Researchers estimate that there were only 83.5 million online payment users in China in 2006, due to the lack of access to payment cards. Admittedly, Tencent with the QQ coin has enabled more payments outside the banking system, but the lack of access to e-payments has been an inhibitor to the democratisation of commerce in China.

However, this is changing and changing fast with UMPay, a Joint Venture between Unionpay and China Mobile, targeting this space through mobile services.

According to UMPay, e- and m- payment users will exceed 500 million people next year and there are already 100 million m-payment users under the UMPay scheme. That’s more than the total number of online payment users only two years ago.

UMPay launched in 2003 and provides China Mobile users with a comprehensive mobile payment platform and mobile payment system provide mobile wallets, financial message services, top-ups and mobile ticketing.

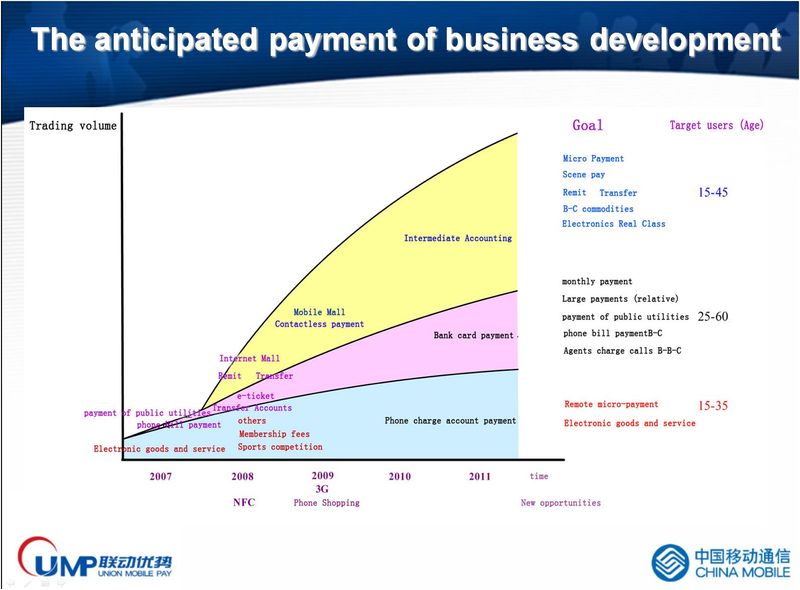

Double-click the image below to see the range and targeted groups for these applications:

Where they are going to gain the greatest growth is from rural farmers though. This is the strategy of UMPay today - to saturate the rural locations with UMPay access - and will take the 100 million users through the half a billion number in the very near future according to UMPay CEO Bin Zhang.

I was lucky enough to catch up with Mr. Zhang in Hong Kong and asked him to briefly explain their strategy. Here's a short version of our discussion** and apologies for the sound, but we were in the middle of a conference:

I particularly liked the chap at the back opening the conference doors and then slinking off again!

Mobile finance is fast demonstrating its power in countries that are using such technologies to leapfrog established financial infrastructures.

In China's case, this is a sophisticated mobile financial service from billing and payments to utilities and transportation. In other words, a comprehensive use of mobile for banking and financial services.

We could learn a thing or two.

** longer versions of our video clips are available for FSClub members

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...