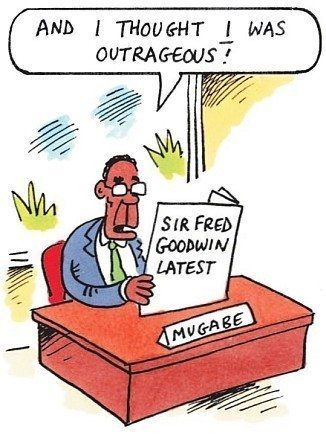

The never-ending UK story about ex-CEO of Royal Bank of Scotland Fred Goodwin's pension rumbles on, with tonight's Evening Standard reporting that Sir Tom McKillop, Chairman of RBS, doubled the pension pot hours before Sir Fred's departure:

"Evidence to the Treasury select committee shows a 'compromise

agreement' drafted for Sir Fred had assumed he would not take his

pension until the age of 60. The agreement, drafted by lawyers Linklaters on 11 October last year, would have meant the RBS chief ended up with a

pension pot of £9.6million. But the deal was changed under the

instructions of former RBS chairman Sir Tom McKillop

to allow Sir Fred to take his pension at 50, effectively increasing the

pot to £21million. Sir Fred's departure was then agreed in the early

hours of 13 October."

Add this to the Telegraph's analysis of announcements by laid-off Sir Fred:

Summer 2006 Sir Fred Goodwin tells RBS board that the bank is not

involved in sub-prime lending

Late 2006 RBS Greenwich Capital thought to have begun buying

substantial amounts of American sub-prime mortgage assets

Early 2007 Citizens Bank, an RBS-owned bank in America, starts buying

sub-prime mortgages from other banks. The RBS board was not informed.

March 1 2007 Sir Fred Goodwin said to City analysts: “We don’t

get involved in sub-prime lending.”

April 2007 RBS annual report for 2006 said: “Sound control of

risk is fundamental to the Group’s business … Central to this is

our long-standing aversion to sub-prime lending, wherever we do business.”

April 13 2007 New Century Financial announces it had sold 2,000

sub-prime mortgages worth $47.3 million to RBS Greenwich Capital

June 5 2007 Sir Fred Goodwin said to City analysts: “We don’t

do sub-prime so we have not perhaps been exposed to some of the more

boisterous elements of the market that others have.”

Summer 2007 Sir Fred Goodwin tells board that RBS has multi-billion

pound exposure to sub-prime mortgage market

December 2007 RBS announces multi-million pound write-down in value of

sub-prime assets

and some folks might have a nasty taste in the mouth.

To remove it, Scottish politicians have worked out how to tax Sir Fred's pension at 100%.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...