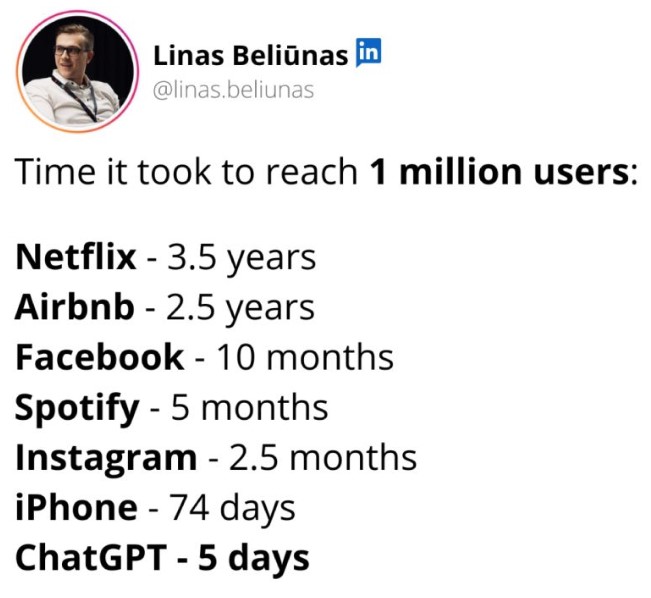

Unless you’ve been sleeping under a log this week, you must have heard all the buzz about ChatGPT. ChatGPT is an OpenAI place where almost any question you have in your head can be answered. The reason it’s got such a buzz is that within just a week of launch, there are over a million people using it.

It's a bit like Google but, because it uses artificial intelligence, it is different. For example, unlike Google which gives you a list of links, ChatGPT (GPT means Generative Pre-trained Transformer) tries to answer your questions in a conversational style. Should Google be worried? Yes and no, as ChatGPT is different and, for the record, Google are developing their own version called Gopher, based on DeepMind.

Anyways, I tried a few chats with it and I must say it is very clever.

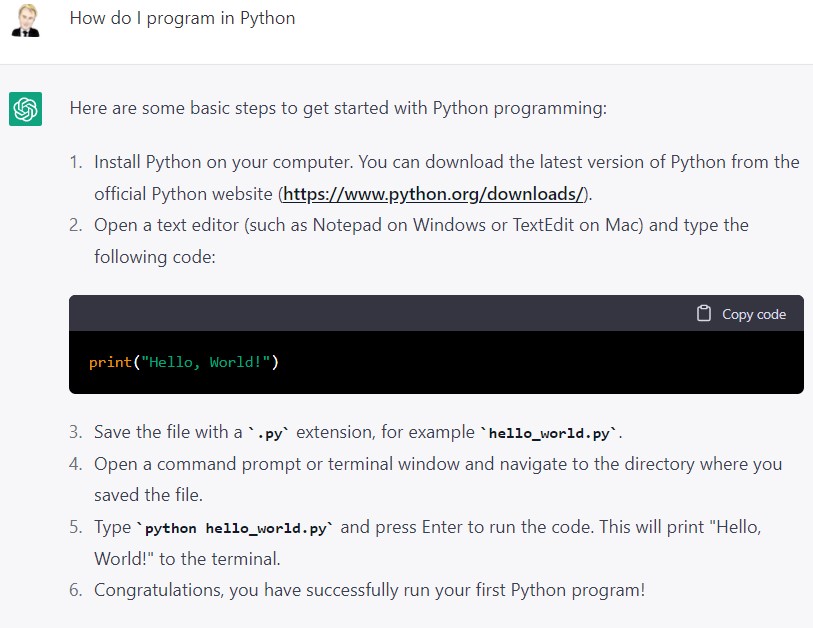

To kick off, it can answer complex questions, such as how do I program in Python?

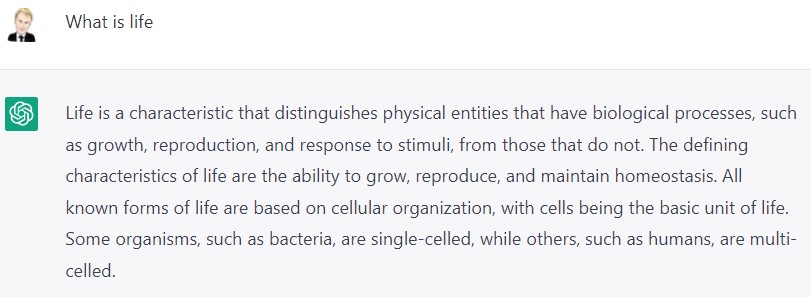

It can also explain things that are complicated, such as What is life?

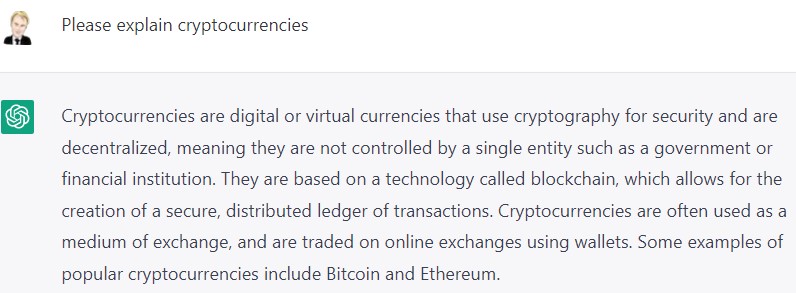

Or cryptocurrencies.

You can even get it to dumb that down, as if you were a five years old.

Or even how to run a cryptocurrency exchange! [Ed: don't tell Sam Bankman-Fried]

It can also be incredibly creative. For example, I asked ChatGPT to write a courtoom drama about a start-up accusing a bank of corruption.

Here is the full text generated:

It was a sunny day in the bustling metropolis of New York City as the trial of Davis vs. The Bank of Manhattan began. The small startup, Davis Tech, was suing the large, established bank for corruption and fraudulent business practices.

As the trial began, the judge called for opening statements from both parties. The Davis Tech lawyers stood up and began to lay out their case.

"Your honor, our client, Davis Tech, is a small but innovative company that has been a victim of the Bank of Manhattan's corrupt and illegal business practices. The bank has used its power and influence to stifle competition and prevent Davis Tech from accessing the funding it needs to grow and thrive.

"The bank has engaged in a pattern of fraudulent behavior, including manipulating interest rates, providing false information to regulators, and engaging in insider trading. These actions have had a devastating impact on Davis Tech, and we are here today to seek justice on behalf of our client."

The Bank of Manhattan's lawyers were quick to respond, painting a very different picture of the events in question.

"Your honor, the accusations made by Davis Tech are completely without merit. The Bank of Manhattan has always conducted its business in an ethical and legal manner, and any suggestion otherwise is simply untrue.

"The problems faced by Davis Tech are a result of their own mismanagement and lack of financial expertise, not any wrongdoing on the part of the bank. We will be presenting evidence throughout this trial that clearly demonstrates the innocence of the Bank of Manhattan, and we are confident that the truth will prevail."

As the trial progressed, both sides presented their evidence and witnesses, and the tension in the courtroom began to mount. Davis Tech brought forth experts and former employees of the bank who testified to the bank's corrupt practices, while the Bank of Manhattan countered with their own witnesses and documents that painted a very different picture.

After several weeks of testimony, it was finally time for closing arguments. The Davis Tech lawyers stood up and delivered a powerful, emotional speech that laid out the extent of the bank's wrongdoing and the devastating impact it had on their client.

"Your honor, the evidence presented in this trial has been clear and compelling. The Bank of Manhattan has engaged in a pattern of corruption and fraud that has had a devastating impact on Davis Tech and countless other businesses.

"We are not here to seek revenge or punishment, but rather to seek justice and ensure that the bank is held accountable for its actions. We are confident that, when you consider all of the evidence, you will find in favor of Davis Tech and award them the damages they rightfully deserve."

The Bank of Manhattan's lawyers gave a equally impassioned closing argument, insisting that their client had done nothing wrong and that the problems faced by Davis Tech were a result of their own mismanagement.

"Your honor, the accusations made by Davis Tech are baseless and without merit. The Bank of Manhattan has always conducted its business in an ethical and legal manner, and any suggestion otherwise is simply untrue.

"We are confident that, when you consider all of the evidence, you will see that the Bank of Manhattan is not guilty of any wrongdoing, and that Davis Tech's claims are without merit. We urge you to find in favor of the bank and dismiss this case."

After considering all of the evidence and arguments, the judge delivered his verdict. In a surprising turn of events, he found in favor of Davis Tech, awarding them substantial damages and ordering the Bank of Manhattan to pay a large fine for its corrupt and fraudulent practices.

The courtroom erupted in cheers and applause as the Davis Tech team celebrated their victory.

However, some aspects of the conversation are a little too formal and reads like a high school essay

Equally it cannot give investment advice …

Or predict the future …

… but at least it can write a whole Coldplay styled song about money:

Verse 1:

Money, oh money

You make the world go round

Some people have lots

Some people have none

Chorus:

Money, oh money

You rule our lives

Some people chase you

Some people hide

Verse 2:

You're the root of all evil

But also the key to success

Some people worship you

Others, you oppress

Chorus:

Money, oh money

You rule our lives

Some people chase you

Some people hide

Bridge:

Money can't buy happiness

But without you, we'd be lost

Money, oh money

Our love-hate relationship is tossed

Chorus:

Money, oh money

You rule our lives

Some people chase you

Some people hide

Outro:

Money, oh money

We need you, but we fear you too

Money, oh money

What will we do?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...