I don’t know if you’ve noticed a new start-up called Column, but it’s worth watching as it’s a chartered bank in America created by the co-founder of Plaid, William Hockey, and his wife Anne.

The problem the Hockeys are trying to solve is that fintechs and large tech companies often need to cobble together a patchwork of financial services partners to offer basic products. They need a chartered bank that can hold deposits and a separate “middleware” software provider to connect the chartered bank’s systems to their own tech. Then they need a banking “core processor” to actually move money. “After working in this space for almost 10 years, this supply chain is kind of silly,” William says. “All this should be consolidated into a chartered bank that is also a technology company” … Nearly every page of Column’s website shows code that can be used with its application programming interface, or API.

Aaaah!!! Finally a true BaaS (Banking-as-a-Servcie) company.

What William has spotted is that most banks are not offering a truly open platform to others. From my perspective, without knowing the company in-depth, it sounds like a Foundry, 10x, Thought Machine or Leveris, although the fact it has a banking license does make a difference, a bit like Solaris in Europe has a banking license. After all, you cannot deliver BaaS is you’re not a bank.

But unlike most BaaS discussions, Column is all about offering BaaS to other companies like Stripe and Plaid. That’s also a similarity with Solaris’s strategy. In fact, you end up with two camps: those who offer APIs to banks, and banks who offer APIs to start-ups and others.

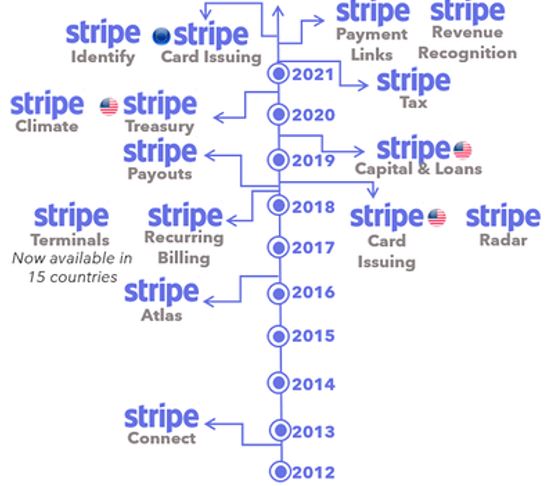

The market gets mixed up this way. You have those providing niche services (Stripe) …

Source: Insights

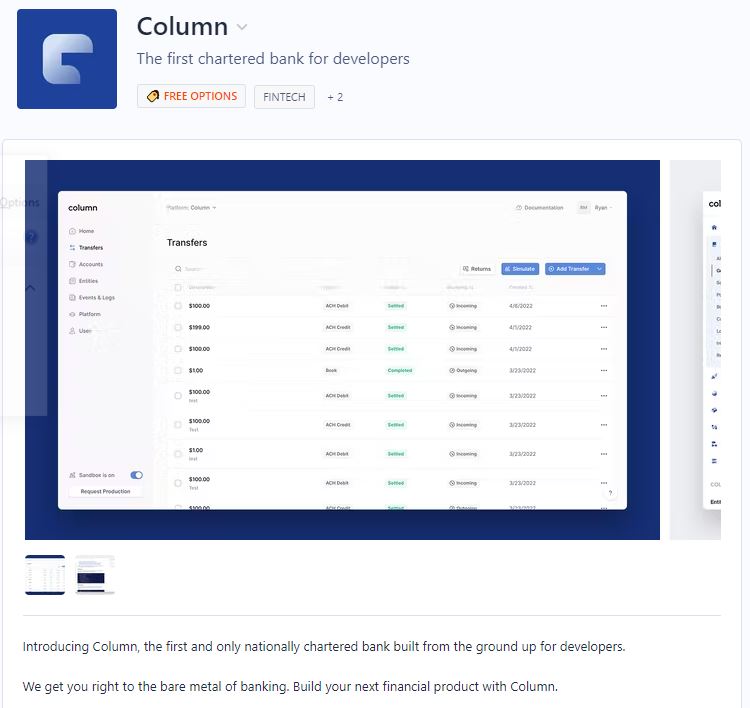

Those providing banking services …

Source: Column

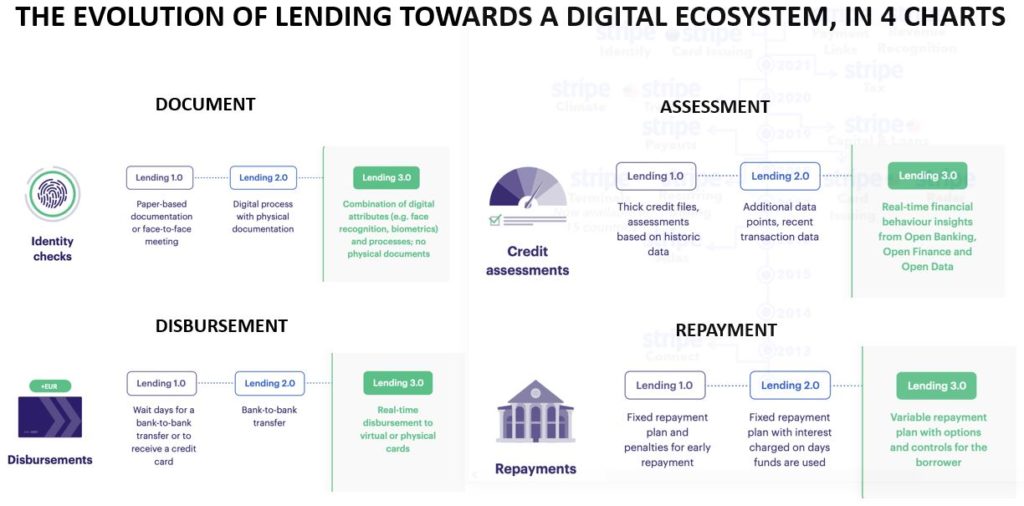

And those providing ancillary services …

Source: Tearsheet

It kinda makes you wonder where a traditional bank fits?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...