Back in 2006 I toured around Asia discussing the rise of Indian and Chinese banks and the fact that, before the end of the decade, Chinese banks would dominate the top tier of banks globally.

The analysis also formed the opening chapters of my book, as well as several other research reports.

The origin of this analysis was a project contracted with TowerGroup, and the American analysts scoffed at my ideas of Chinese banks dominating. I also wrote an article for an American magazine in summer 2006, and they also seriously questioned my views about Chinese banks saying that they couldn’t see it.

Admittedly, I never thought of the contextual implosion of European and American banking due to systemic risks, although I had concerns about them, but the result is that China is now dominating our financial landscape.

For example, the Top 10 largest banks in 2008 by shareholder equity were:**

- Bank of America, USA

- HSBC, UK

- JPMorgan Chase, USA

- Citi, USA

- Intesa Sanpaolo, Italy

- Royal Bank of Scotland, UK

- Mitsubishi UFJ, Japan

- Unicredito, Italy

- Santander, Span

- BNP Paribas, France

With China’s ICBC in 12th spot, China Construction Bank in 16th and the Bank of China in 18th.

Mmmm ... big change in one year, with China’s top banks reporting fourth quarter results of net profits up over 5% year-on-year and a net increase of 37% for 2008 overall.

That’s pretty good when you look at the US and European bank results.

However, these are not the results of simple change but of a fundamental restructuring of the landscape of finance and financial services.

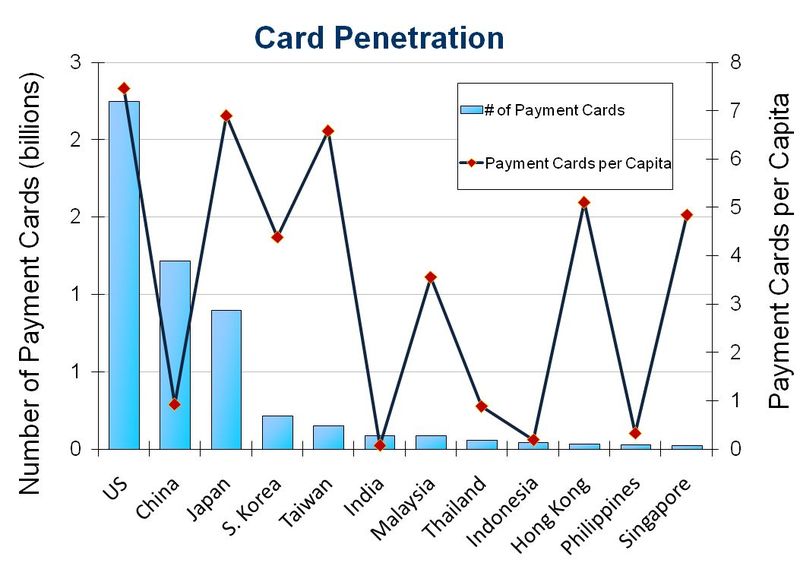

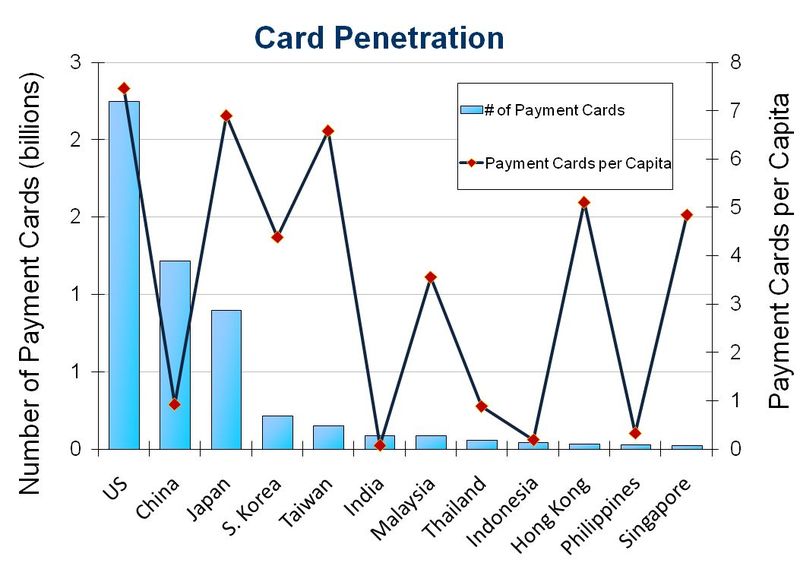

For example, Zennon Kapron of Kapron Asia, talked about the 1.2 billion cards issued in China today, saying that if the card numbers rise to the same levels as the USA, where average cardholders have over 7 cards each, then China will have almost 10 billion cards issued within the next few years.

Copyright: KapronAsia 2009

Firms with a billion cardholders seemed unimaginable in a country that, only a decade ago, had just branches with queues and cash.

For example, some speakers explained how, only a few years ago, everything had to be transacted in cash in China.

You buy a car, you pay cash.

You rent a house, you pay the rent each month in cash.

Today, electronic bank mandates and wireless payments are common.

In fact, one speaker told me that he made a $200,000 debit card purchase in one swipe. No limits to the payment as it was a debit payment, and immediate transaction straight through processing.

Another told me about how folks come to the office these days to get a payment and, unlike in 2005 where cash would have been transacted, they carry wireless POS terminals.

Talking of wireless, UMPay’s Chief Executive Bin Zhang provides card payment services for UnionPay (over a billion cardholders) through mobile carrier China Mobile (600 million subscribers).

Mr. Zhang talked about UMPay’s mobile payments capability being popular with their 100 million subscribers.

100 million mobile card subscribers!

He then explained that there is a massive opportunity to expand their services to rural farmers through mobile services over the next few years.

In a country that had virtually no electronic payments at the start of this decade, China's low value payments markets are booming thanks to a technology leapfrog via wireless and mobile. China is now seeking to deploy 21st century payments infrastructure and capabilities that would be the envy of many.

No wonder China’s banks are profitable and business is still good.

It may not stay that way if China's growth story reverses due to the global downturn but, according to this conference this week, there’s no signs of it happening yet in the retail payments space.

** interesting to note that Chinese banks may be large but are they safe? Global Finance has just released the Top 50 Safest Banks in the World list and no Chinese banks are listed.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...