I am sometimes a Luddite. Today is that day.

I woke up and found that a payment was made via a direct debit for a service I no longer use. It’s an annual payment, and I’d forgotten to cancel it. It was for $500. I was irritated, to say the least.

I then realised I have lots of payments like that. Recurring annual payments you forget about, then they suddenly appear in-app and you think WTF? Of course, yes, you can cancel them and even sometimes get your money back, but what a pain in the ass.

So, in Luddite mode, I was thinking about the good old days where all you had was cash or a cheque. In the good old days, it was all physical. No one could take money from you invisibly or annually without asking, and you always had the right to say NO!

This is where banks are missing a trick.

The ideal way in which things should work today is permissions-based. You don’t need to ask for permission for every single thing – I hate it when the bank blocks my online payment and sends me a text asking if it was me Y for Yes and N for No – but there should be permissions for an annual payment being taken from the account. You are about to pay $500 for an annual subscription to Nerdgeek.com, are you OK with that? Equally, there should be permissions for any subscriptions payments above a certain amount, for example over $100.

It does amaze me how often my bank challenges payments that I am validly trying to make, and yet lets payments go through my account for subscriptions I no longer need. The bank would claim that I set them up, so I need to close them. I would claim, as a user, that banks should regularly ping me to say these are the current subscriptions on my account, do I wish to cancel any of them.

But then my main bank doesn’t even allow its cards to be used in Apple Pay. It has an app, but the app does not work with their credit card. It has an app, but the app never alerts me to anything. It only works when I open it. I have a bank built for the year 1982. Now, it’s 2022.

It is 1000% clear to me that my bank is built for 1982, because so much does not work online or in-app. They have an app, but the app looks just like a bank statement. If I go on their website, the website is clunky and difficult to use. It’s 2022 guys!!! Why are you working this way???

Oh, because the system behind it all was built for 1982. Actually, it was probably built for 1972.

That’s why you cannot alert me when a payment comes into my account. That is why you cannot ask me if I want to renew a subscription I no longer need. That is why you have an app that purely presents transactions and balances and provides zero information or analytics.

So, why don’t you switch to another bank Chris? A challenger bank?

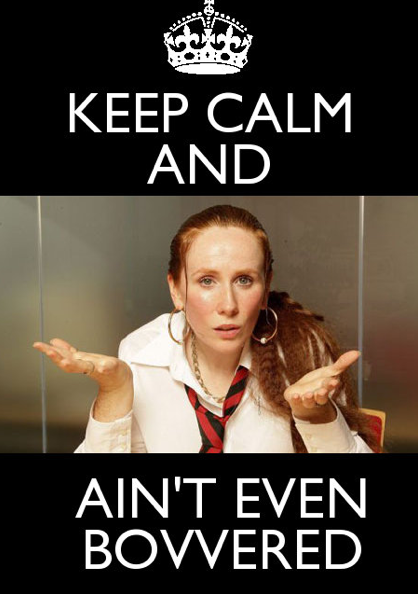

Because I can’t be bothered ….

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...