I’ve been presenting and writing about the end of branches, cash and cards for twenty years:

2007: Bank strategies are fundamentally flawed - design around IP, not branches

To be clear, I'm not saying they're dead. I've been saying their role is replaced by the network and digitalisation. Digitalisation is the core, and these old physical forms of transacting and paying are now peripheral. It’s been clear that digitalisation would replace branches, cash and cards with apps and tokens for years. I said years ago that MasterCard should rename themselves MasterChip. Well, now it’s happening.

The pandemic is driving out cash …

In June 2019, overall contactless adoption in the region was at just 40%, according to figures from payment processor Nets. The average contactless rate is now 77% in Germany, 82% in Austria and 80% in Switzerland … in January 2020, average contactless adoption in the Nordics was at 56%. This grew to 75% by January 2021. Norway saw extreme growth, with only 35% contactless adoption in January 2020 rising to 79% in January 2021.

There has been “a 6.5% decline in bank branches since 2012: This trend would see total number of physical banks nationwide fall to fewer than 16,000 by 2030 and all branches closing by 2034.”

And all things physical ...

We don’t need physical access and paper in a digital world. We need chips and tokens.

The thing is that if you agree with that statement, did you build your business to behave that way? Have you built a business for Mars?

This is the urgent driving factor of 2020 and beyond. Can you serve customers as though they lived on Mars, whilst employees are on Earth and Head Office is on the Moon?

It’s the question I would ask every business. Could you work this way?

After seeing our first space tourists returning from three days circling Earth, do you really think your business is fit for a multiplanetary, digital world?

This is the thing that is changing fastest on Earth – the links between people, the network effect. The faster we network, the more we need networked finance. For so many years finance has been embedded in bricks and mortar; today, it needs to be embedded full stop.

It’s in our walls, our cars, our clothes, our fashion, our thinking, our life.

That’s the big difference today: are you embedded, immersed, integrated with a world of digitality? If your business model built that way? Are your producst and services designed that way? Are you a digital native?

I’m living in a digital world and I am digital born (credit to Madonna).

Are you digitally born? Do you think that way? Is your business structured that way?

These are the big challenges for all business created after 1990. They need to be created for a network and digital reach, as though their customers were on Mars and their employees on Earth. If you haven’t created that, then what are you doing?

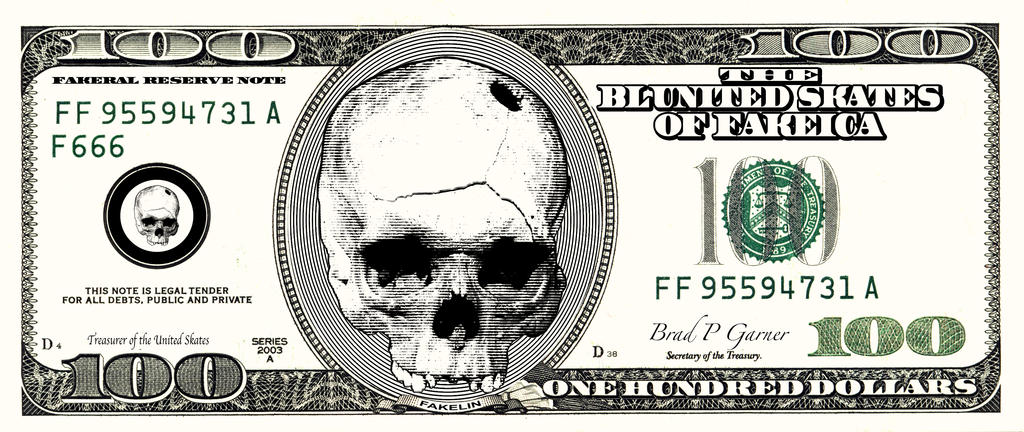

Meantime, branches, cash and cards? Get out of here!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...