Payments is an area that has a positive vibe in banking as 'Transaction Services' - the payments processing part of a bank - is one of the more profitable and reliable businesses right now.

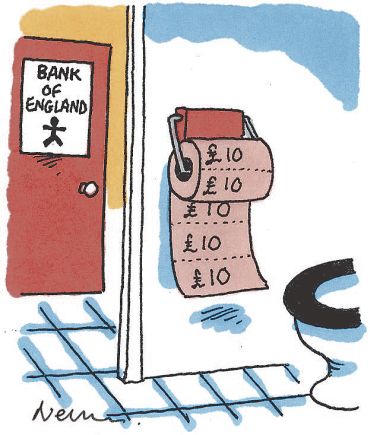

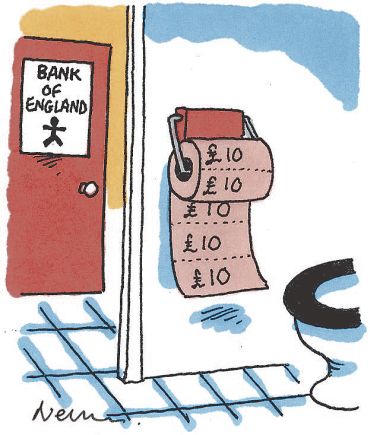

I don't think this will happen, but could even this be threatened by the loss of confidence people feel with banks especially after quantitative easing, which the media translates into 'printing money'.

Could people even question the meaning of money itself?

Some people might, but what's the alternative?

Probably the same one that came up during the Great Depression of 1929.

Back then many people felt lost and money became meaningless. The runaway inflation in Germany led to the rise of Hitler, and millions of people were unemployed, homeless and hungry. The result was the rise of complementary currencies, also known as community currencies.

Most of these currencies are used as an alternative to national legal tender, and are transacted and traded locally to encourage local transactions using stable local trusted mechanisms and administered by the local community.

Community currencies can be 'earned' by doing work for the community and in the locality. Fixing gates, ploughing fields, painting fences ... you name it. If it's good for the community, you get some community currency.

All shops, merchants, farms and dealers will accept this currency, often in preference to real money, especially if 'real' money becomes uselss due to hyperinflation (take note Zimbabwe).

These currencies arose en masse in the 1930's, to get around the issues of the Depression, the loss of faith in the banking and political system, and the challenge of work.

Sounds familiar?

Funnily enough, one of those currencies is still around: the Wir, meaning 'we' in German - we are the community - the Wir Bank still operates in Switzerland. Rising from just 16 constituents in 1934, the Wir now supports over 62,000 small to medium businesses transacting around CHF 1.65 billion (US$1.4 billion) a year.

Anyways, I've mentioned such currencies several times before, but now note that these are rising worldwide and fast, from the Liberty Dollar (USA) to the Lewes Pound (UK) to the Boon Kud Chum (Thailand) to the Tianguis Tlaloc (Mexico) ... in fact, you can pretty much find a LETS (Local Exchange Trading System), Regio (Regional currency) or Time-based currency system anywhere today.

I'm sure it's a subject I'll come back to and just lay this down again as a marker note right now. It would also be interesting to hear from anyone who has experience of such currencies in action.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...