I just received an interesting report from Simon Kucher & Partners, a marketing strategy consulting firm, about Neobanks. It starts with some basic stats:

- There are 400 neobanks around the world with over a billion clients

- Over 50 neobanks launched in 2021

- The main focus of Neobanking is UK, Sweden, USA, Brazil and South Korea

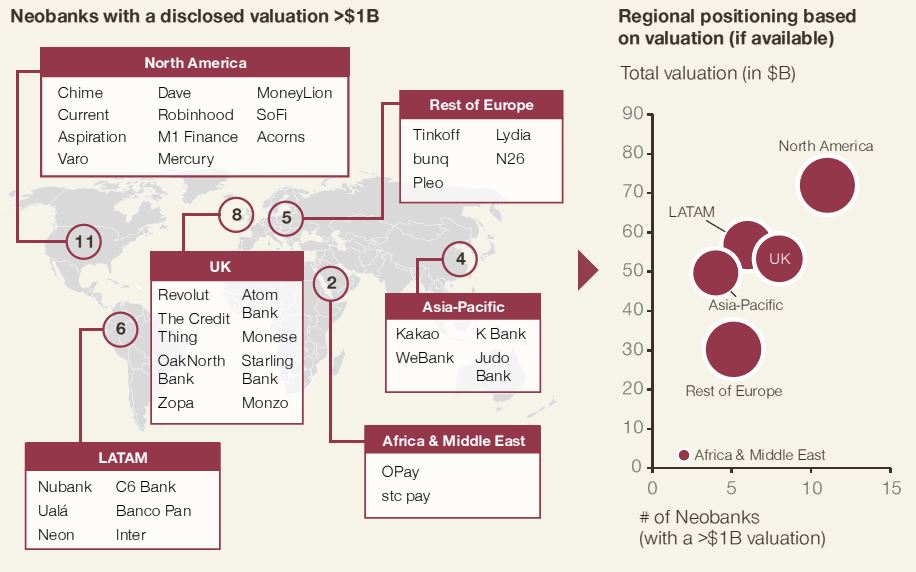

- The neobanks are worth around USD$300 billion with at least 36 unicorns (2021)

- Less than 5 percent have reached breakeven, with most making heavy losses

They also do a dive into regional variations from Middle East/Western Asia through America. I found it interesting that America has neobanks serving 100 million people with 19 new banks entering the market in the last year. That’s notable. They also pick out Brazil for innovation, where 80 million people are being served by new banks and it’s not just NuBank! There are nine neobanks in Brazil, all with sizable customer bases.

A notable part of the report is profitability. The text:

Our latest analysis found that only two out of 25 advanced-stage Neobanks have reached operational breakeven. Extrapolating these results across the industry and considering that over half the players are not yet three years old, we predict that less than 5 percent of the world’s 400 Neobanks have turned profitable so far. Moreover, cash burn rates remain stellar for several banks, with annual losses exceeding 100 million dollars in some cases. What is more, even after adjusting for the high acquisition costs, the large majority of Neobanks still haven’t found the key to making money.

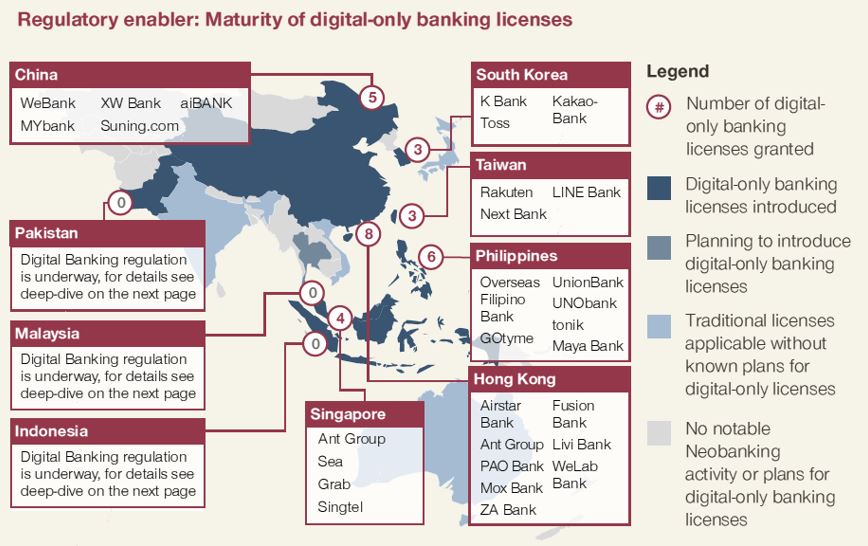

And the report goes on to outline their views of how to address this issue. But the miss another issue, which is the regulatory challenges and, specifically, the lack of compliance with rules. Monzo, N26 and others have fallen foul of the regulatory requirements for client onboarding, and many have a naivety when entering these markets.

As the report states: “going from a garage startup to an international in just a few years is a stretch, even for the most professional Neobanks”.

Anyways, here are my three favourite charts from the report:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...