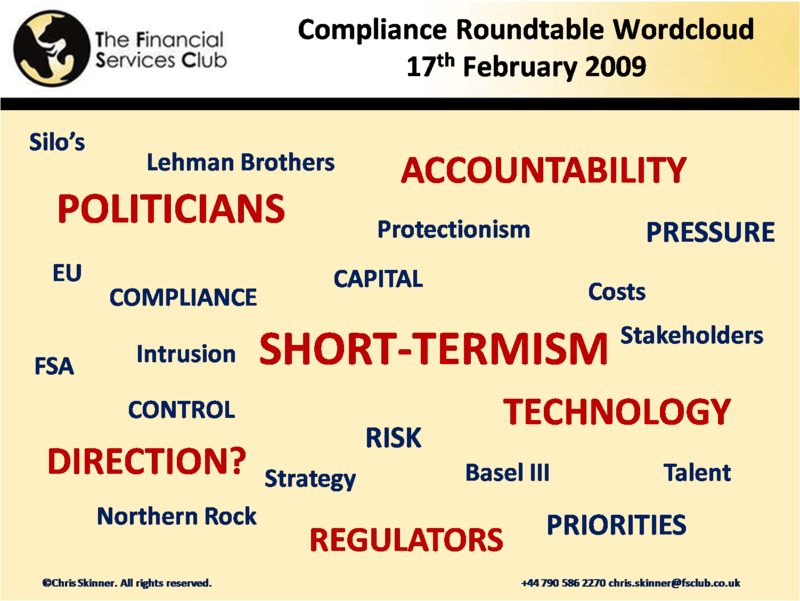

I chaired a dinner on compliance last night, with eight risk and compliance professionals from a range of international and global banks. Without any particular science to this, I noted key words used throughout the evening and came up with a word cloud that looks a bit like this:

What this demonstrated is that there is a major concern amongst the compliance community with regard to the potential knee-jerk reactions of politicians and regulators to the crisis, which might result in short-term changes that are inappropriate or poorly executed.

Meanwhile, the business internally is looking for clearer direction of what changes to make and why, with most of the focus upon accountability.

All in all, an interesting dialogue.

What was particularly interesting is that hardly anyone talked about

European regulations, even though the banks at the table were global or

international. Not a single domestic bank was at the table.

That was interesting because this morning Eurofi, the European Think Tank dedicated to the creation of the European Single Market for Financial Services, released a whole raft of reports on new EU regulatory thinking this week:

1. Restoring Confidence :

Proposals for improving confidence within the banking system

![]() 7. Microcredit :

7. Microcredit :

Banking regulations must also factor in the growing role of Microcredit

There are some interesting views in these documents.

From #1 re improving confidence focuses upon accounting rules and recommends that: "more specific action is required from the G20 to bring together the conditions for a return to confidence and facilitate the States’ intervention

- Such initiatives should ideally be carried out on a global level and be initiated by the G20 at the beginning of April.

- Accounting rules and naming systems should be defined by the Financial Stability Forum, IASB and FASB, according to their respective fields of competence.

- In case such methods would be optional and not compulsory, the banks adopting them would be awarded a label by the national supervisors highlighting their high degree of transparency and enabling their identification by investors.

- It can be envisaged to limit this disclosure to national supervisors which would be in this specific context responsible for commenting upon the quality of the solvency related to financial institution under their scrutiny. This option is suggested by some Eurofi partners who want to avoid excessive quantity information or to avoid any possible increase of mistrust resulting from the extent of bad assets.

- Independent auditors should receive a specific mandate to pay a special attention to the consistency of their implementation."

#2 calls for a network of EU Supervisory bodies working in harmony.

"The European integration of supervision must ...

- Be based on harmonized accounting and prudential rules

- Ensure that the supervisors of a given group are put in a situation enabling effective cooperation, i.e. that they give access to all to the relevant information in a timely manner

- Have mandates, mechanisms and procedures for cooperation that enable decisions to be taken as quickly as possible, that do not favour any country over another or any financial institution over another, whatever their business models, and that involve countries based on what is effectively at stake for them in the decisions to be taken

- Have neutral appeal procedures in the event of any disagreement between supervisors or appeals by a financial institution

- Use and develop the technical capabilities of the various supervisors, as well as their knowledge of the national economic and regulatory conditions (local conduct of business, consumers protection provisions etc.)"

#3 on Macro-Prudential Supervision calls for a "new European Macro-Prudential Supervision Institution (EMPS)" which "should group together the Commission (DG ECFIN in charge of economic and financial matters within the Commission), CEBS, CEIOPS, CESR, the members of the ESCB and a representative from each EU member state. Unlike the approach for the Lamfalussy process, it is this institution that would validate the action plans and recommendations prepared by this entity’s teams. This entity could be located in Frankfurt in order to be 'physically' close to the ESCB’s headquarters."

Mmmm ... isn't that the home of the European Central Bank too?

You can read the rest and probably have gathered already that Brussels, the regulators and supervisors, the central banks and the industry are slavishly working away at a whole new raft of prudent rules for fairer valuation of assets and accounting, combined with harmonised frameworks and integrated supervisory authorities.

Bottom-line: our compliance folks will probably have "EUROPE" at the centre of next year's word cloud, with "SHORT-TERMISM", "POLITICIANS" and "REGULATORS" possibly written large just underneath!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...