Yesterday I asked the question, “Do we really need

Fund Managers” and there were a couple of interesting comments which, rather

than responding individually, I thought it worth writing a follow-on note.

One was from Matthieu de Heering who says: “If you're trying

to do as well as the market, then tracker funds (spiders) are probably a better

‘bet’.” This goes to the heart of another debate: whether it is better to

use a passive or active fund manager.

This was a question I researched in 1998 for a report where I interviewed

a range of firms, including Gartmore, Virgin, Norwich Union, Legal &

General, Foreign & Colonial and 30 other fund mangers, on the future of

fund management. The debate had risen back then about

active versus passive funds, as tracker funds were doing very

well. Here’s a few comments from way back then:

- “Retail companies that major on investment performance are going to be wiped

off the face of this earth” - “If you have been a dog, you are likely to be a dog.”

- “Indexation is not the only solution.”

- “Most active houses say they give better performance. There is a lot of

evidence to prove differently.” - “Trackers do not make decisions.”

- “The marginal return between active and star is not worth it.”

- “If you eliminate the fund manager, who is going to drive the index?”

- “You can never automate the whole process.”

- “Index tracking does not require 21st century tools.”

And yet active fund managers haven’t died.

In fact, we now have a new class of fund manager: the hedge fund manager, and

they’re thriving.

This year’s highest paid hedge fund manager, according to Alpha Magazine,

is John Paulson with a mere $3.7 billion take home pay for 2007. Here’s a few

other items of note from this year’s list:

- Five of the managers on this year’s list each made more in 2007 than the $1.2

billion JP Morgan agreed to pay for Bear Stearns. - When inaugural list was published in 2002, George Soros was at the #1 spot

with $700 million; in 2007, that would have gained him ninth spot - In 2002, a hedge fund manager had to earn $30 million to break into the top

25 whereas, in 2007, he or she would need to earn at least $360 million. - The grand total earned by the top 25 in 2003 was $2.8 billion which, in 2007,

was less than the earnings of each of the top three managers, and under a fifth

of the earnings of the top ten put together ($16.1 billion). - This year, the list length was increased from a Top 25 to a Top 50. Even so,

folks like poor old Mark Kingdon of Kingdon Capital Management missed the cut,

despite making $200 million as this year’s minimum earnings to break into the

top 50 was $210 million.

The reason for such stellar earnings is given away by the name of the magazine, Alpha.

The search for alpha - high returns with lowest risk - is the search for the

holy grail, andsome firms believe that having the fund manager who can

deliver alpha is worth millions, or even billions. This is because having

a stellar, stock picking, fund manager, is critical to differentiate in the

institutional investment business. Just look at Greg

Coffey and GLG if you need a good example. A strong

fund manager will make or break a fund.

Nevertheless, I do agree with some of the thinking that a star trading active

fund manager is hard to find, and even harder is finding one who is consistent.

It’s a gift for those who are the best, which is why the Warren Buffett’s,

George Soros’s and Ken Heebner’sare so revered.

It is also why the general masses of fund managers are viewed as being no

better than a stock-picking monkey, and here’s a monkey just to prove it.

This particular monkey is 36 years old, is called Adam Monk and works for the Chicago Sun Times. Adam has consistently picked

stocks that outperformed the S&P 500 index for years, so you make your own

mind up,

Now moving on to the other comment by Ron Clarke, who states that rather than Fund Managers, my

target should have been Independent Financial Advisors (IFAs) and the other

middle men who broker business.

A comment I might have agreed with twenty years ago, but not today.

The reason I said that I would agree with it twenty years ago, is that I

forecasted the end of the IFA in 1990 and yet they’re still around and business

is still booming.

I forecast it back then because I could not see how their business could be

sustainable when the Financial Services Act, a law introduced in 1986, made it

clear that business would polarise between firms with direct sales forces, and

IFA’s who must be able to advise and sell all insurance firm’s products. With

the introduction of technology, call centres and other capabilities, we

all said IFA’s with their higher fee rates would be dead.

It didn’t happen.

We then forecast that the internet and ecommerce would kill the IFA.

It didn’t.

We then said that comparasites – the websites that compare all insurance

product prices through a single aggregated window on the web – would kill the

IFA.

They haven’t.

The IFA won’t die, long live the IFA.

Why won’t they die?

Because people do not trust their own decision making. Nor do they trust

a bank or insurance firm to advise them. They suspect the latter will just

stitch them up with whatever product makes the most margin. That is

why we go to independent advisors, believing that they will offer ‘best

advice’. Some IFAs do, although many just sell whatever product makes the most

commission, something the FSA is trying to crack down upon.

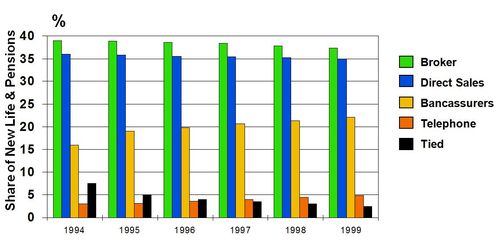

Just to prove that they won't die, I delved around to find some charts.

Here’s a chart I was using in 1996 to forecast distribution trends in insurance

for example.

This comes from Data Monitor’s research reports, and shows that brokers (IFAs)

represent 35% of sales distribution, slightly declining over time. We

thought back then that they would disappear by the end of the decade because of

the internet.

Then I read a paragraph from Aviva’s, one of the largest insurance firms,

annual report in 2004:

“Independent advisers continue to be our largest source of new business (for

long-term savings), providing around 47% of worldwide sales. Bancassurance is

important, generating 23% of the group’s business, and is the dominant sales

channel in a number of our markets. Direct sales represent 26% of the total and

partnerships with non-banking organisations provide the remaining 4% of sales.”

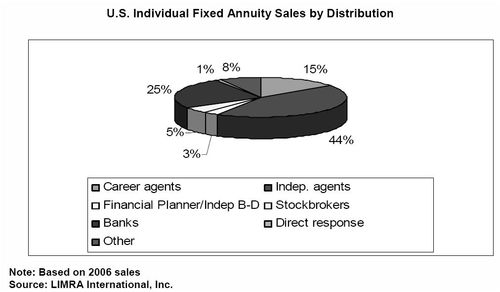

And a chart from LIMRA, the Life Insurance and Market Research Association,

showing American sales of fixed price annuities (pensions) in 2006 shows that

the lion's share of sales (44%) is through independent agents.

For all the research I read and all the presentations I listen to, IFAs are as

strong as ever.

So no, I wouldn’t forecast their demise just yet.

Where does this take us therefore?

Fund managers stock picking is no better than a monkey’s, but we trust their

decision making better than our own.

Equally, IFAs are trusted because they come out and have a face-to-face meeting

with us at home and claim to be 'independent', so we trust their decision

making better than our own, or those of direct sales and agents.

Because we cannot make decisions ourselves, we will always use advisors to

assist us. That is why fund managers, brokers and IFAs thrive and survive,

regardless of how much technology we try to deploy to decimate them.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...