I fly back to London last night and see this headline in the Evening Standard:

The full story is all about how anyone in a spivvy City suit will be lynched next week as the G20 arrives in London.

Add to this Professor Chris Knight's comments on the radio yesterday: "We are going to be hanging a lot of people like Fred the Shred from

lampposts on April Fool's Day and I can only say let's hope they are

just effigies. To be honest, if he

winds us up any more I'm afraid there will be real bankers hanging from

lampposts and let's hope that that doesn't actually have to happen."

Add to this the headlines of today:

City IT workers brace for anarchist attack

G20 anarchists plan wave of strikes against Canary Wharf and BT Tower

Anarchists warn of London G20 summit action

Police preparing for an anti-capitalist ‘summer of rage’

and you soon get the picture.

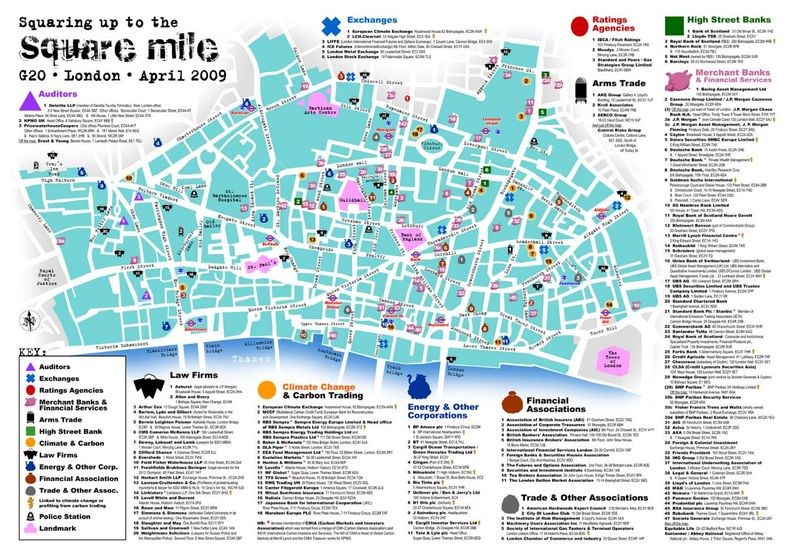

In case you're wondering who is targeted and where, here's a nice little map courtesy of G20-meltdown (double-click picture to get a clearer view):

So yes, there will be trouble.

In fact, put "banker anger" into Google and you find there are over 180 headline news items and 1.5 million returns. People are pissed off with this industry.

I particularly took note of the headline: Fat cats in terror after anti-capitalists attack Fred the Shred's home.

Should the fat cats be running in terror and does anyone ask: how must Sir Fred feel? Does anyone care?

I mean less than two years ago, he’s sealed a deal to create one of the largest banks in the world, after taking over ABN AMRO in an acrimonious battle. He walks on water, is given accolade after accolade, and does not suffer fools.

Today, he’s a pariah. A parasitic leech. The scourge of society as a beacon of blame for this crisis that affects everyone.

This is why his home was targeted for attack from a group calling themselves: “Bank bosses are criminals”.

But what must it feel like to move from the cosseted world of multimillion pound bonuses, private aircraft trips, meeting the highest ranking members of business and society at Davos and through the Queen’s invitation ... to suddenly finding yourself hiding away, hoping that no-one recognises you and realising that, if they do, they might hang you from the nearest tree.

How must it feel to be master of the universe, lord and master of all you see, to running scared at night away from those who seek to do you harm.

And, no matter how much money or protection you receive, can you ever hold your head high and walk with pride ever again?

Probably not.

And it’s not just Sir Fred who has suffered this ignominious fall but Dick Fuld, Stan O’Neal, Chuck Prince, the AIG bonus crowd and many other City and Wall Street Investment Banker who fed at the trough of easy money and now are exposed to the ire of the taxpayer, public, politicians and more.

I cannot think of any equivalent of such a massive fall to such public outrage since the storming of the Bastille and Marie-Antoinette’s screams as she and her children were forced from the Palais of Versailles by a baying crowd.

The idea of a modern day guillotining of our banking leadership seems incomprehensible ... but if the media continue to stoke up the debate, such that the ardent viscious few make their point because they feel they have to, then my prediction of a riot will seem mild by comparison to what may happen.

Now I know this will fall on deaf ears, but it just might be time we bought some humanity back into banking as, no matter how right or wrong you believe Misters Goodwin, Fuld, Prince and O’Neal to be, they were:

(a) operating within the law,

(b) applauded for their good work,

(c) felt by investors, shareholders, employees and government to be doing absolutely the right thing for their institutions, and

(d) rewarded for doing so, quite rightly, within the remit of their obligations of employment.

What went wrong were all the parameters by which we measured and rewarded their success.

As a result, they are now paying the price and, for those of us who work in this industry, maybe we should be saying “tonight thank god it’s them instead of you”.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...