the numbers …

Postnote:

The chart above is incorrect as someone noted that 12 out of 13 banks are invested in R3, but this is not the case. The only banks invested in R3 direct are HSBC, Bank of America and SBI Holdings during their last funding round and CLS in their previous funding round. Therefore, the banks listed here are not invested in R3, but paying fees to be part of the consortia. It’s a different thing.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...