In a hoo-ha that started just before Christmas, the Church has decided to wade into

the debate about money and the war of words is escalating.

It

all started with the Pope speaking out against greed and the pursuit of

profit in his address for World Peace Day. In

his statement appeared sentences such as: ""Financial activity is only focused on

itself without any consideration of the long term, the common good."

It

certainly doesn’t sound as though financial returns are top of mind: “The unbridled pursuit of wealth for wealth's sake

creates a risk that in the world the rich will live in an ivory tower

surrounded by a desert of poverty and degradation."

The Pope continued with such sentiments with

more words on Christmas Day: “Our world will certainly fall apart ...

if people look only to their own interests."

The

Queen added a nod in her Christmas speech with

lines such as:

"Over

the years those who have seemed to me to be the most happy, contented

and fulfilled have always been the people who have lived the most

outgoing and unselfish lives; the kind of people who are generous with

their talents or their time.”

And it is that time of year for

some, who are of that faith, to pay respects for his teachings, which

is why the Church of England and many other churches, then added their

considerable weight to the debate today, with five leading bishops

accusing the Government of thinking that money is the answer to

everything.

Bishops of Durham, Winchester, Hulme, Manchester and Carlisle made the comments to the Sunday Telegraph. Their

target is the policy of the current Government, but the comments

attack the heart of financial motivations and markets.

For example, the

Right Reverend Nigel McCulloch, the Bishop of Manchester, states: “This

is not just an economic issue, but a moral one. It’s about what we

value,” he said.

“The Government believes that money can answer all of

the problems and has encouraged greed and a love of money that the

Bible says is the root of all evil. It is morally corrupt because it

encourages people to get into a lifestyle of believing they can always

get what they want.”

The Right Reverend Stephen Lowe, the

Church’s Bishop for Urban Life and Faith and also the Bishop of Hulme,

said: “The Government isn’t telling people who are already deep in debt

to stop overextending themselves, but instead is urging us to spend

more. That is morally suspect and morally feeble.”

And the

Right Reverend Tom Wright, the Bishop of Durham, said: “While the rich

have got richer, the poor have got poorer. When a big bank or car

company goes bankrupt, it gets bailed out, but no one seems to be

bailing out the ordinary people who are losing their jobs and seeing

their savings diminished.”

Strong emotions indeed.

This follows

their Christmas sermons, where these bishops attacked banks

and governments.

For example, the Right Reverend Nigel McCullouch said

on Christmas Day: “the good thing is that this collapse of the god of

materialism and consumerism is forcing us to think again ... As the New

Testament aptly concludes, in a frequently misquoted verse, it is not

money itself but 'the love of money' that is at the heart of evil.”

The Archbishop of Canterbury, Rowan Williams, preached that: "Christianity neither condemns nor canonises the market economy

– it may be an essential element in the conduct of human affairs. But we have to remember that it is a system governed by people, not some

blind force like gravity. Those who operate the market have an obligation to act in ways that

promote the common good, not just in ways that promote the interests of

certain groups. The market economy will only work justly if it has an underlying moral

purpose."

And

these sentiments were reflected in other countries, as the German head

of the evangelical church, Bishop Wolfgang Huber, said: “a really

important lesson from this year has been that we really stop

worshipping money the way we have," and particularly attacked Deutsche

Bank’s CEO, Josef Ackermann, accusing him of ‘idolatry’ to money and

saying that “never again will a (CEO) set a target of 25 percent on

equity returns."

Mr. Ackermann is well known in Germany for setting the

goal of earning a pre-tax return on equity of 25 per cent.

Result?

Josef

Ackermann has been about the only banker to stand up against this

attack over the Christmas period, quoted as saying

that Bishop Huber’s comments were “inappropriate”.

That's not that strong a retort though, and I

am sure that Mr. Ackermann was raging at home ... but then maybe, just

maybe, all of this sabre rattling is just the Church's way of reiterating the

teachings of their God:

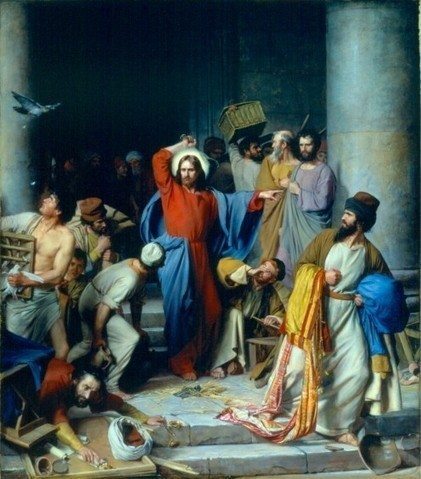

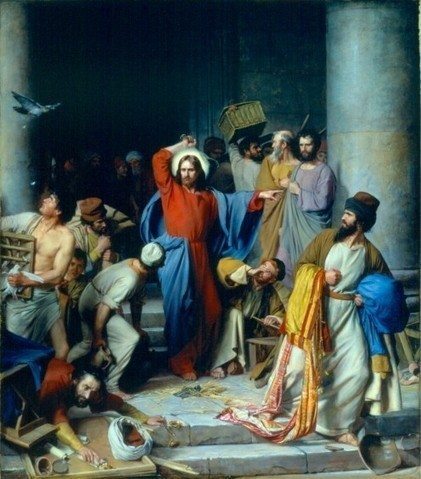

"Jesus entered the temple area and drove out all who were

buying and selling there. He overturned the tables of the money changers

and the benches of those selling." Matthew 21:11-13

The Money Changers by Carl Heinrich Bloch (May 23, 1834 – February 22, 1890)

p.s. what was the Church talking about during the boom times?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...